The average mortgage has increased substantially as the property market continues to cook. During the week APRA took steps to cool things down.

Both Reserve Bank Australia (RBA) and the federal treasurer have said they won’t increase interest rates to cool the overheated property market. They want the states to do it by allowing more homes and apartments to be built… and they want lending standards tightened.

In fact, APRA during the week informed financial institutions they cannot lend home loan borrowers anything more than six times their current income. In recent times more than 20 per cent of new borrowers secured loans above this level.

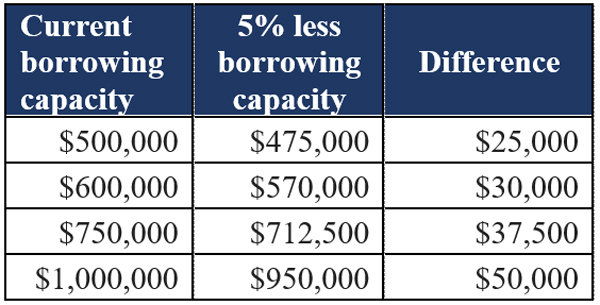

Maximum borrowing capacity will drop by 5 per cent

When assessing how much to lend, financial institutions will also base their approval on the ability of the borrower to pay an extra 3 per cent interest on top of their current rate.

Lower borrowing limits will naturally dampen demand for property and hopefully cool value increases.

APRA estimates a household’s maximum borrowing capacity will drop by 5 per cent.

Therefore, a household, who under the old rules could borrow a maximum of $500,000 will see their borrowing capacity fall to $475,000 – a drop of $25,000.

However, many households do not borrow to their full capacity and so may not be impacted by these changes.

Source: RateCity.com.au

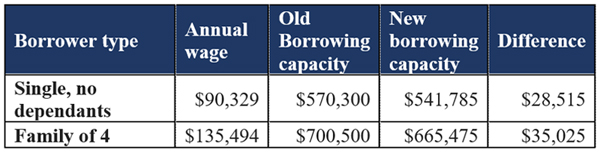

How Australians on the average income will be impacted

RateCity.com.au estimates the average family’s maximum borrowing capacity could drop by $35,025 under the new serviceability buffer rules.

This assumes one adult is working full time and the other part time (1.5 times full time average wage), with two dependent children, and based on CBA’s serviceability calculator on a fixed rate.

A single person on the average income will be able to borrow approximately $28,515 less under the new rules.

Source: RateCity.com.au. Notes: Calculations are based on CBA’s serviceability calculator for a borrower taking out a CBA fixed rate. Income is based on the ABS average weekly wage, full time adult ordinary time earnings, a family is considered to have 1.5 full time incomes. HEM is estimated to be $4,500 per month for a family and $2,000 per month for a single person. Assumes no other existing debts.

