The facts are clear that while we have a housing rental crisis, private property investors are doing the heavy lifting. Governments complain but do very little in terms of solving the issues.

The most recent data from the Australian Taxation Office shows 2,245,539 Australians or around 20 per cent of Australia’s 11.4 million taxpayers owned an investment property in 2020-21.

Just over 71 per cent of those investors owned just one property and 19 per cent owned two. Around 12 per cent of those investors were aged 65-74 years and the rest pretty evenly spread across all other ages.

You, a relative or friend probably own an investment property and would be annoyed at the criticism you’ve been receiving from tenants and politicians about increasing rents. The reality is that if it wasn’t for you the rental crisis would so much worse.

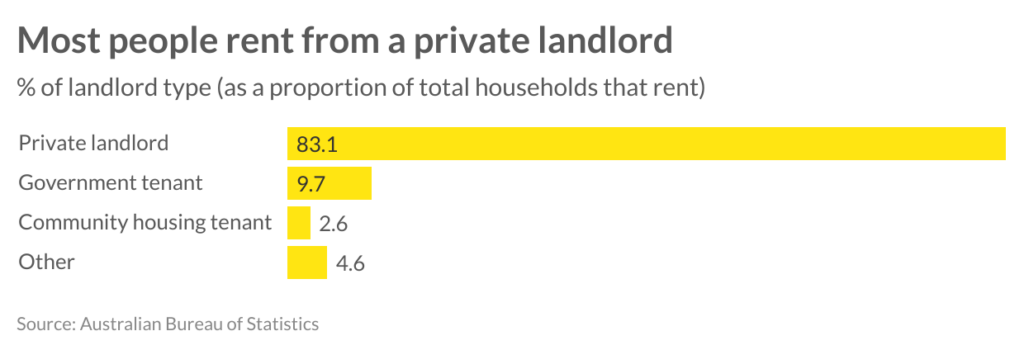

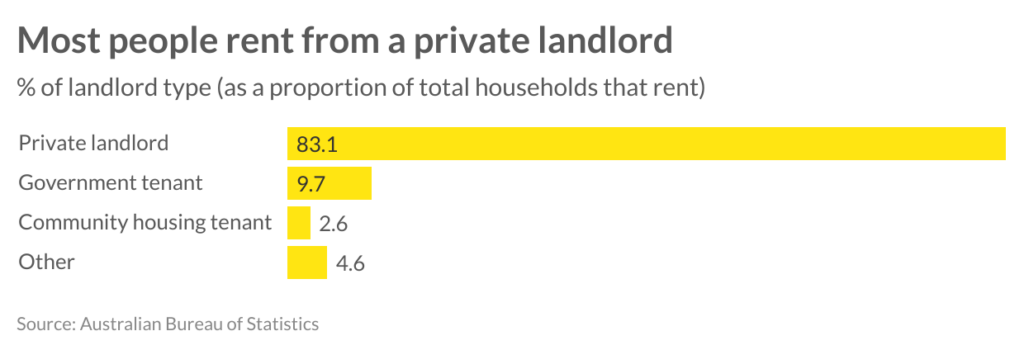

Private investors (“mum and dad” investors) provide most rental properties in Australia. If tax policy is changed that makes owning a rental property less attractive, there will immediately be far fewer rental properties available.

