Those on a fixed-rate mortgage could be in for a huge shock when their fixed term ends.

RateCity analysis of the big four bank half-year results and APRA loan book data show approximately 38 per cent of home loans are currently fixed, in dollar terms, with the peak of people coming off their fixed rates around mid-to-late 2023.

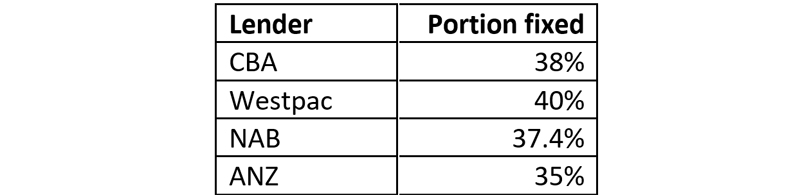

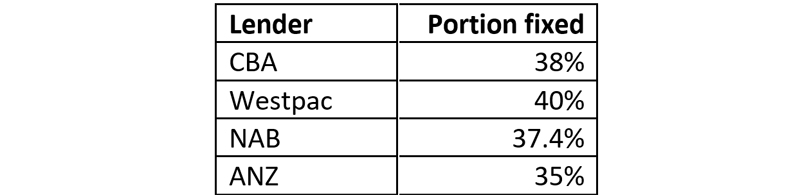

Proportion of big four bank residential mortgages currently fixed

Source: Big four banks’ half year results; CBA results ending December 2021, Westpac, NAB, ANZ results ending March 22. CBA proportion includes BankWest. Proportion without BankWest is 39%.

People coming off fixed rates could see repayment rises of up to 45 per cent. ABS data shows fixing peaked in popularity in July last year, when 46 per cent of new loans were fixed.

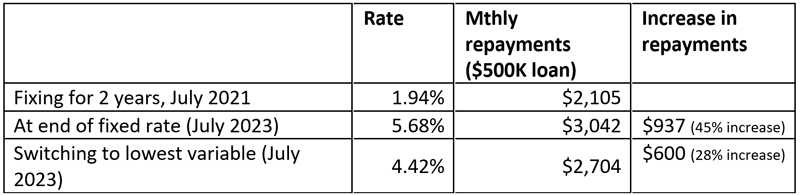

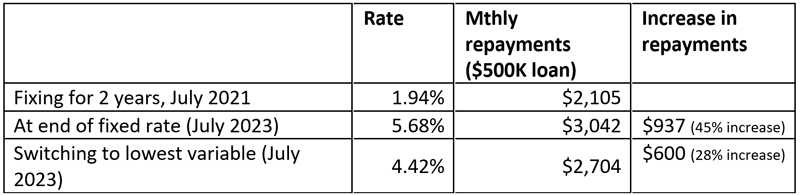

If someone with a $500,000 loan fixed in July 2021 on the average big four bank 2-year rate of 1.94 per cent, they would currently be paying $2,105 in monthly repayments. This is based on someone on a package loan paying principal and interest with 25 years remaining.

When their fixed rate ends in July 2023, they would be looking at an average revert rate of 5.68 per cent (if forecasts for the cash rate are realised). Their monthly repayments would rise to $3,042, which is an increase of $937 per month.

Even if they managed to renegotiate their loan to the big four banks’ average lowest variable rate, they would still be paying 4.42 per cent… more than double what they are currently on, with an increase in monthly repayments of $600.

The fixed rate cliff: increase in repayments for someone coming off a 2-year rate next July

Based on an owner-occupier with a $500K debt, 25 years remaining

Source: RateCity.com.au. Notes: based on an owner-occupier paying P&I with a $500,000, 25-year loan in July 2021 at the average big four 2-yr rate of 1.94% then moving to the average big four bank revert rate or lowest rate. 2023 rates are based on forecasted cash rate hikes from Westpac and assumes they are passed on in full.

But the good news is high risk borrowers are falling

The value of new mortgages with risky levels of debt has dropped slightly, according to new data released by the financial regulator APRA.

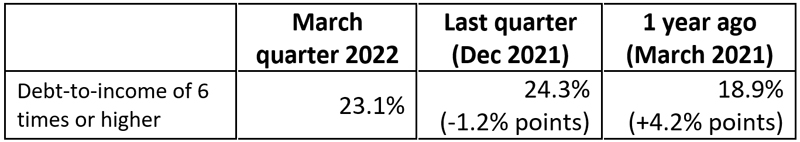

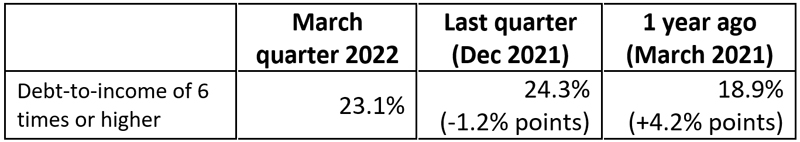

APRA’s Quarterly ADI Property Exposure report for the March 2022 quarter shows 23.1 per cent of new mortgages had a debt-to-income ratio of six times or more, in dollar terms – down from the record high of 24.3 per cent in the previous quarter, but still significantly higher than a year ago.

Debt-to-income ratios of six and over are considered risky by APRA.

In November 2021, in response to rising debt-to-income levels, APRA increased the rate at which banks stress test mortgages from 2.5 per cent to 3 per cent. This means anyone applying for a mortgage today needs to show the bank they can afford the repayments, even if their interest rate rose by 3 per cent.

This is the first full quarter of data where banks stress tested new home loan applications at 3 per cent.

The value of risky lending is likely to drop further in coming quarters, as rising interest rates reduce the maximum amount people can borrow from the bank.

Proportion of new mortgages with a debt-to-income ratio of six times or more

Source: APRA Quarterly ADI Property Exposures for March 2022, new lending, ADI’s, released 14 June 2022.

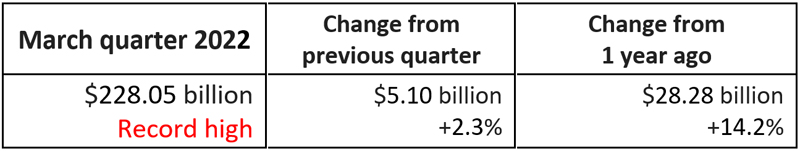

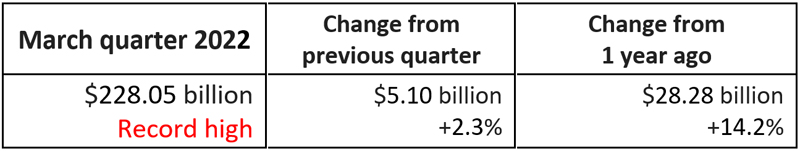

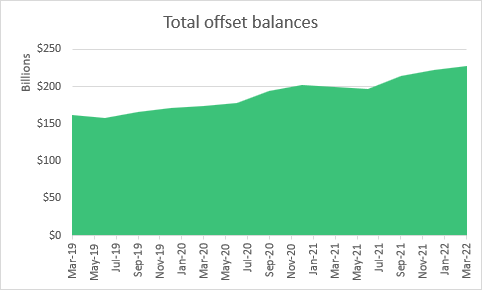

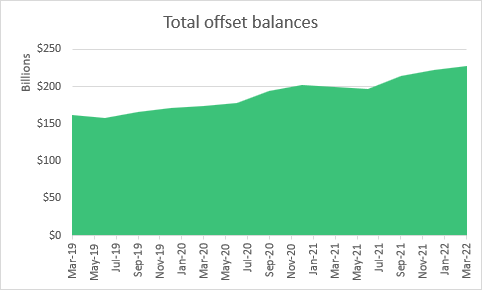

And in another sign borrowers are in reasonable shape at the moment, offset account balances hit another record high of $228 billion.

Offset account balances – outstanding loans

Source: APRA Quarterly ADI Property Exposures for March 2022, outstanding loans ADI’s, released 14 June 2022.

Source: APRA quarterly authorised deposit-taking institution statistics for March 2022, ADI’s, released 14 June 2022.

5 strategies to avoid fixed term loans cliff

If you’re in the 1 per cent and you’re finding it hard to meet your new mortgage repayments, the first thing to do is contact your loan provider. They will have a program in place to help those experiencing hardship and can offer you support and solutions. You should also contact the National Debt Helpline on 1800 007 007 to seek advice.

WLTH founder Drew Haupt also offers these tips for anyone who is starting to experience mortgage stress:

1. Be realistic about what you can afford

Everyone wishes they could afford their dream home straight off the bat, but it’s not realistic for most Aussies. At the end of the day, there is no point putting yourself at risk of mortgage stress by taking on excessive amounts of debt.

2. Consider rentvesting

Rentvesting is where you buy and lease out an affordable investment property, then rent your ideal living property. It’s a win-win situation, where the profit you make from your investment property funds both the rent in your dream home and existing loan repayments.

3. Set up an offset account

Depending on your home loan provider, if you have an offset account set up you can link the funds in the account to your home loan. The money in your account reduces the balance of your home loan, so you pay interest on a lower balance.

4. Reduce unnecessary expenses

If you are struggling to meet your mortgage repayments, it’s probably a wise idea to assess where you can cut back your spending. Cutting costs across different spending categories can add extra cash in your kitty to put towards your loan repayments.

5. Look into split loans

It may be worth speaking to your home loan provider about splitting your loan. That way part of your home loan balance is charged at a variable rate and the other amount charged at a fixed rate. This option provides you with more flexibility with payments, based on what works best for your financial situation.

Trending