We know residential property values have been booming, but it seems we have a two-speed property market. Houses are doing much better than home units.

Maybe with all these lockdowns Aussies are chasing more space to cope? Plus the home unit market is affected by an over-supply of stock from new construction and previous Airbnb properties coming onto the long-term rental market.

House values almost double the rise of units

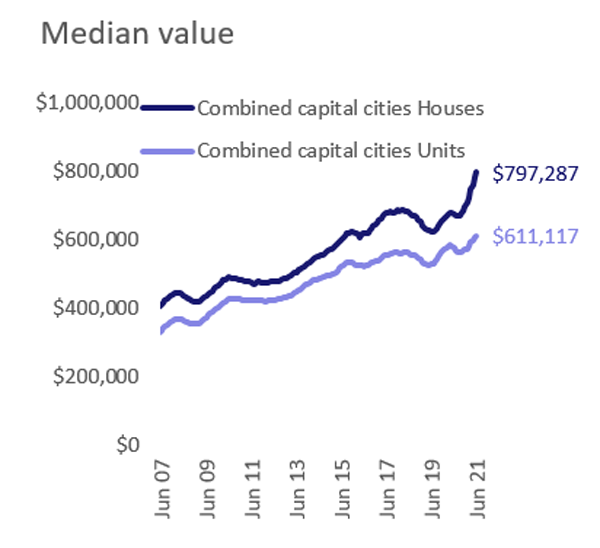

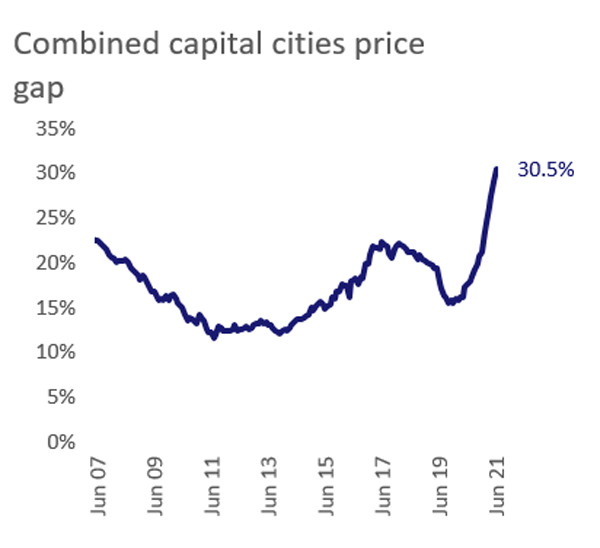

According to research group CoreLogic, in the past 16 months capital city house values rose 14.2 per cent. Which is more than double the 5.6 per cent rise in unit values – hence the two-speed property market. This is a 30.5 per cent gap between median house and unit prices, which is the highest on record. The charts below compare median house and unit values across the capital cities, alongside the house and unit value gap for the past 15 years.

Over the past 15 years, June 2021 marks the biggest gap between median house and unit values across Sydney, Melbourne, Brisbane, Adelaide, and Canberra. The Perth price gap between houses and units has just come off record highs, from 39.1 per cent over May, to 38.9 per cent over June. Meanwhile, the price gap between median house and unit values has been trending down across Hobart and Darwin.

Around the capital cities

Sydney: has a record 54.2 per cent gap between house and unit values as falling rents from an oversupply of units and migration bans has sparked lower interest from investors.

Melbourne: 54 per cent gap, not helped by the fact there has been oversupply of units since 2017.

Brisbane: since the onset of COVID, house values across Brisbane have increased 15.5 per cent, compared to just 5.0 per cent across units. But the gap between house and unit values has risen fairly consistently since mid-2015. Five year annualised growth rates also sit at 4.3 per cent for houses, compared with a -0.1 per cent decline in units.

Adelaide: Adelaide has long seen a premium on houses relative to units, with an average differential in the median of 34.7 per cent for the past 15 years.

Perth: shows the second-lowest house premium of the capital city markets at 38.9 per cent. This follows a 15 year average house premium of 25.6 per cent, which is the lowest of the capital cities.

Hobart: currently has the lowest gap between the median house and unit value at 32.3 per cent, though this is above the 15 year average of 27.6 per cent. It is likely that a lack of available stock, and extreme affordability constraints, have pushed more demand into the unit segment in recent months.

Canberra: currently has the biggest house and unit price gap of the capital city markets, at 74.8 per cent. Since the onset of the pandemic, the Canberra Home Value Index increased 22.7 per cent across houses, compared with 8.7 per cent across units.

Trending