Source: Ray White

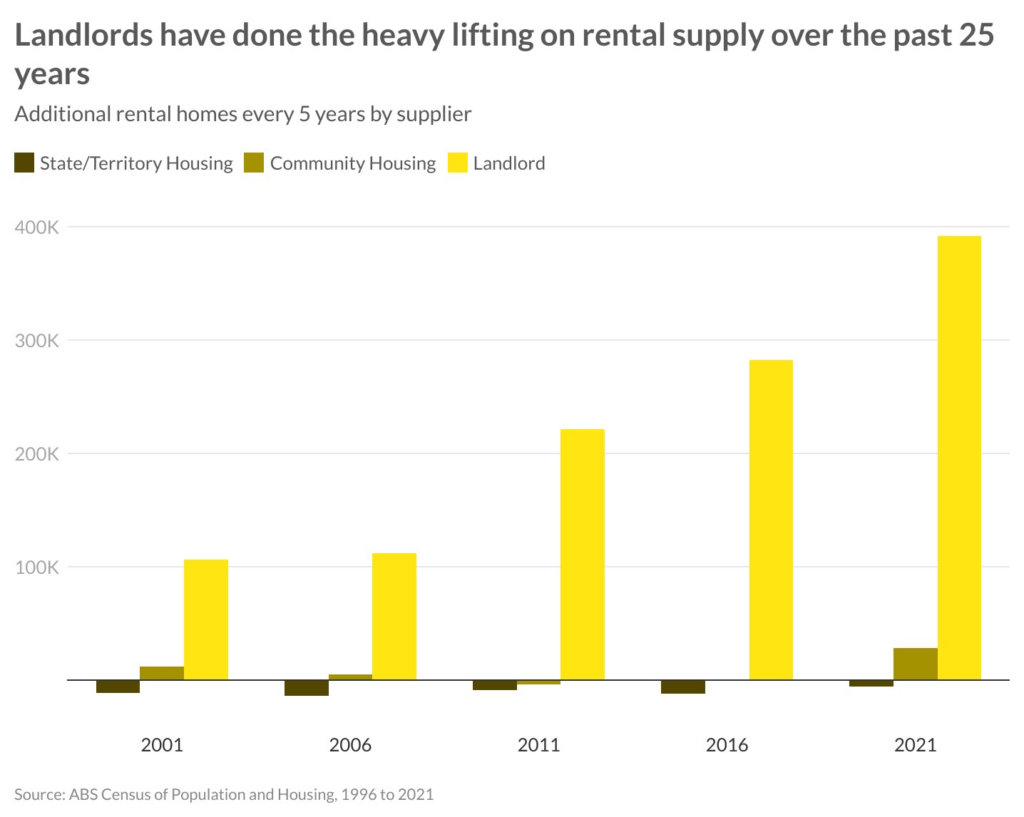

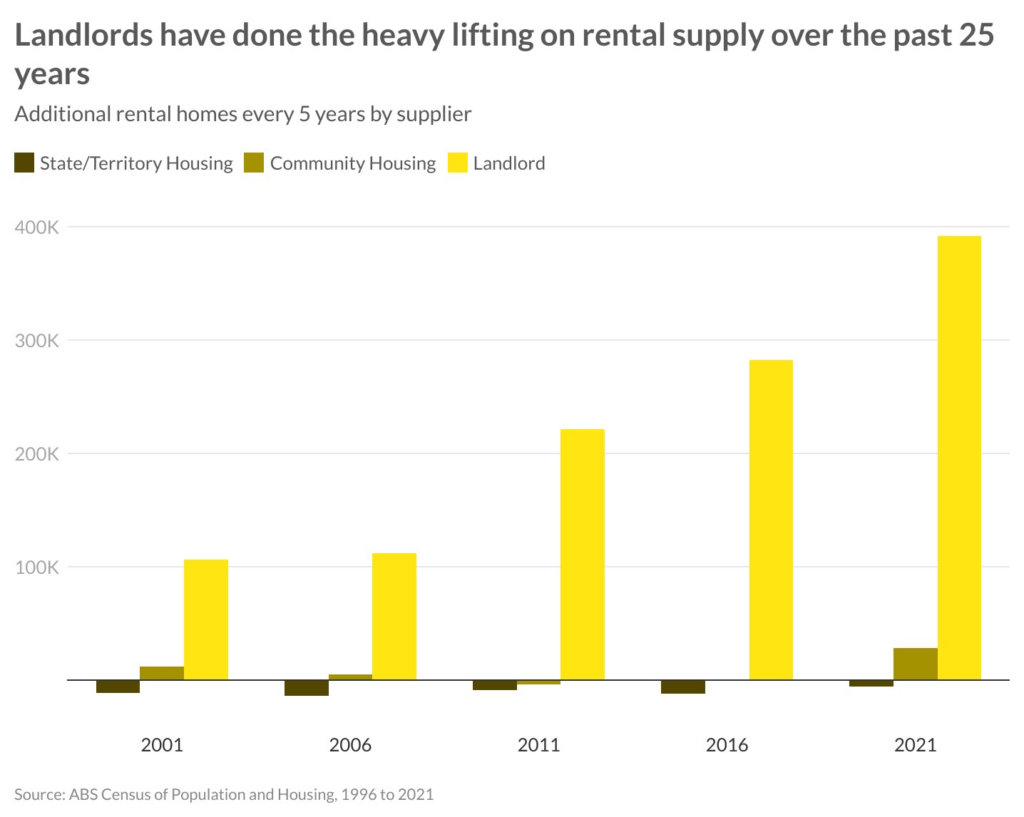

According to a great research paper from Ray White chief economist, Nerida Conisbee, between 1996 and 2021 there were an additional 1.1 million rental properties provided by investors.

Compare this to an increase of 41,000 homes provided by community groups and a loss of 53,000 rental properties provided by the government.

