Happy Friday everyone,

As Victoria goes back into lockdown to fight a second wave of the Coronavirus, economists are getting concerned about the economic damage and investors are getting spooked.

A couple of points to make up front;

The Government is borrowing money at less than one per cent interest.

I’ve mentioned this before, but it’s worth restating, while Government debt will obviously rise to fund the economic stimulus packages the debt level is easily manageable… and it’s borrowing at an interest rate of less than one per cent.

For example, just this week the Australian government sold $2bn in bonds set to mature in 2030 at an average yield (interest rate) of 0.8759 per cent and had demand from investors of more than three times the offer.

This latest Treasury tender sold $2bn in May 2030 bonds to 18 successful bids, with total demand of $7.3bn. The lowest yield accepted was 0.8725 per cent, and highest of 0.8775 per cent.

Bottom line is lots of demand for our government bonds from major international institutional investors at very low interest rates.

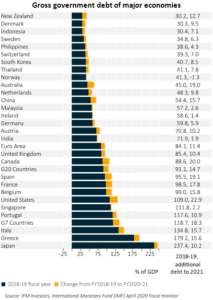

This chart shows our current debt level, and post pandemic, really well. Australia’s Gross Government Debt as a percentage of the economy before the Covid stimulus was 45 per cent … the dark line next to us on the chart.

The yellow line shows how much our debt will rise to finance the stimulus… 19 per cent.

So after the stimulus our Government debt (mortgage) to the size of the economy (the house) will be 64 per cent.

At that level it is still very manageable and way below our major trading partners.

Look at China (70%), Germany (66%), UK (96%), US (132%), Japan (250%) and Canada which is a similar sized economy as ours at 109 per cent.

And the RBA is still comfortable

While everyone expected the Reserve Bank to keep official interest rates on hold at the current record low 0.25 per cent, it’s their commentary which everyone focussed on.

Which is still pretty optimistic despite Victoria’s second wave.

They cautioned that the “outlook remains uncertain and the recovery is expected to be bumpy”, but emphasised that “conditions have, however, stabilised recently and the downturn has been less severe than earlier expected.”

Australia’s overall success in containing the virus was behind a “pick up in retail spending” and “while total hours worked in Australia continued to decline in May, the decline was considerably smaller than in April and less than previously thought likely.”

With the Aussie economy “experiencing its biggest contraction since the 1930s,” the RBA reaffirmed that “it is likely that fiscal and monetary support will be required for some time.”

Low interest rates are getting lower

Despite the RBA not shifting official interest rates, financial institutions are changing rates themselves. Good news if you’re a borrower, bad news if you’re a saver.

For example, UBank has cut its variable home loan rate by 0.1 per cent.

The new rate is UBank’s lowest ever variable rate in 11 years …2.49 per cent p.a (variable) for owner occupier home loan customers paying principal and interest –

The reduction could save owner-occupier customers paying principal and interest save $400 a year on a $400,000 home loan

Since June last year, UBank has lowered our variable interest rates by 1.1 per cent in total … potentially saving customers an additional $4,380 on a $400,000 loan in the first year and possible $85,000 over the 30 year loan term.

But, as I said, good news for borrowers and bad news for savers. Look at how low the savings rates are.

Big four bank rates

Standard savings accounts:

| Bank | Product | Intro rate | Ongoing rate | Intro term |

| CBA | NetBank Saver | 1.00% | 0.05% | 5 mths |

| Westpac | eSaver | 1.00% | 0.05% | 5 mths |

| NAB | iSaver | 1.05% | 0.05% | 4 mths |

| ANZ | Online Saver | 0.80% | 0.05% | 3 mths |

Conditional savings accounts

| Bank | Product | Base rate | Max rate | Conditions |

| CBA | Goal Saver | 0.10% | 0.50% | Deposit $200+/mth, no withdrawals |

| Westpac | Life | 0.40% | 1.00% | Balance needs to be higher every mth |

| NAB | Reward Saver | 0.05% | 1.00% | 1+ deposit and no withdrawals per mth |

| ANZ | Progress Saver | 0.01% | 0.85% | Deposit $10+/mth, no withdrawals |

Note: based on a balance of less than $50K. CBA has higher rates for higher balances.

