Even though you may not own any shares directly, it is worth following the health of the sharemarket because your superannuation fund is doing it for you. The good news is that your retirement nest egg has certainly had a big boost from the booming sharemarket.

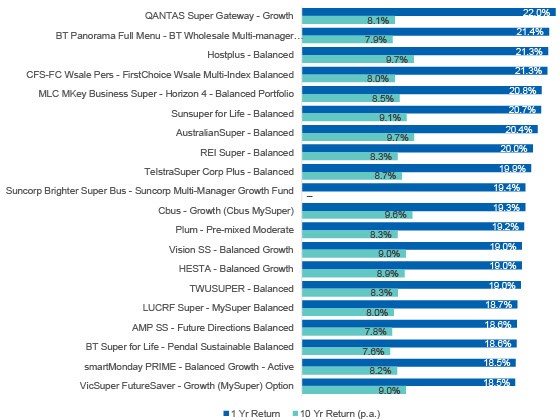

The top 20 performing balanced option super funds all returned over 18 per cent to their members over the financial year to the end of June, a result that nobody would have predicted this time last year.

According to data from leading research house SuperRatings, QANTAS Super Gateway – Growth was the top performing fund, returning 22 per cent. This was followed by BT Panorama Multi-manager and Hostplus, whose balanced options returned 21 per cent.

All of the top 20 performing funds earned over 18 per cent return. So when you get your annual superannuation statement in the next month, 18 per cent is the benchmark for you to know whether your fund is any good or not.

Top 20 Balanced Options over 12 months

Source: SuperRatings

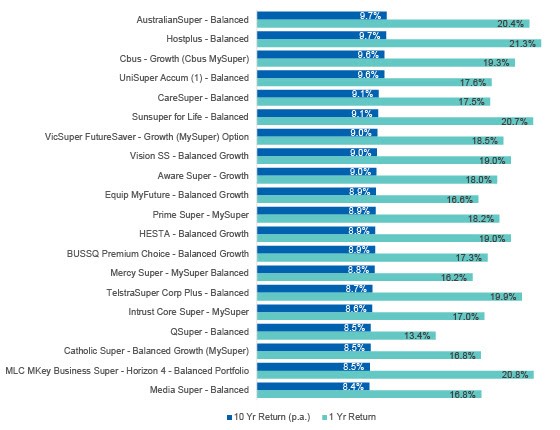

Having said that, we all know superannuation is a very long term investment – you’re basically locked in until retirement. So it’s best to assess super fund performance over a longer period. You can sort of forgive a fund manager for underperforming in the odd year, but not ongoing bad figures.

The key is to be in a fund with good consistent performance during market booms and busts. So 10 year performance is a good benchmark.

