Despite the Reserve Bank of Australia promising to keep official interest rates on hold until 2024, the rates we pay on some loans are already going up… and are expected to keep going up. In practice, we can already see that interest rates are rising.

Australians have been enjoying home loan rates under two per cent for just over a year now. Despite the rate hikes on some loans, there are still 189 loans with rates under two per cent, mainly fixed rates.

But when these low fixed rates come to the end of their term, the interest rate landscape is likely to be noticeably different. And you need to be prepared for that now.

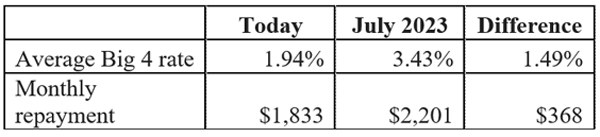

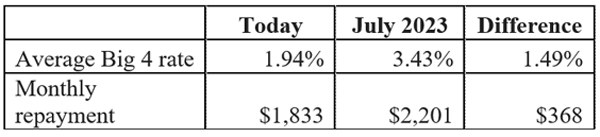

For example, let’s look at an average mortgage holder with a $500,000 loan fixed with a Big Four bank for two years at 1.94 per cent. At the end of the two-year fixed term they could be faced with an average “revert” rate of 3.43 per cent – that’s the new rate they would roll their loan over to. As a result, their monthly repayments would rise by $368. This revert rate could be even higher if variable rates rise before July 2023.

Even if the person renegotiated or re-fixed their mortgage, they are likely to be offered significantly higher interest rates.

Note: based on a $500K, 30-year owner-occupier loan paying principal and interest. Assumes revert rate remains the same.

How can borrowers prepare for rising interest rates?

It always pays to be prepared, and that means assuming right now that the interest rate on your mortgage is going to increase sooner rather than later. Now is the time to make a few changes that should put you ahead of the rise.

Don’t bite off more than you can chew

The banks stress-test your loan, but make sure you do the same. Check you’re comfortable paying the mortgage if rates rise at least 2.5 per cent, even more if you are on a fixed rate. If you find that you won’t be able to manage at the higher rate, now is the time to seek financial advice.

Start here: How to choose a good financial adviser

One option for you might be to lock in part or all of your mortgage at a fixed rate that you can afford for the next few years.

Make extra repayments

Every extra dollar you put in your home loan now is a dollar less you will have to pay interest on when rates do rise. If you have an offset account, make sure you deposit all of your income into it.

Those that don’t think they can trust themselves to keep away from their savings might benefit from making extra repayments directly into their loan account. If you have a redraw facility on your loan, these extra repayments will still be available in an emergency if you need them.

If you are on a fixed rate and exceed the extra repayments cap, look at setting the money aside in a savings account so you’re ready for when you come off your fixed term.

Set a reminder to refinance

If you are on a fixed-rate loan, diarise the end date and shop around for a better deal when it comes to an end. Use a mortgage comparison website like Canstar, Compare the Market or RateCity.

If you’re on a variable rate, give your home loan a health check at least once a year. Use the mortgage comparison websites to see how your current loan stacks up. Be prepared to move to a new provider if it doesn’t.

This might help: 5 ways to negotiate a better deal and save plenty of money

Pay down other debts

Current low interest rates mean that at about three per cent of income, the percentage of household income needed to service debt is the lowest since the 1990s. That’s well down on the 10 year average of five per cent of total income and the peak of nine per cent during the Global Financial Crisis back in 2008.

So a good tactic to prepare for inevitable rising interest rates would be to work out what five per cent of your current household income is. Include all income earners in the household. Pay that five per cent amount (which should be higher than your current repayments) against your debts.

This will do two things:

- it will get you ahead on your repayments;

- and, it will help you adjust your spending habits early for the possibility of higher rates in the future.

Trending