A family trust can serve a wide range of purposes and be extremely useful vehicles for tax planning, financial planning and investment.

The Australia Institute examined ATO data and found that there are more than 800,000 trusts in Australia, with assets totalling more than $3 trillion.

One of the reasons for the popularity is that trusts are seen as a good way for a family to structure its tax obligations. The trustee is free to distribute trust income to as many beneficiaries as possible, and in whatever proportions take best advantage of the personal marginal tax rates of those beneficiaries.

While tax effective structures are one benefit of establishing a family trust, it’s not the only one. Let’s take a look at the basic principles of a family trust, their benefits and how they work.

What is a family trust?

Firstly, let’s unpack what a trust is in simple terms.

A ‘trust’ simply refers to a relationship where property is held by one party (the ‘trustee’), on behalf of other parties (the ‘beneficiaries’) who are entitled to the fruits of that property.

A trustee is the legal owner of the property, yet the beneficiaries are the beneficial owners. It’s a special kind of relationship where there is a distinct separation between the legal and beneficial ownership of property.

For example, I have $100 and want it to be set aside (held on trust) to be given to my son when he reaches age 21. I might ask my friend Michael, “could you please hold this $100 on trust for my son until he turns age 21.”

We have just created a trust, the essential elements of which are:

- Property –> $100

- Trustee (someone to hold the property on behalf of another) –> Michael

- Beneficiary –> my son

- There is intent

- There is an obligation to deal with the property for the benefit of the beneficiary(s)

A family trust is simply a special type of trust. It’s generally used to hold assets and distribute income to beneficiaries all belonging to the same family.

Who might use a family trust?

A wide range of people establish a family trust. These include business owners, a family group wishing to share investment income, investors, those wishing to provide a safety net around assets and those wanting to pass assets from one generation to the next using the same vehicle.

What are the benefits of a family trust?

Those setting up a family trust usually have a range of overlapping objectives in mind, such as to:

- make provision for their family, including young children and children with a disability

- attach certain conditions to gifts

- give children the benefits of family wealth without losing control over key assets

- create a framework for family assets to be passed from generation to generation

- protect these assets against potential creditors

- create a tax effective structure where taxable income can be distributed to different family members (beneficiaries) each year

How does a family trust work?

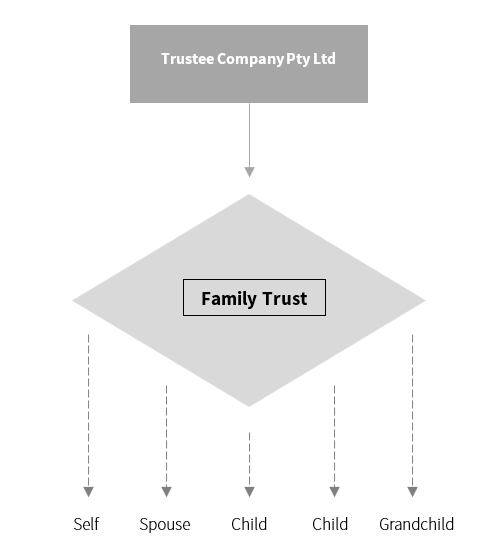

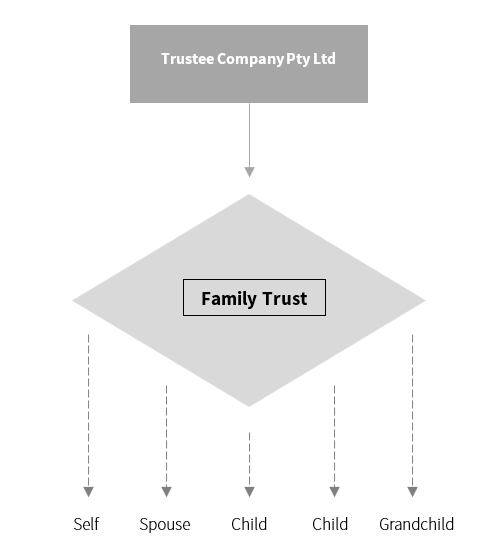

A family trust is usually controlled by a company with one or more directors. This company holds the assets “on trust” for the future use and enjoyment of the beneficiaries.

In most family trusts, none of the beneficiaries have an entitlement to assets in the trust. Instead, they are considered potential recipients of income each year, as determined by the trustee. The trustee may use its discretion to distribute the income in the most effective manner.

Getting good advice on whether a family trust is suitable for your circumstances is vital. So, if you need further help or guidance on setting up a trust, contact a financial planner who can assess whether it’s the right structure for you.

This is an edited version of an article that originally appeared on Align Financial and is republished here with permission. This article contains general information only. This should not be relied on as independent finance or tax advice. If you are after specific professional advice, speak to your registered tax agent/financial advisor or reach out to Darren at Align Financial.

Trending