We all love our tax deductions, right? “I’m paying too much tax, how do I reduce it?”

I have these conversations with my clients all the time. Unfortunately there’s a giant myth when it comes to tax deductions that not everyone is aware of.

There are lots of opportunities out there, for better or worse, that offer tax deductions as a “benefit”. We often see these tax deductions mistakenly being used as the reason for making a significant financial decision. This might be for an investment, a business trip, a novated car lease packaged through work, donation, personal insurance or some other form of spending.

Let’s get one thing clear…

When you get tax back through your tax return, it’s because you’ve already spent the money… and you only get a portion of it back.

If you were already going to spend this money, then go bananas and find every legal loophole to get your tax back. However, if you’re yet to spend (invest, donate, lease that car) and are weighing up your options, then you need to pause and make sure it’s for the right reasons.

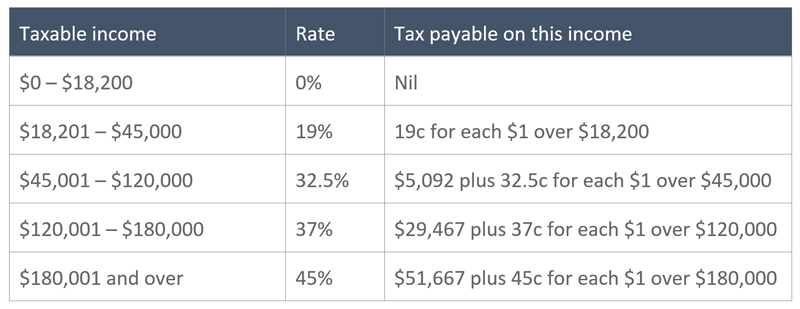

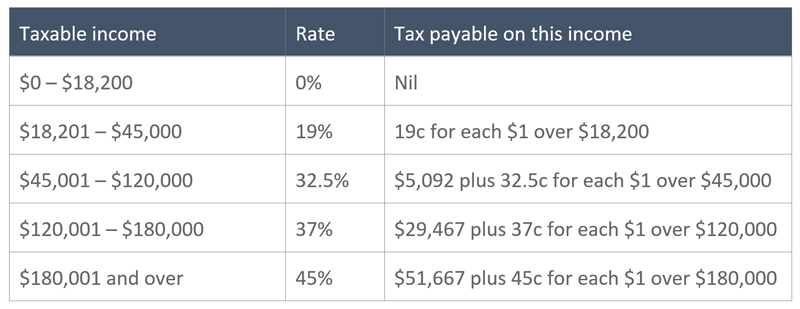

Here are the current 2021-2022 personal tax thresholds in Australia (to save confusion we’ve omitted the 2 per cent Medicare Levy):

Data: ATO

So if you earn $100,000, the $54,999 you earn above $45,001 is taxed at 32.5%. Therefore, if something is tax deductible for you, like a $10 donation, you will receive $3.25 back when you do your tax return. Effectively you’ve lost (or, in this case, donated) $6.75. Which is nice when it’s for a charity you want to support, less nice when that $6.75 is going directly into, say, your bank’s profits. Or the bin.

“Tax deductions” need to add up properly

The conversation goes a little like this:

Confused Investor, chasing gold at the end of mythical tax rainbow: “Guess what! I’m buying an investment property, it’s tax deductible!”

Concerned Friend: “Great, where is it? Is it going to grow in value and give you a good rental return?”

Confused Investor: “Dunno, but I’ll get a better tax return each year!”

What they’re really saying is: “Guess what? I’m going to drop a dollar! But it’s ok, I still get to pick up 37 cents!”

Not. Cool.

A tax deduction can help make an investment more affordable, but if that investment doesn’t perform, you still lose.

Unfortunately I see this with new clients all the time. Many of us have fallen into the trap of using the idea of a tax deduction as an excuse for purchasing something. It’s seen as a “discount” in some way.

The trouble is, it’s this type of behaviour that will lead you into the false sense of believing you have your finances under control. That feeling is dangerous if it leads you to make decisions based on false presumptions, like the investment property example above.

Are you really benefiting?

Stop and ask yourself whether you’re really benefiting. If you’re not sure, speak to a professional who can help.

Let me shout this out one more time; if you’re doing something purely for the tax deductions, please drop it.

Investing, purchasing insurance, leasing a car or making any other decision that involves spending to get a tax deduction? Do it because it’s a decision you would have made without the tax benefit, and now you can claim that spending back as a bonus.

I hope this helps to clear up the myth make think twice about chasing tax breaks that might not be all that helpful. Remember that when you have a large amount of tax to pay, this can only ever come about because you’ve made good money. I’m not saying don’t go hard trying to legally retrieve as much of this as possible, just always do it through options that are beneficial.

This is an edited version of an article that originally appeared on Sufficient Funds and is republished here with permission. This article contains general information only. This should not be relied on as independent finance or tax advice. If you are after specific professional advice, speak to your registered tax agent/financial advisor or reach out to James at Sufficient Funds.

Trending

Sorry. No data so far.