Rising interest rates will have a big impact on the average mortgage – and an increase is predicted to happen sooner rather than later.

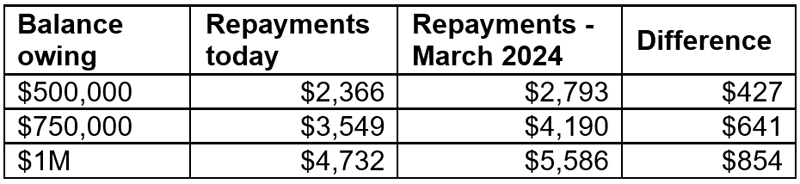

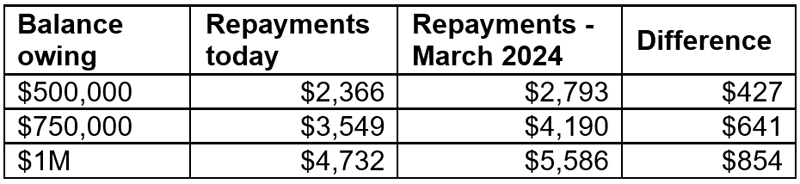

The average mortgage holder could end up paying $103 more in monthly repayments on their home loan by the end of this year, and $427 a month more by March 2024, should Westpac’s cash rate forecast be realised.

Westpac’s chief economist, Bill Evans, has said the cash rate will go up to 1.75 per cent by March 2024.

Westpac has brought forward its forecast for the first interest rate rise to August 2022, when it expects the cash rate to increase to 0.25 per cent from 0.1 per cent, followed by a further increase in October to 0.5 per cent.

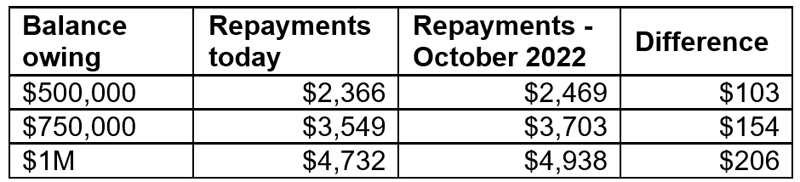

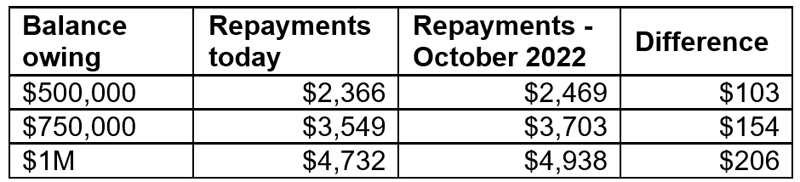

According to RateCity.com.au, if Westpac’s forecasts are realised, the average variable rate borrower with $500,000 owing on their mortgage could see their repayments rise by $103 a month by the end of October. This estimate includes principal they would have paid off in this time and assumes that the borrower has 25 years remaining on their loan.

Impact of forecasted cash rate hikes on average variable rate borrower, October 2022

Source: RateCity.com.au. Note: based on an owner-occupier paying principal and interest on the average existing customer variable rate of 2.98% and 25 years remaining. Loan size is based on amount owing in Jan 2022. Rate hikes are based on Westpac forecasts published 20.01.22.

Impact of forecasted cash rate hikes on average variable rate borrower, March 2024

Source: RateCity.com.au. Note: based on an owner-occupier paying principal and interest on the average existing customer variable rate of 2.98% and 25 years remaining. Loan size is based on amount owing in Jan 2022. Rate hikes are based on Westpac forecasts published 20.01.22. Assumes rate hikes in 2023 and 2024 occur at the end of each quarter.

How to plan for rising interest rates

Whether Mr Evans’ prediction comes true or not, it’s a good idea to plan for rising interest rates now. You’ll either be ready to meet your bank’s increase when the time comes. Or you’ll start to pull ahead on your mortgage repayments. Either way, you’ll be in a sweet spot.

Here are a few ways to rise along with the rates.

1. Work out what your increased repayments will be

Don’t wait for your bank – calculate how much extra you’d pay on your current home loan with rising interest rates in 0.25 per cent increments. It’s an easy job when you use the Money Smart mortgage calculator. Just plug in your current loan in ‘amount borrowed’, then add all the other details as per your current mortgage, including your current interest rate.

Now, change the interest rate up by 0.25 per cent and note the repayments figure down. Then increase the interest rate by 0.25 per cent and keep noting down the increases in your repayments.

2. Take a look at your budget

Once you know what higher interest rates are likely to do to your repayments, it’s time to reassess your budget. You’ll need to find the extra money somewhere. What can you squeeze to make the higher mortgage repayments?

For some, it will mean taking money that’s allocated for regular savings or investing. For others, it may mean cutting back on things like activities or home entertainment.

3. Understand your options

If you would really feel the squeeze if your interest rate increased by 0.25 or 0.5 per cent, it’s a good idea to talk to a financial counsellor.

Even though it ‘hasn’t happened yet’, pre-empting a crisis makes sense. The National Debt Helpline is a free service and you can either call them on 1800 007 007 or click through for a live chat session.

They’ll talk you through options like:

- Extending the length of the loan so that your repayments are lower

- Converting the loan to interest only payments for a period of time

- Reducing your repayments to the minimum monthly repayment amount

- Accessing money you may have available in any redraw of your loan

- Consolidating debts for example: personal loan, credit card and home loan debts into one loan, so that your total repayments are lower.

4. Save the difference between your current repayment and the new repayment

If you’ve worked out that you’re okay to meet an increase, you should start living as if it were the case right now.

Say you’ve estimated that with a 0.5 per cent increase, you’ll pay an extra $103 per month, consider adding that amount to your mortgage repayments now.

If you can’t commit to that just yet, at least try to save the extra $110 each month so you can get used to paying it.

Trending