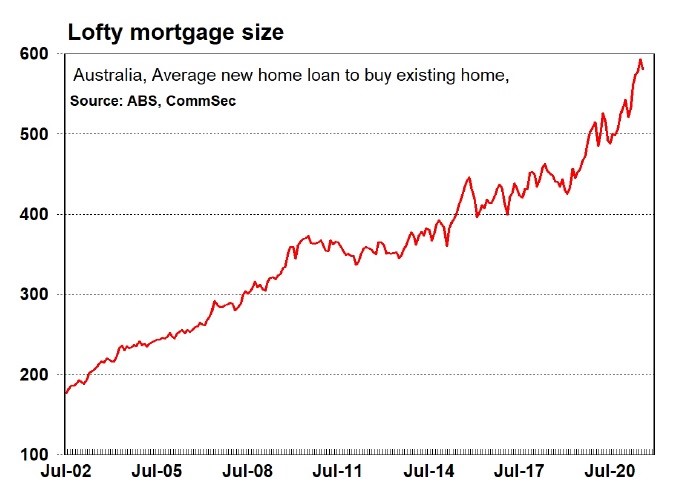

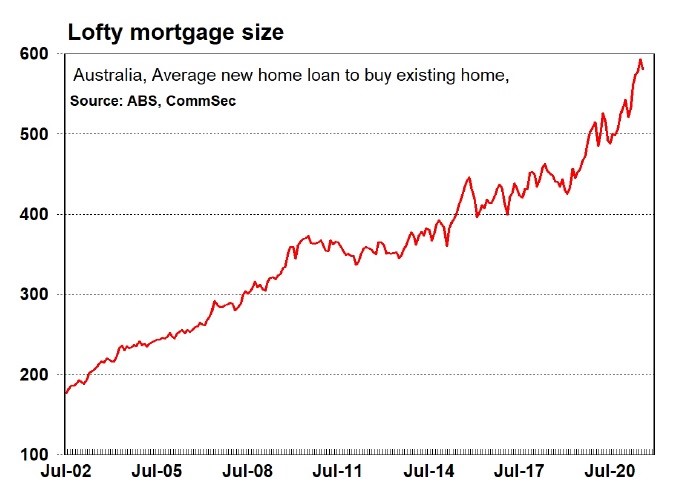

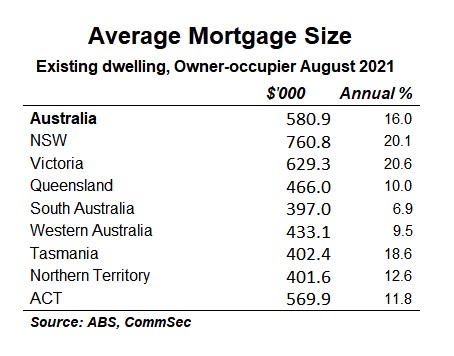

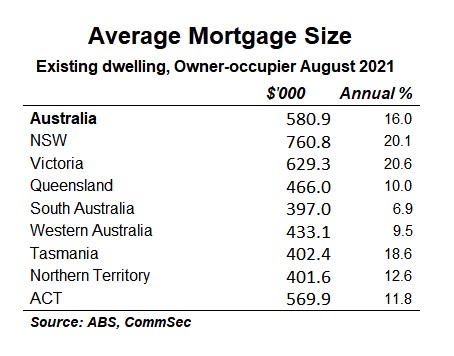

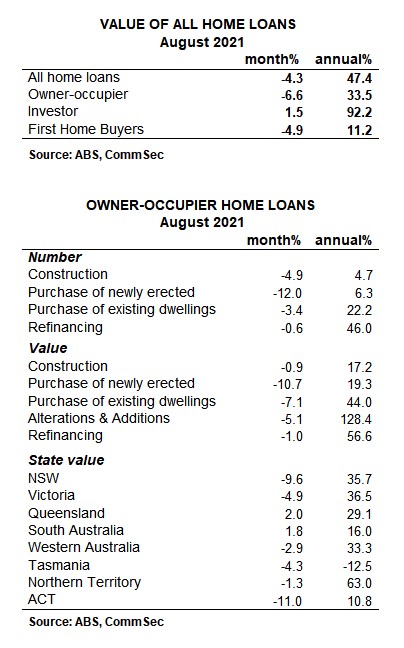

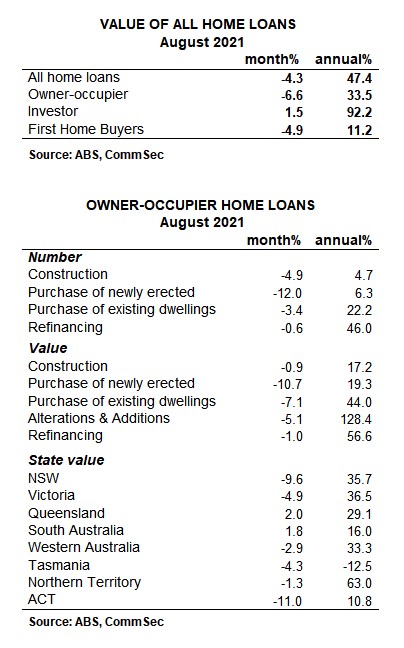

The reason for the concern is the average new mortgage for people wanting to buy an existing home is $580,900. Which is up 16 per cent over the past year or an increase of over $80,000.

Source: ABS/ CommSec

Of course, this is an average mortgage across the country. In South Australia the average mortgage is $397,000, which is now below that of Tasmania. In NSW, the highest new average mortgage is a whopping $760,800.

Source: ABS/ CommSec

The average mortgage can be influenced by interest rates, home prices, the size and quality of homes purchased, as well as changes in wages, wealth and the cost of other items in the household budget. So if the average borrower needs to find an extra $80,000, this may influence future spending and lifestyle choices.

Source: ABS/ CommSec

That means borrowers have less money to spend on things like clothes, cars, entertainment and travel. So there will be a ripple affect across the broader economy.

Trending