Super Fund returns bounce back in June quarter

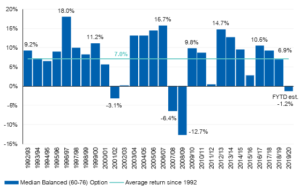

A strong June quarter has seen super funds recover but results for the 2020 financial year will still be negative..

According to estimates from leading superannuation research house SuperRatings, the median balanced option returned 0.8 per cent in June as sharemarkets continued to recover from their March lows. Despite a promising comeback over the quarter, super funds were unable to make up the deficit for a positive annual result.

Based on June’s estimate, members in the median balanced option have seen their super fall by around 1.2 per cent over the past 12 months. However, while the financial year result will be negative, it is a relatively mild drop compared to previous years in which super has taken a hit.

Super funds still have some way to go before recovering from the virus-induced sell-off in February and March this year. Since the start of 2020, the median balanced option has fallen 5.1 per cent, while the median growth option is down 6.7 per cent. The capital stable option, which includes more defensive assets like bonds and cash, has fared relatively better, falling only 1.6 per cent.

Accumulation returns to end of June 2020

| FY20 | CYTD | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a) | |

| SR50 Growth (77-90) Index | -1.6% | -6.7% | 5.5% | 6.3% | 8.0% | 8.0% |

| SR50 Balanced (60-76) Index | -1.2% | -5.1% | 5.1% | 5.9% | 7.3% | 7.6% |

| SR50 Capital Stable (20-40) Index | 0.4% | -1.6% | 3.5% | 3.9% | 4.7% | 5.1% |

Source: SuperRatings estimates

MEDIAN BALANCE FINANCIAL YEAR RETURNS SINCE INTRODUCTION OF SUPER GUARANTEED

Be careful of your tax adviser

The Tax Practitioners Board has put out their annual warning to make sure your tax agent is qualified.

. Check your tax practitioner is registered on the public register at tpb.gov.au/onlineregister. Only registered tax practitioners can charge a fee for tax agent services.

. Be careful if an agent offers to secure you additional government stimulus payments as a result of the COVID-19 situation.

. Never share your myGov password with anyone … doing so puts your personal information at risk.

. You should not allow anyone to lodge or prepare your tax return through your myGov account.

Stock of the Day; Sezzle

AfterPay has been a stellar stock on the sharemarket which has also put the focus on other stocks in the sector like Zip and Sezzle… are they baby Afterpay’s?

This week on my daily program “The Call” streaming on the Ausbiz business and markets channel, we focussed on Aussie listed but US-based Sezzle. The day following our discussion, Sezzle went into a trading halt as it raised $80 million in new capital to fund expansion.

Buy-now-pay-later Sezzle got the tick of approval from revered American venture capitalist Gene Munster this week, who said the company “crushed it” over the June quarter.

Merchant sales surged 349 percent to US$188 million over the past 12 months thanks to increased online sales during the lockdown.

With the stock up to a record $5.24 yesterday, Kochie asked our experts, Henry Jennings from Marcus Today and Kim Slater from Kimber Capital.

Henry says Sezzle has followed the Afterpay model to a T, with the same payment terms and even a similar looking website, and is expanding its footprint in the US, where it is headquartered.

“It’s a fraction of the price of Afterpay, so you are getting in at what is the ground floor. But it’s such a busy sector at the moment… Sezzle is the most like Afterpay of any them.”

Kim said his philosophy is always to go with the incumbent i.e. Afterpay as the smaller players are just picking up the crumbs from the table.

He says the growing scale of the buy-now-pay-later sector means it is unlikely to remain unregulated for long.

“Think about Facebook. When it first started it was in an unregulated market, then it ran headlong into the regulators… Afterpay is not going to be any different.”

“I’d stick with Afterpay because I think that’s where you’re going to get the maximum afterburn.

Henry also likes Afterpay but says Sezzle could be an interesting prospect if it can continue on its current growth trajectory, which is similar to Afterpay.

“You can value everything on the back of the big daddy,” he says.

Trending

Sorry. No data so far.