Hi gang,

Was chatting with my colleague, David Scutt (Scutty), from our Ausbiz streaming service during the week about all the economic data coming out and what it’s telling us about the economy going forward.

I really value Scutty’s perspective because he is a good counter to my natural optimism.

In his view, forget trying to predict what shape Australia’s economic recovery will look like moving forward, be it a U, W, L, K or some other letter of the alphabet other than a V. It’s what happens in the labour market in the months ahead that will likely dictate what trajectory the economy takes as we enter 2021.

Except for a reasonable weekly payrolls report released by the ABS this week, the employment indicators don’t paint a rosy picture on what the future holds.

ANZ Bank’s monthly job advertisement series posed a minuscule increase of 1.6 per cent in August, undermined by weakness in the most populous states, Victoria and New South Wales. Total postings remain down 30 per cent from a year ago. For context, advertising levels weren’t all that lofty back then, either.

The NAB business survey also offered little reason for optimism with measures on employment, new orders and capacity utilisation all slumping, fitting with weaker activity, investment and hiring ahead.

And while the unemployment expectations sub-index in Westpac’s consumer sentiment survey improved sharply in September, this measures views on joblessness looking one year ahead. As we already know, unemployment currently sits at levels not seen since 1998.

Given the insights from these long-running data series, it’s little wonder economists are warning about the likelihood of renewed job shedding in August and September. At a time when household support payments are being unwound, the risks to the recovery are building to the downside.

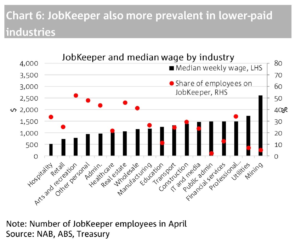

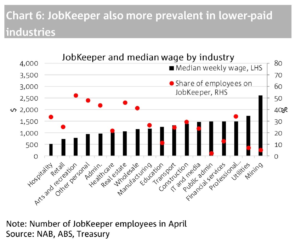

And when you look at this graph on the industries and jobs depending the most on JobKeeper, there could be a fair bit of pain coming next month as this wage support starts to wind back.

We’re wiser at using our credit cards

With the average interest rate charged on outstanding balances at 16 per cent, thank goodness we are using our credit cards better.

The average credit/charge card balance fell by 4.2 per cent to 14-years lows of $2,768.13 in July. While the number of credit and charge card purchases rose by 1.6 per cent in July after rising 7.7 per cent in June.

Interestingly, the value of purchases made with credit and charge cards fell by 1 per cent in July to be down 14.3 per cent on a year ago.

The number of credit and charge card accounts stood at a near 12-year low in July at 13.96 million, down from 14.09 million in June, while The number of debit card accounts rose 0.4 per cent to 40.2 million in July.

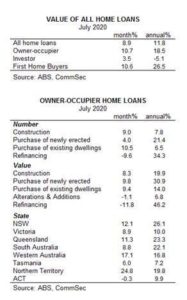

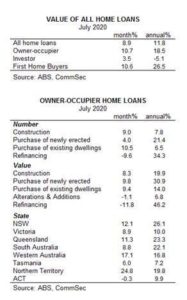

Despite the uncertain economy, home loans are up

I does make me wonder whether the full implications of an economic recession are not sinking in when I see such healthy home loan data and average home loans bigger than a year ago.

There are more first home buyers taking out loans than at any point over the past decade. Also expectations of future house prices lifted almost 22 per cent last month.

Spending is rising at double digit annual rates and people are still confident enough to be buying and building more homes.

Maybe the Reserve Bank strategy is working. Super-low interest rates and an expectation that they are not going to rise for three years are encouraging people to buy and build homes.

Macquarie polishes the crystal on sharemarket winners for next year

Macquarie stockbrokers believe the stocks which have taken the biggest revenue and profit hit as a direct result from COVID are likely to be the biggest winners from a rebound in the economy and a vaccine.

It says the travel and leisure sector are likely to be big winner and likes stocks such as Flight Centre, Qantas, Sydney Airport, Corporate Travel, Crown Resorts, and Star Entertainment.

Macquarie also says that continued low interest rates and the upcoming Government stimulus will boost housing related stocks such as Harvey Norman, JB Hi-Fi and Nick Scali… because you have to furnish new homes.

Because flight bans and social distancing rules are likely to stay in place for a while, we’ll be driving more to work and on holidays so the likes of ARB Corporation, Bapcor, Transurban, SG Fleet Group, and GUD Holdings will benefit.

The broker also likes WiseTech, NextDC, Goodman Group, Amcor, CSL, Brambles and James Hardie.

Big banks take on Buy Now Pay Later programs

In one week the Big 4 Banks (well, atleast 2 of the at the moment) have launched an attack on the Buy Now Pay Later groups… like Afterpay and Zip.

Instead of launching their own BNPL programs, CBA and NAB have launched 0% interest credit cards with small credit limits.

It’s a smart idea because young Australians have a serious aversion to credit cards and their high interest rates… that’s why they love Afterpay and Zip.

So how do these two new cards compare.

Research group RateCity have done the analysis for us.

HOW DO THE BIG BANK CARDS COMPARE?

| CommBank Neo | NAB StraightUp | |

| Interest charges | 0% | 0% |

| Late payment fees | $0 | $0 |

| Foreign exchange fees | 0% | 0% |

| Credit limits | Opt for a $1K, $2K or $3K credit limit | Opt for a $1K, $2K or $3K credit limit |

| Monthly fees | $1K credit limit = $12 / mth

$2K credit limit = $18 / mth $3K credit limit = $22 / mth Waived if you don’t use the card and have a $0 balance. |

$1K credit limit = $10 / mth

$2K credit limit = $15 / mth $3K credit limit = $20 / mth Waived if you don’t use the card and have a $0 balance. |

| Minimum monthly repayments | 2% of balance or $25, whichever is higher. | Between $35 and $110, depending on credit limit. |

| Where it can be used | Anywhere Mastercard is accepted. Not for gambling or cash advances. | Anywhere Visa is accepted. Not for gambling or cash advances. |

| Other | Access to CBA’s Mastercard rewards program available to debt and credit customers | N/A |

Source: RateCity.com.au

While CBA’s card is very similar to NAB’s, aside from the small variation in monthly fees, there are two key differences, according to RateCity research director Sally Tindall.

“The main difference between the two cards is NAB is asking customers to pay back more of their debt each month, which will see them clear it faster.”

“The second difference is CBA offers shopping perks, but only if customers spend at certain stores.

“Customers should be wary: if they start buying things in a bid to claw back their monthly fee, then they’ve probably been had.”

So how do these cars compare with the BNPL programs from Afterpay and Zip?

How do the new cards compare to buy now, pay later services?

| CommBank Neo card | NAB StraightUp card | Afterpay | Zip Pay | |

| Interest rate | 0% | 0% | 0% | 0% |

| Credit limit | Up to $3K | Up to $3K | $2K | $1.5K |

| Late fees | $0 | $0 | $10 per late repayment. An extra $7 if you don’t pay in 7 days. Max fee 25% or $68 whichever is lower. | A dishonour fee of $15 applies. An extra $5 after 21 days of not paying the minimum. |

| Ongoing fees | Up to $22 per month when in use or debt owing | Up to $20 per month when in use or debt owing | $0 | $6/mth if you have money owing. |

| Where can you use it? | Anywhere Mastercard is accepted except gambling and cash advances | Anywhere Visa is accepted except gambling and cash advances | Affiliated retailers only. | Anywhere a credit card is accepted. |

| Repayment schedule | 2% of balance or $25, whichever is higher. | Minimum repayment of $35 – $110 depending on credit limit | 4 instalments over 6 weeks | Minimum repayment of $40. |

Source: RateCity.com.au

Should you be concerned by this week’s big share sell offs

|

Stock of the Week #1; CSL

Close to 89 million COVID vaccine doses could be manufactured by CSL in Australia… with plans underway to produce 51 million doses of the vaccine by the University of Queensland. CSL said the numbers ordered by the government equated to one dose and a booster for every Australian, with hopes it could be delivered as soon as early next year in Australia.

Prime Minister Scott Morrison warned there were no guarantees the vaccines would work, but if they do “the agreement puts Australia at the top of the queue”.

CSL is one of Australia’s great homegrown Medtech’s… it’s the old Commonwealth Serum Laboratory. I asked my experts on The Call, Andrew Wielandt from DP Wealth Advisory and Rob Corlett from Maqro Capital, to give their diagnosis on CSL.

Andrew says it’s one of his favourite stocks.

“I’d be very keen picking this up under $300 a share. It certainly gets the green light from me. During March 23rd madness, it got down as low as 250 bucks. You should have been all over that like a cheap suit.

“It is a quality business and has a 36 per cent return on shareholders’ funds. There are so many positive drivers. One of the only negatives I can think of is the rising Australian dollar.

“I find most clients don’t own it because they’re scared of paying $280. But this is a company that is just doing so well. I’ll be very comfortable in holding on to it.”

Rob agrees with Andrew and it’s great at anything under $300.

“It’s one of the great companies we’ve got. Their plasma division was underperforming on the basis that people weren’t in the city to stop at the blood donation banks. By the time they report next, people would have gone and got the flu vaccine this year, so that revenue should be at an all-time high.

“There are huge barriers for entry for any competition, which is why they have performed so well. A growing population is a growing market for them.

“If you get it under $300, count yourself lucky. Make it a sizable allocation and then just forget about it.”

Stock of the week #2; Whispr

Whispir’s pre-IPO backers, Australia’s Telstra Ventures and Singaporean fund OpenSpace Ventures during the week sold their combined $76.2 million stake in the business. This comes just a week after it was announced that Whispir would be added to the S&P/ASX All technology Index.

Given it was listed on the ASX last year at a price of $1.60 (and its been trading just under $4 this week), it appears these early investors decided to take their impressive gains off the table. As a result, the share price has come under pressure, closing down 11.4%.

I asked our experts on The Call (M-F 12-1pm AEST on Ausbiz), Julia Lee from Burman Invest and Rod Bristow from Clime Investment Management, to give their opinions on WSP. Julia likes that the company and has been adding new clients.

“Whispir is having its day in the sun. It’s winning a number of government contracts because of COVID-19.

“This is a communications platform that amalgamates different things. So if you want to send out SMS or emails, you can do it all through this platform. When you do see big backers selling out of companies, you have to ask yourself, are the best days already behind it?

“I think the exciting thing is that they haven’t made huge in-roads in the US yet, which is a big market. That opportunity is still in front of them. For the short term, taking a little bit of money off the table probably looks prudent. I base my investment around fundamentals but I like to look at technicals. I hate buying something and then watching it drop-off. So in this particular case, I’ll probably wait to see how it turns out.”

Rod agrees with Julia and thinks there is a lot to like about WSP.

“We’ve got this combination of recurring revenues, good customer base and government clients. Companies like AGL, Monash University, City of Hobart are some of its clients. I think it has a good increase in recurring revenue year-on-year which is very positive.

“I think there are potentially two ways to look at the institutional sellout. One of those ways is, of course, the concern, which is why they’re getting out now. If they thought the stock was cheap, they would be probably holding them. The other way is that perhaps this might actually free the company up a little of the overhang from institutional investors and get that out of the way.

“It’s valued at 10 times revenue, which is always a little bit of a concern. We think that there’s $15 million worth of cash sitting there on the balance sheet. There might be a risk of needing to go back and tap the market if the growth strategy either accelerates or doesn’t pan out the way as expected.

“It is expensive at the moment and it looks like a hold, for now, and I also agree it might be an opportunity to take a little bit of money off the table.”

Trending

Sorry. No data so far.