There’s no doubt we all need a pay rise to help us keep up with inflation. But just how much is needed and how can we increase our chances of getting it?

CommSec released a fascinating research report which has taken the latest inflation figures and applied them to average weekly earnings.

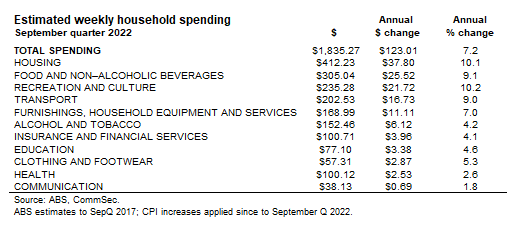

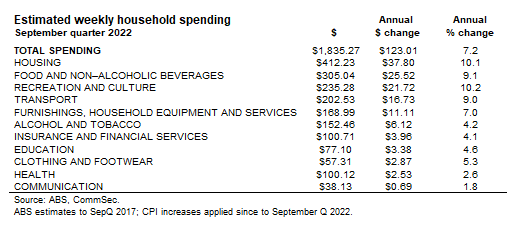

It found the average Australian household (and they acknowledge that every household is different) spends about $1,835 a week and that has gone up 7.2 per cent over the last year, which equates to an extra $123.01 a week.

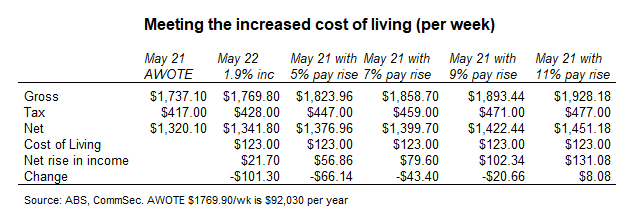

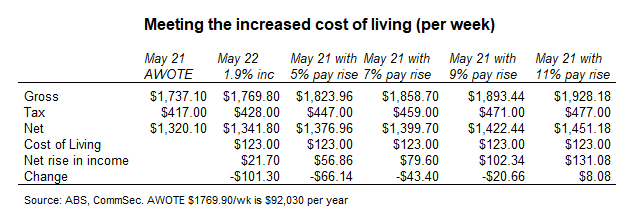

CommSec then calculated what sort of pay rise you’d need to cover that extra weekly spend. As you can see, the 1.9 per cent minimum wage rise granted in May falls well short of covering the extra $123 in bills… in fact the average wage increase is $101.30 short.

As the table shows, you’d need at least a 10 per cent pay rise to just break even with inflation on a cash-in-hand basis. The problem with an 11 per cent pay rise is that your weekly tax bill goes from $417 to $477.

That 11 per cent increase in wages triggers a 14 per cent increase in tax payments… that’s double the inflation rate.

It’s called “bracket creep” and Treasurer Jim Chalmers isn’t talking about it because the Government is the biggest beneficiary of wage rises; they take their cut in tax before the cash gets to you to pay for the extra bills.

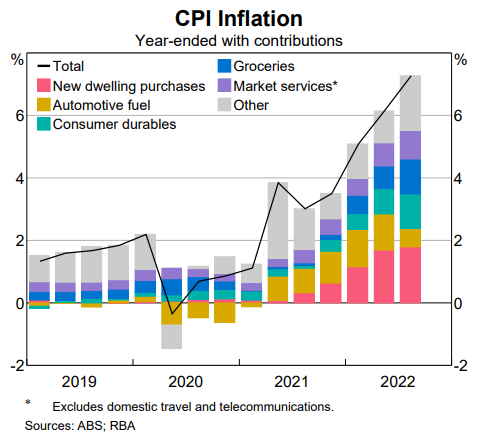

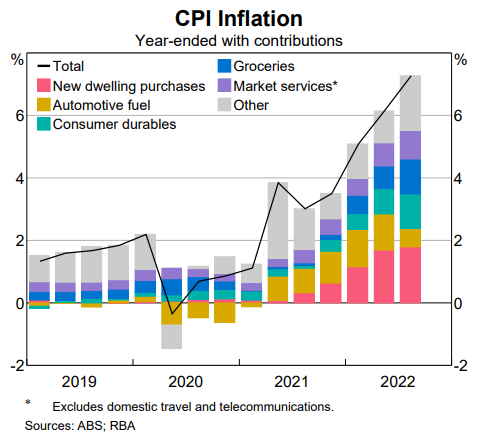

The graph below also gives a clear picture of the biggest inflation drivers and how they’ve changed over recent years.

How to get the pay rise you need to keep up with inflation

Firstly, go to online recruitment websites like seek.com.au to see what the going rate is for your position. If there’s a disparity then it’s worth approaching the boss.

You need real, practical examples that you can fire off that demonstrate your great performance, or your readiness to accept greater responsibility.

List a bunch of recent case studies that you can use as examples of where you’ve gone above and beyond expectations, or where you’ve performed exceptionally well. But also start thinking about ways you could improve and evolve the business, both within your area and overall.

It doesn’t have to be revolutionary. Even if it’s a simple change to an internal process that streamlines work a bit. Little things can have big impacts, but they also demonstrate your ability to think laterally and critically.

The goal is to have your boss thinking that you’d be a good person not to lose, to keep developing and hopefully pay more.

Here are three steps to help get your next pay discussion right.

1. Book it in

This absolutely must be a formal meeting. No off-the-cuff comments looking for an opening or tagging the topic on to the end of another meeting.

Ask for a time to sit down with the decision makers and get yourself prepared.

2. Pump up your tyres

Most people are terrible at taking credit and talking themselves up. But if there is a time and place to be a tall poppy, it is here.

Walk the pay masters through how your role has changed since your last salary review and highlight any achievements and innovations you’ve brought on board.

But, more than that, talk about why you’re there, what you want to achieve and how you see your role and responsibilities developing. Managers love this stuff.

3. Get a result

This is where a lot of people fall down. You can’t leave that meeting without an agreement on the next steps.

What else do you need to do to hit that next pay bracket? When will the next review take place? What date will they come back with an offer? When will the pay rise kick in?

If you leave the next steps hanging, or meekly back away from your once-firm position, you will have shown your cards and could be left in limbo. So, make sure to get a result.

If this all sounds a bit serious, it is. But it can be an easy conversation when approached in a level-headed and well thought out way.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending