PayPal has a new Buy Now, Pay Later product called Pay in 4. Here’s the lowdown on what they’re offering and how it compares to what’s currently out there.

Buy Now, Pay Later (BNPL) is hot… with both shoppers and investors. Shoppers love the convenience and investors have loved the booming share prices of companies like Afterpay, Zip and Sezzle.

But critics of these shares say they are overvalued because there’s nothing to stop competitors coming into the market. And that is exactly what we are seeing.

Payments giant PayPal is the latest to launch a BNPL service in Australia called Pay in 4. It is now available to the majority of its nine million Australian customers. They’ve been approved for use by PayPal without needing to apply for the credit service.

Pay in 4 charges no interest, account fees or late fees.

This is just one of the many new BNPL offerings hitting the market. Last week, tech giant Apple said it was going to launch its own BNPL and most of the Big 4 banks are looking to get in on the action as well. Commonwealth Bank is about to launch Step Pay. Shoppers will be spoilt for choice.

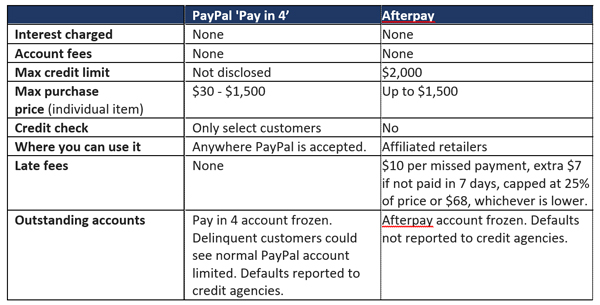

Pay in 4 v Afterpay

Okay, but how does PayPal’s Pay in 4 compare to Afterpay?

The two BNPL platforms provide a similar offering to consumers, with no interest, no account fees and fortnightly payment plans that typically run over the course of six weeks.

However, PayPal has decided not to charge late fees. It also does not have one maximum borrowing limit for its customers, opting to determine this on an individual basis. They’re able to do this because they already have the credit history of their customers.

It could affect your credit score

But PayPal customers who miss repayments should be aware that if you default, it could end up on your credit file. Like any other BNPL, Pay in 4 is the same as any other debt: you need to be able to repay it on time and in full to avoid it impacting your credit score.

More on this: How ‘buy now, pay later’ affects your credit score

A recent report found people getting into trouble using BNPL were more likely to have multiple accounts. With over 20 BNPL services currently in the market, customers can easily rack up a slew of debts across a number of platforms.

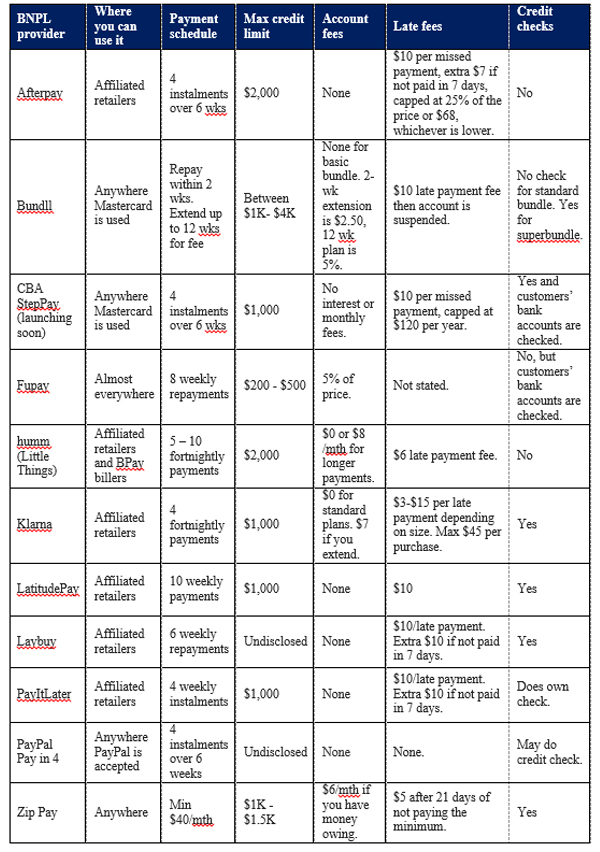

Pay in 4 compared to all BNPL offerings

RateCity.com.au has analysed the BNPL sector and compared what’s on offer from the major players. Consider what the terms are and decide which service (if any) is right for you.

Quick tips to avoid getting into trouble using BNPL platforms

- Read the terms and conditions and understand which fees you could get hit with.

- Set yourself strict spending limits.

- Limit yourself to one platform and one purchase at a time.

- Don’t impulse buy. Sit on any major purchases for at least 24 hours.

- If you get into trouble, pull the pin and call for help. Each platform should have a hardship policy to help you get out of trouble.

This article contains general information only. It should not be relied on as finance or tax advice. You should obtain specific, independent professional advice from a registered tax agent or financial adviser in relation to your particular circumstances and issues.

Trending