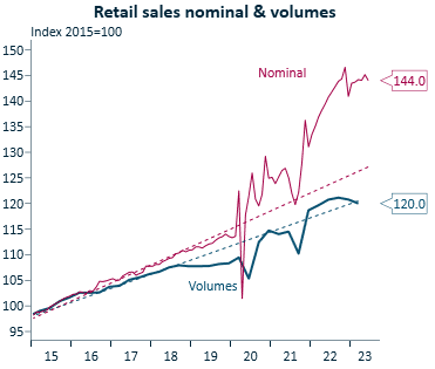

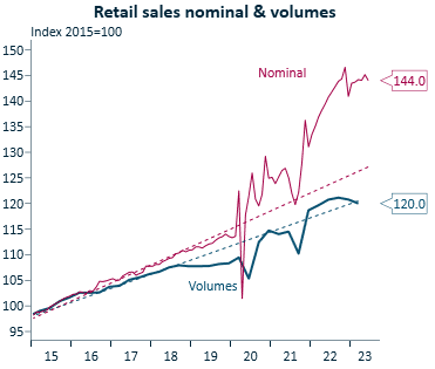

It’s the first week of the month and all eyes were on the Reserve Bank board meeting which decided to keep official interest rates on hold for a second consecutive month at 4.1 per cent. This time last Friday morning I said the latest retail figures would swing the RBA vote.

If retail sales slowed, the RBA was likely to keep rates on hold as it showed Aussie consumers were tightening their belts and cutting spending. If retail sales rose strongly then it would show the economy was still hot and rates would rise again.

Thankfully those retail sales started to trend down.

Source: IFM Investors

Inflation remains high

That weakness in retail sales and falling inflation offset the continuing strong job market which, along with the recent lift in the minimum wage, is underpinning continuing high inflation.

In this week’s RBA statement attached to the rate decision, the RBA points out:

“Inflation is declining but is still too high at 6 per cent.

“Prices of many services are rising briskly.

“Services price inflation has been surprisingly persistent overseas and the same could occur in Australia.”

The RBA expects CPI to continue to decline and be around 3.5 per cent by the end of 2024 and within the 2‑3 per cent target in late 2025.

Further tightening may be required

Basically, the two biggest issues for the RBA are the steep rises in housing rents and wage increases. “At the aggregate level, wages growth is still consistent with the inflation target, provided that productivity growth picks up.”

As for the future, the RBA’s forward guidance remained unchanged in August, and is the same as it’s been since May. “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe.” But the qualifying sentence has been slighted altered to, “but that will depend upon the data and the evolving assessment of risks.”

So it is still very willing to lift rates if the economic figures take a turn for the worse. Between now and the 6 September RBA board meeting we’ll see the June quarter Wage Price Index and next month’s CPI result. These are two big economic data signals we need to watch and which I’ll keep you up to date on.

Big four forecasts for peak of the rate cycle

So, after this week’s RBA decision to keep rates on hold, the big banks are now forecasting that this is the peak of the rate cycle:

Source: Mortgage Choice

- CBA: peak of 4.1 per cent, with four cuts next year, starting in March. Down to a cash rate of 3.1 per cent by end of 2024.

- Westpac: peak of 4.1 per cent with the first cut in September 2024. Total of six cuts across 2024 and 2025 to 2.6 per cent in late 2025.

- NAB: One more hike in November 2023 to a peak of 4.35 per cent. Five cuts in 2024 and 2025 to a cash rate of 3.1 per cent by early 2025.

- ANZ: peak of 4.1 per cent with one 0.25 per cent cut in late 2024.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending