The Labor Government’s new Help to Buy scheme will be open to 10,000 Australians each financial year.

Under the scheme, you can access an equity contribution of up to 40 per cent of the purchase price of a new home and up to 30 per cent of the purchase price for an existing home.

The Help to Buy scheme has been welcomed by property experts. CoreLogic’s Research Director Tim Lawless says, “Being able to share up to 40 per cent of the purchase price with the government, along with only a small deposit and opportunity to save on lenders mortgage insurance, helps to overcome several of the hurdles of home ownership.”

You’ll need to meet the following criteria to eligible:

- You’re an Australian citizen and at least 18 years old.

- You earn $90,000 or less per annum if you’re buying as an individual, or $120,000 or less per annum for couples.

- You’ll live in the property you buy under the Help to Buy scheme as your principal place of residence.

- You don’t currently own any other land or property in either Australia or overseas.

- You’ve saved the required minimum 2 per cent deposit of the home price and qualify (and can finance) the remainder of the purchase through a standard home loan with a participating lender.

- You can pay for any extra costs of buying a home, like stamp duty, legal and bank fees. You’ll also be responsible for all ongoing property costs like rates, strata and any other bills.

Beware of the risks

Although the Help to Buy scheme is expected to be popular among buyers, Mr Lawless warned anyone considering the scheme should be aware of the risks associated with buying on such a small deposit.

“With the housing market probably heading into a downturn over the coming year or years, some buyers may find their home is worth less than the debt held against it,” he said.

“It’s important to know if the government will share in the downside risk if the property is sold while in a negative equity situation.”

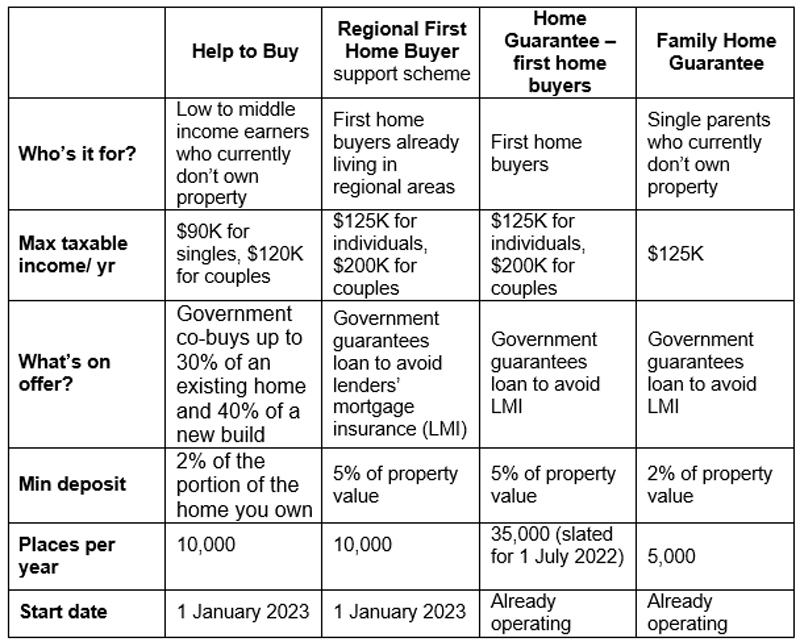

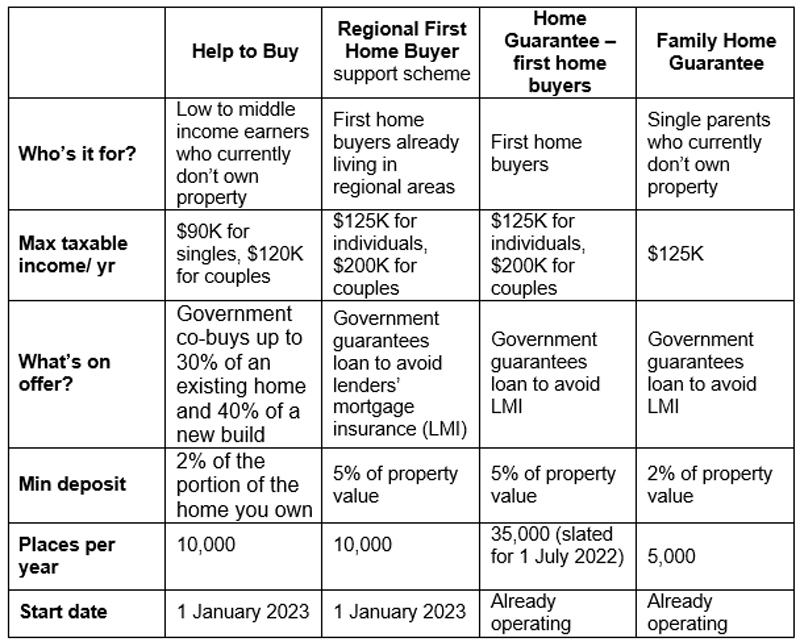

Other Federal home buyer support

The new Labor Government has also committed to keeping the Coalition’s existing Home Guarantee Scheme, but not the proposal to allow first home buyers to use their super.

RateCity has compared what support is on the table for Australians looking to buy a home.

Source: Ratecity.com.au

Help to Buy: the finer details

- Borrowers don’t have to pay Lender’s Mortgage Insurance (LMI) or rent, but are responsible for other costs such as stamp duty, strata levies and council rates.

- When the property is sold or borrowers buy back equity, they will need to pay the government their share of capital gains (adjusted for any major renovations paid for by the borrower).

- If a person earns over the income threshold for more than two years, they’ll need to buy back equity from the government. The amount will be determined on a case-by-case basis.

- Borrowers can also buy more equity from the government, however, they must buy at least 5 per cent at any one time.

- The government will not force a borrower to sell their property at any time.

Trending