Source: Ray White

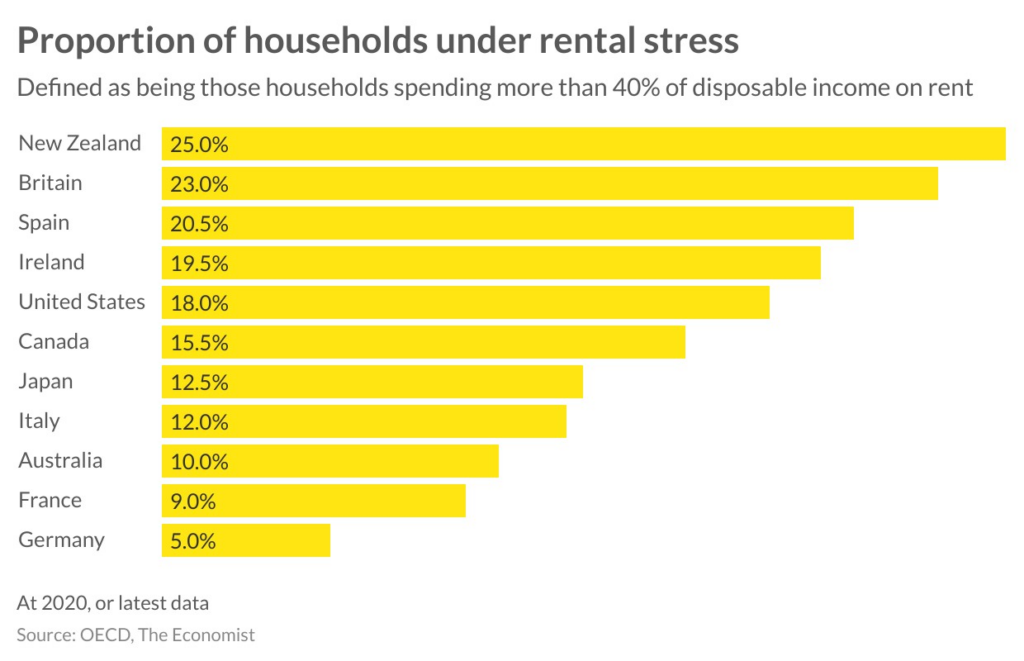

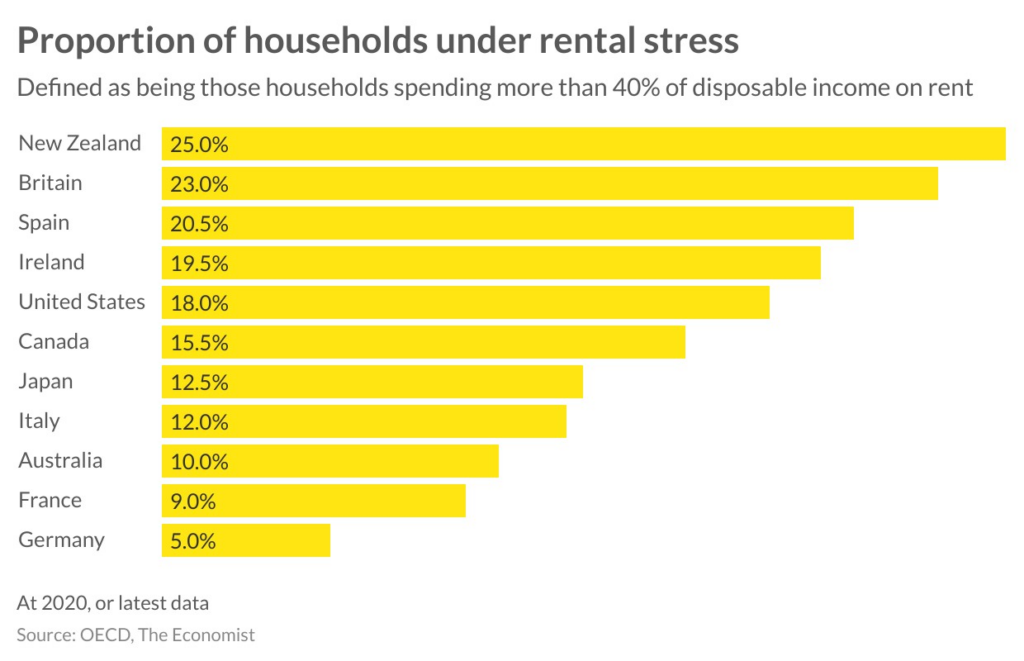

But according to Nerida, despite the rental crisis, rent stress in Australia has been kept low at a global level. An analysis of OECD data has shown that the proportion of households under rental stress is relatively low at 10 per cent. As a comparison, New Zealand, Britain and Spain all have very high levels of stress, exceeding 20 per cent.

While this measure would have increased since the start of the pandemic, the rental shortage is similar everywhere around the world and other countries would have seen similar increases.

