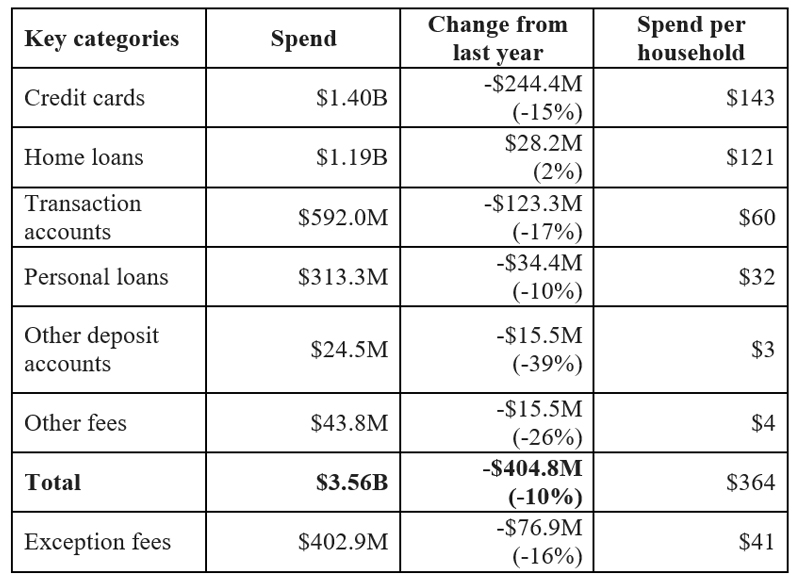

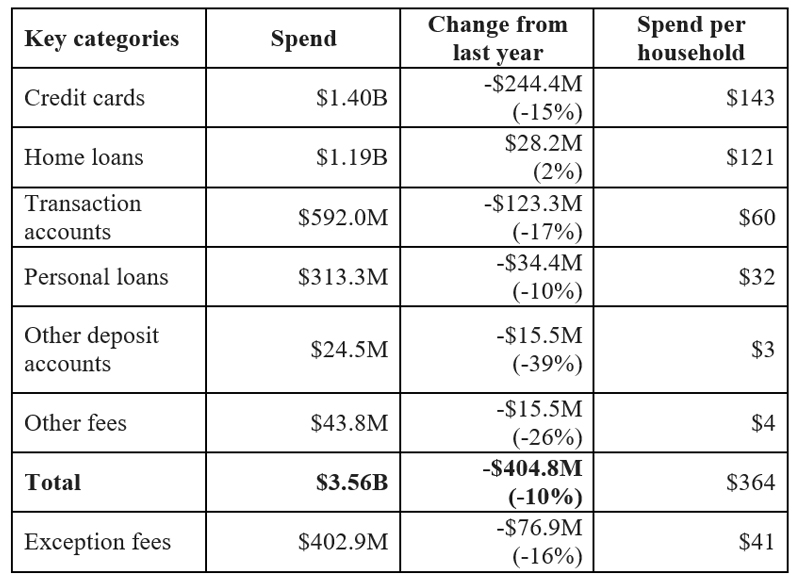

Would you believe that according to figures from the Reserve Bank, Aussies paid $3.56 billion in personal bank fees last financial year? That equates to around $364 per household in bank fees a year.

The good news is we’re wising up to the bank fee rorts – these amounts were 10 per cent down on the previous year.

Credit card fees, at $143 dollars per Australian household, were the biggest drain followed by home loan fees at $121 a year and transaction accounts at $60.

How much Australian households spent on personal bank fees in FY20

Source: RBA Domestic Fee data 2020, released 17 June 2021. Each bank provides data on income received over the financial year ending in 2020. Number of households is an estimate from ABS Household Financial Resources, Sept 2020.

Bank fees are an annoying financial leak to the household budget and they can be significant. You could definitely put that money to a better use than increasing the bank’s profits. So reducing the fees you pay is worth looking into.

Steps to reduce your bank fees

To kick the review process off, get out your bank statements. Identify all the common, recurring fees you currently pay. Think account keeping and transaction costs, foreign exchange fees, late payment penalties, overdrawn account charges and ATM withdrawals.

Once all the fees have been listed, the next step is to see whether they’re fair compared to industry averages. Good planning and awareness of fees is the quickest way to cut your banking bill.

Check these too: 5 financial mistakes you didn’t know you were making

There are a raft of online comparison sites to check accounts against the rest of the market, but the best is probably CANSTAR. These guys are fiercely independent and have a very comprehensive suite of products in their database. For examples, account keeping fees on transaction accounts can range from zero to $10 a month.

There are a range of mortgage products that carry no monthly fee and credit cards without an annual card cost. There are also transaction accounts that charge nothing, provided you only withdraw from the right ATMs. Making these accounts work is just good planning.

Of course, the more features and flexibility an account has, the more expensive fees tend to be. So the trick is to figure out what features you need and find a product that fits.

Negotiate a better deal

Once you’ve compared your current accounts to the market and identified where savings can be made, it’s time to ask your bank a few questions.

Heading into these discussions with the bank it’s important to understand that whatever level of customer you are, there is significant value attached to your business. Banks know that a simple savings account can lead to a credit card, that can lead to a mortgage, that can lead to a lifetime of fees, so don’t underestimate your bargaining power.

Bargaining advice: 5 ways to negotiate a better deal and save plenty of money

Ask what each fee is for, what they’re providing in return and what can be offered by way of a better deal. Nine times out of 10 the bank will put some concessions on the table. And remember what I’ve said before about interest rates: if you’re paying the advertised rate on a loan, you’re a mug. So demand a better deal.

It’s also worth asking what you need to do to have fees waived altogether. Most banks will offer to waive account keeping fees if you make a certain number of transactions or deposits each month, so find out what these waiver levels are. Similarly, there might be waivers for bundling products, like insurance or multiple accounts, with the same provider.

Of course, the numbers still need to be crunched on anything that’s bundled up. But if each product fits the bill then it can be a money saving move that centralises all your finances.

Trending