I’m all for helping first home buyers get into the property market, as long as it’s done the right way at the right time. I’m not sure the Home Guarantee Scheme is it.

I get concerned when help for first home buyers happens at a time when property values are falling (in Sydney and Melbourne) and interest rates are set to rise. Plus, other capital city markets are close to the peak of the property cycle.

I’m not saying the Home Guarantee Scheme is bad, but it worries me. Just advise your kids or friends to go in with their eyes wide open.

What is the Home Guarantee Scheme?

This scheme allows first home buyers to purchase a property with a deposit as small as 5 per cent, without paying lender’s mortgage insurance. The Federal Government guarantees it instead.

From 1 July, the number of spots available under the Home Guarantee Scheme will be increased to 50,000 annually, which includes 35,000 spots for first home buyers under the First Home Guarantee.

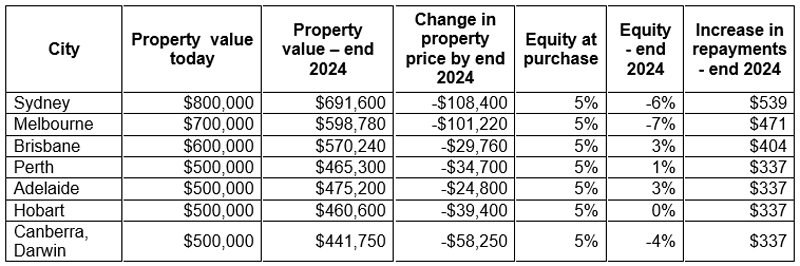

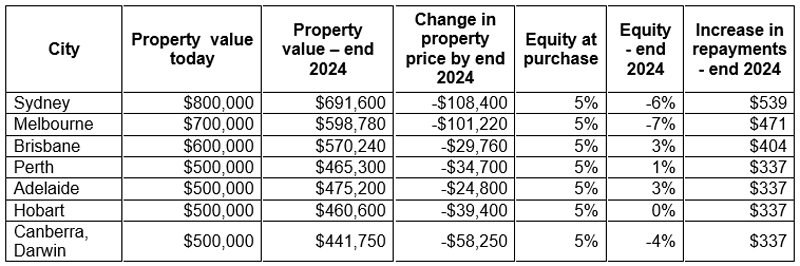

For argument’s sake, if a Sydney first home buyer bought now using a 5 per cent deposit, they could end up with negative equity of 6 per cent (the loan is higher than the value of the house) by the end of 2024 if the forecast 11 per cent drop in property prices comes to fruition. A Melbourne first home buyer could be in 7 per cent negative equity.

Plus, interest rates are about to start a quick move upwards. Again, based on bank forecasts, the monthly average mortgage repayments will rise an estimated $539 over the next 18-24 months.

So while the Home Guarantee Scheme looks attractive, it’s coming at a time of falling property values and rising interest rates… not a great combination.

Research group RateCity.com.au have produced a terrific table on the impact across the capitol cities.

Home Guarantee Scheme: why buying with a small deposit can be risky

Source: RateCity.com.au. Notes: based on a first home buyer buying a property at the end of 2022 as part of the government’s FHLDS paying principal and interest on CBA’s lowest variable rate applicable for low deposit loans. Assumes property is purchased with a 5% deposit at the top of the property price caps as determined by NFIC. Westpac economics’ property price and interest rate forecasts are applied. Property price forecasts for Canberra and Darwin are based on national forecasts.

Buying with a 5 per cent deposit means a person’s loan size is significantly larger than if they had bought with a 20 per cent deposit. This means when interest rates rise, their repayments will go up by more. If property prices then drop, people using this scheme are also likely to be locked into their lender and their guarantor for longer.

Before you get a loan, the bank makes sure you can afford the mortgage repayments even if rates rise by 3 per cent. That said, it’s worth doing the maths yourself to make sure you’re comfortable with this figure.

The sensible approach to getting your first mortgage

Some great advice from RateCity:

Start small: If you’re starting out don’t expect to buy your dream home straight away, buy something you can afford and possibly improve.

Set a price limit: don’t rely on the bank to tell you what you can afford to borrow. Think about how much debt you’re comfortable taking on.

Avoid mortgage stress: Mortgage stress is considered to be when low-and medium-income households are spending more than 30 per cent of their pre-tax income on housing costs.

Keep a rainy-day fund: Pipes can crack, hot water systems can blow, so make sure you have an emergency fund ready to pay for unexpected costs associated with your new property.

Trending