Source: Ray White

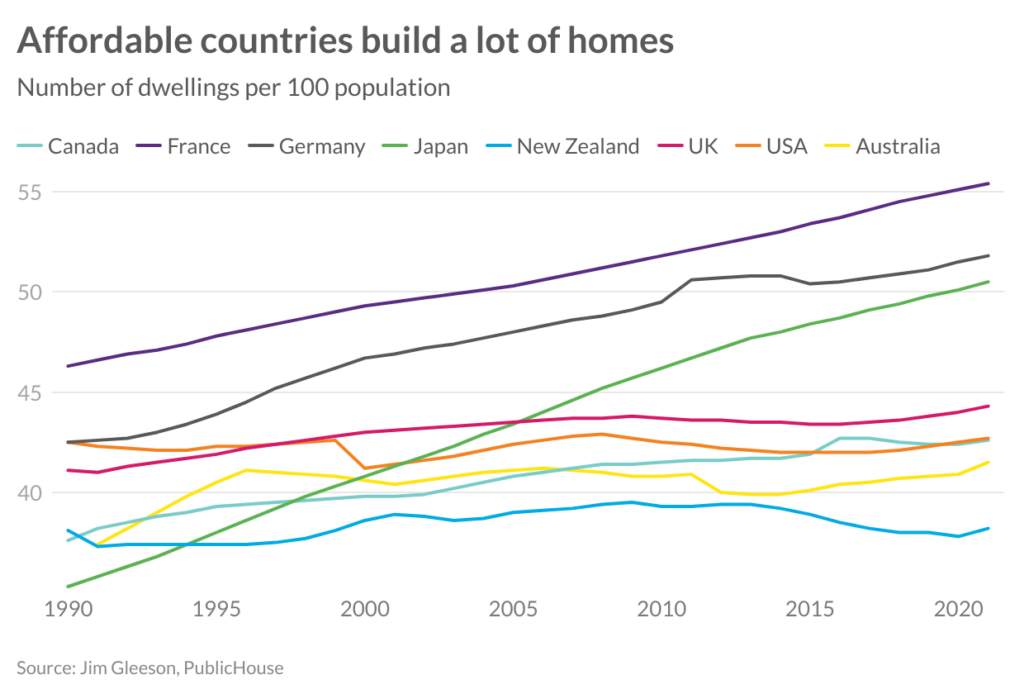

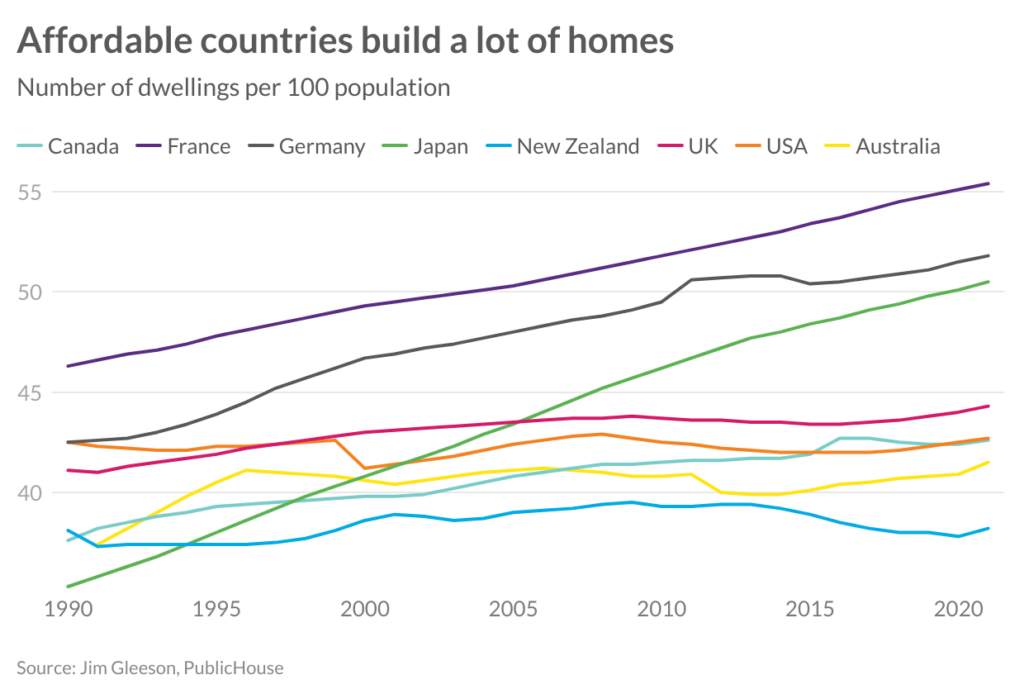

What is even more interesting is that Australia has maintained this low proportion of rental stress even though we have not built enough new homes relative to our population growth.

France and Germany have maintained rental affordability because they build a lot of homes relative to population growth. New Zealand has built the least which explains their lack of affordability. Australia has also under-built over a long time but has maintained higher rental affordability. It is likely that negative gearing has been a major contributor to this.

Source: Ray White

Many investors rely on negative gearing to make the investment viable and a loss of this incentive would lead to a large number selling. This will reduce the number of rental properties immediately. There are groups that could potentially step in but they are not ready to provide the amount required. In some cases, they are not interested or lack the capability to provide scale.

Historically, state and territory governments have supplied rental housing, however this has been reducing steadily over the last 20 years. Theoretically, this could be reversed, although many of the problems that face private developers would also face the government sector.