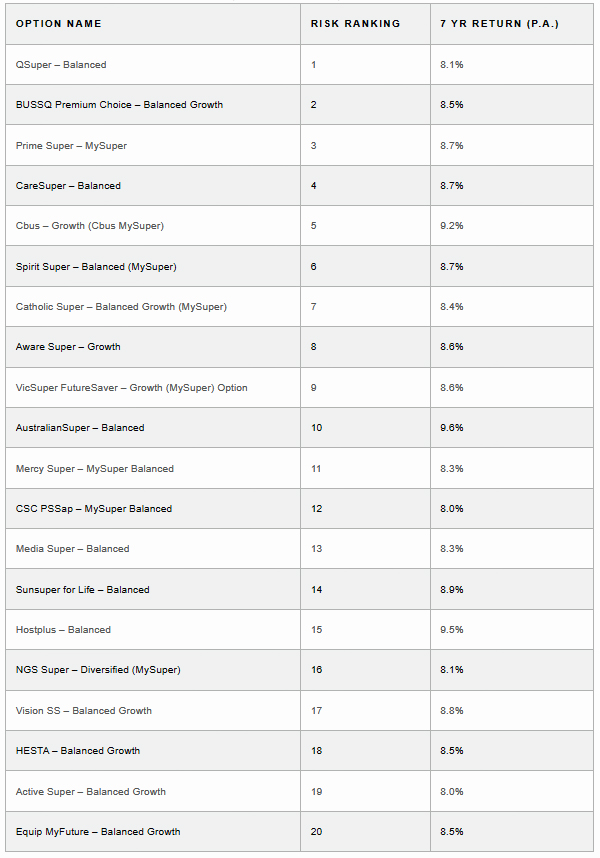

The top performer over 10 years was AustralianSuper, whose balanced option has returned 9.7 per cent a year over the last decade. This was followed closely by Hostplus – Balanced and Cbus – Growth (Cbus MySuper), returning around 9.6 per cent.

All of the top 20 funds over 10 years returned over 8.4 per cent a year. So that’s your 10 year benchmark on your annual performance statement to assess the fund.

Top 20 Balanced Options over 10 years

Source: SuperRatings

How does you super fund handle risk?

The next investment filter – after straight performance – to apply to your super fund is how the investment manager handles risk. That is how it copes with market crashes.

Before the impact of the COVID pandemic, the world had seen the longest run of sharemarket growth in its history. As a result, the market crash in February 2020 would have been the first time younger investors experienced a sharp fall in their wealth. Increasingly, investors are understanding the importance of not only the return that a superannuation investment option delivers, but also the level of risk it takes on to achieve that return.

One way to assess this is looking at the ups and downs in returns over time. Growth assets like shares may return more on average than traditionally defensive assets like fixed income, but shares come with a bumpier ride.

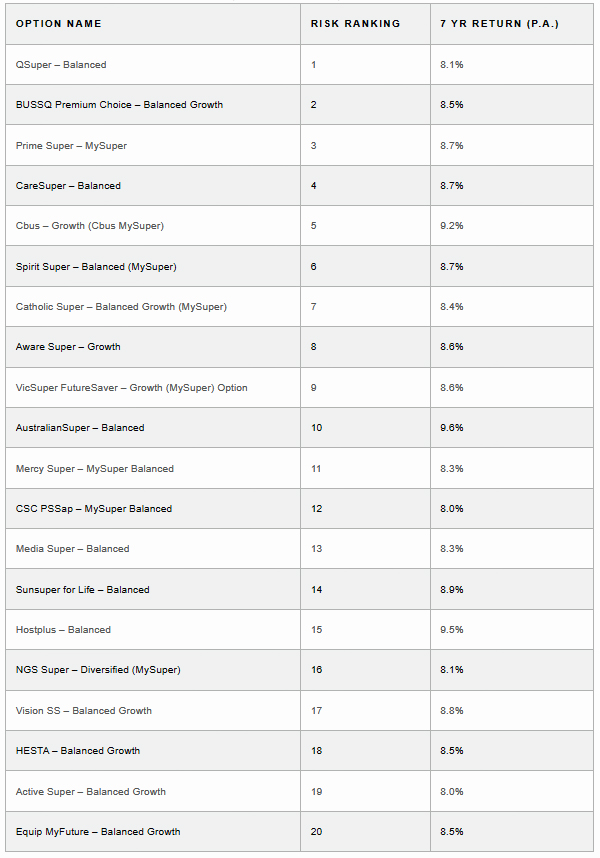

So research house SuperRatings has ranked the top 20 funds according to their volatility-adjusted return. This measures how much members are being rewarded for taking on the ups and downs.

QSuper’s balanced option return of 8.1 per cent over the past seven years is below some of its peers, but it has achieved this with a smoother ride along the way. This means it has delivered the best return given the level of volatility involved.

Top 20 balanced options over 7 years ranked by risk and return

Source: SuperRatings

Compare how your super fund stacks up

Remember, it definitely pays to keep an eye on how your super fund is performing. Put it on your annual financial to-do list.

As we’ve seen here, returns vary significantly, even across the top 20 performers. If your fund isn’t on these tables, you really need to question why.

Trending