If you’re one of the 13.6 million Aussies with private health insurance, we’ve got some bad news: health insurance premiums are about to go up again.

Premiums across the industry will increase by an average of 2.7 per cent, with government calculations putting the average increase to families at $125.84.

But Compare Club’s analysis of its customers’ average annual premium suggests that number is closer to $154 for a family with both parents in their late 40s, and could be as much as $174 for Australians over 60.

As you know I’m married to the world’s best negotiator and Libby makes it an annual event to compare our private health insurance and to switch to a better deal.

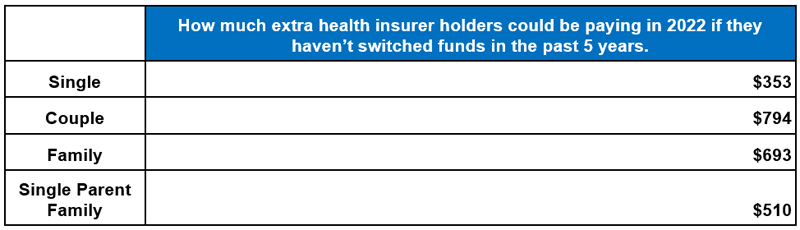

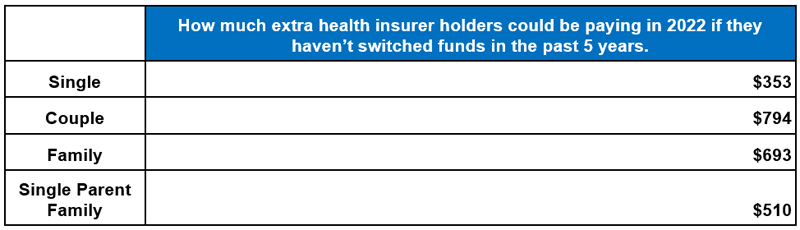

By the time premiums increase in 2022, Australians who haven’t switched their health fund in the last five years could be paying almost 16 per cent more for health insurance than they were in 2018, based on Compare Club data. For a couple, that could be as much as $794.

Note: Based on average premium sold by life stage by Compare Club in 2018 with every average rate increase since 2018.

HCF, Medibank and NIB have already flagged a delay in premium rises, with other funds expected to follow, but that shouldn’t deter Australians from switching. Those premiums will still increase and consumers shouldn’t be distracted by promises of delays.

To help with your research I’ve outlined some of the most important things to consider depending on your stage of life.

Young, single and ready to mingle

If you’re young, fit, healthy and not planning a family, you can enjoy significant savings by opting for just basic hospital and extras cover.

Basic hospital provides you with a wide range of treatment options in the event of an emergency, but you won’t be forking out for a whole raft of treatments that you’re unlikely to require.

The level of extras you need depends on your situation. However, some combination of basic dental, optical and physio will generally cater for most young people. You might even find you don’t need extras cover at all.

If you’re under 31 years of age, given our first-world hospital system there is a valid argument for not having private cover at all.

Growing up and starting a family

As you become older and wiser, private health insurance becomes more important.

This is especially true for couples planning on starting a family who want the added comfort and peace of mind of choosing their hospital and healthcare professionals.

You may also wish to better protect yourself against the unexpected or save on out-of-pocket expenses through improved extras cover. Things like obstetrics and IVF being obvious inclusions.

Plus, there are financial implications for not taking out cover as you get older.

The government’s Lifetime Health Cover initiative means that people who don’t take out private hospital cover by the 1st of July after their 31st birthday have to pay an extra two per cent on their premiums for every year they’re aged over 30.

And people earning more than $90,000 a year who don’t have private health insurance will be whacked with what’s known as the Medicare Levy Surcharge at tax time. It ranges from 1 to 1.5 per cent, depending on your income.

Families

From dentist trips to late-night dashes to the doctor, kids are a constant source of expensive medical bills.

Private health insurance can help families save significantly on the out of pocket expenses associated with raising kids. It also provides a wider range of treatment options if things go wrong.

Having consolidated family cover means that everything is in the one place, and everyone is properly protected.

Keep checking which policy presents the best value for your family as the kids grow, too.

Empty Nesters and Retirees

The facts of life are that age does wear out the body. You certainly don’t ‘bounce back’ like you did as a youngster. Add declining potential income and senior Australians can’t afford a major medical event to drain their retirement nest egg.

That translates into needing robust private health insurance toward the top levels of cover.

Other considerations

We have a great public health system in Australia with Medicare, but private health insurance provides an increased choice of care and improved peace of mind. It can also provide significant savings on services Medicare doesn’t cover.

Still, as we’ve seen with the latest round of premium rises, it’s also a significant expense. So no matter your age, it’s important to consider whether the cover you’re paying for is appropriate for your situation.

And with rates about to jump, now’s the perfect time to reassess your policy and check the market for better deals.

Always remember to watch out for waiting periods when you upgrade your policy or switch funds, and be smart about how you use your cover. For the best possible savings, use affiliated care providers.

Trending