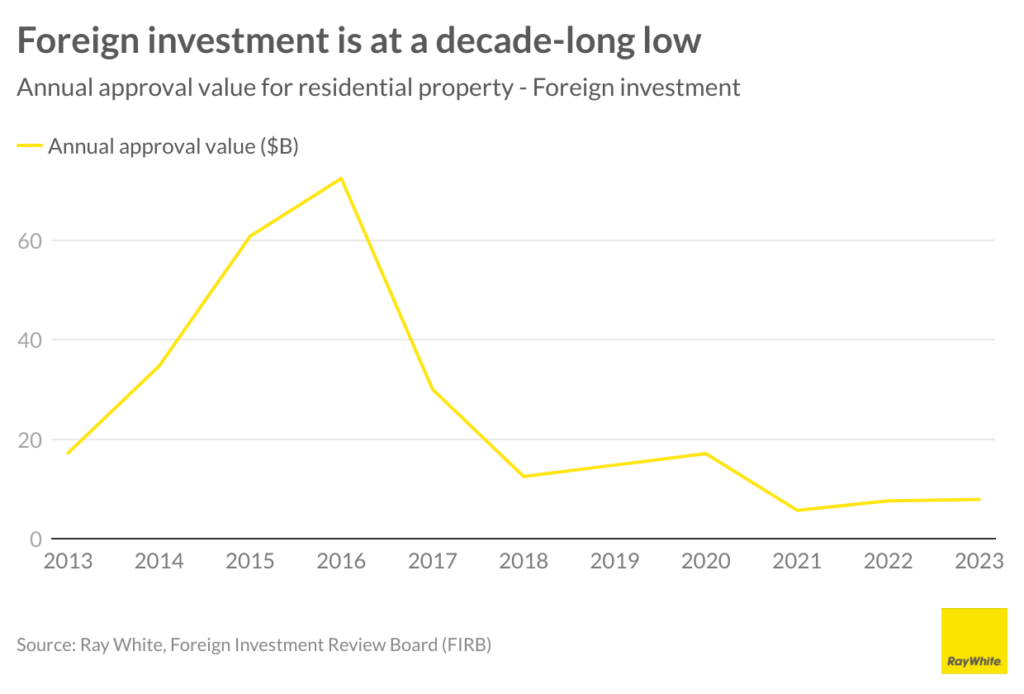

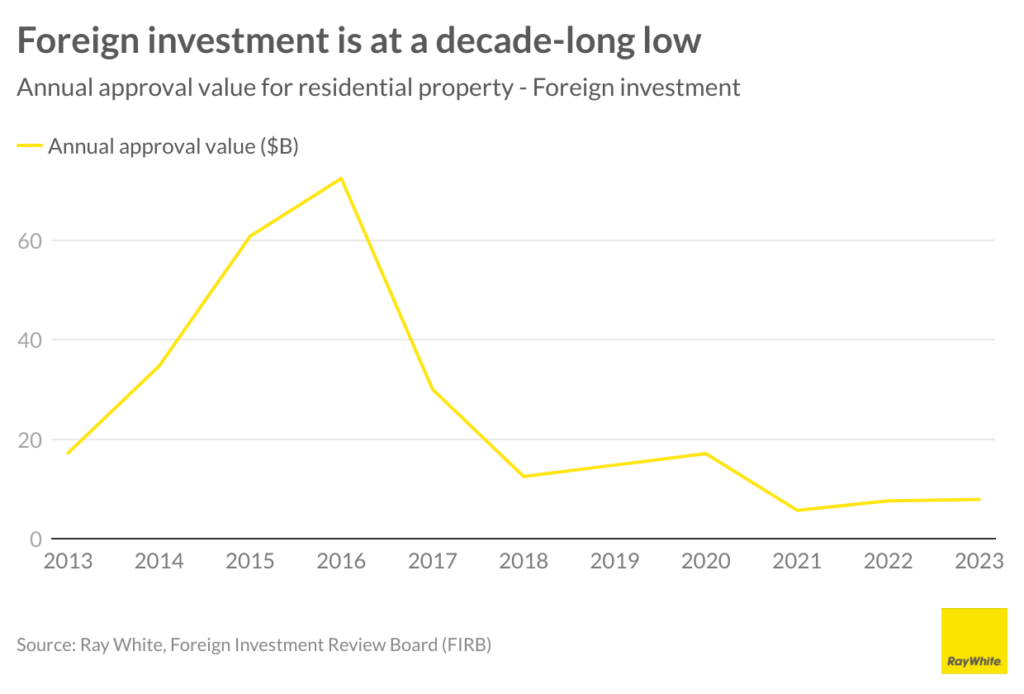

Foreign investors have been significant suppliers of rental properties in Australia however Nerida suggests they won’t return in the same way as seen in the last decade.

Source: Ray White

Even if many of the additional taxes we placed on foreign investors last decade were clawed back, restrictions imposed by foreign governments, particularly China, make it difficult to invest in Australia.

Trending

Sorry. No data so far.