Why is it that you’re constantly getting into financial trouble even though you try so hard? Could you somehow be self-sabotaging your finances?

No, you’re not intrinsically bad with money. But you might be unintentionally self-sabotaging your finances. All the budgets, savings plans, investment advice and frugal tips in the world aren’t going to help if you’re subconsciously determined to fail.

But what exactly are you doing to self-sabotaging your finances? You’re not burning money around the fire pit on a Friday night, are you? Not shouting the entire bar because you won a whopping $25 on the pokies? Buying Gucci slippers?

Nothing quite so ridiculous. Instead, you’re probably guilty of self-sabotaging your finances in one of these less obvious ways. Relax, there’s no need to put your hand up when you spot yourself.

1. Your FOMO is OOC

FOMO has been defined as “a pervasive apprehension that others might be having rewarding experiences from which one is absent”. It’s perpetuated by the way social media constantly updates us on what other people are up to. In the good ol’ pre-Facey days, you couldn’t miss what you didn’t know about.

We’ll simply never get that pre-2004 happy ignorance back, so we must learn to live with feeling ‘left out’ from time to time. That’s because when your ‘fear of missing out’ is frankly ‘out of control’, you’re basically self-sabotaging your finances. There’s no question that being part of things usually means spending money:

- Making sure you’re at every event that shows up in your feed

- Throwing down a house deposit on a car because your tribe is eco-friendly

- Holidaying in ‘grammable places you really can’t afford

- Etc etc etc

To get over FOMO, you need to get to know yourself better. Learn your values, trust them, live by them. Your values are the key to knowing what’s a need and what’s just a want in your life. Focus on your own priorities and live within your means.

PS – always remember that the person whose life you so intensely crave probably can’t afford it either.

2. You haven’t figured out that being rich doesn’t mean you’re wealthy

Being ‘rich’ is using money to buy stuff. A big house, fancy car, latest technology, resort-style landscaping, a butler’s pantry for your non-existent butler… you know the drill.

Being ‘wealthy’ is about using money to buy security. It’s what’s left in the bank when you spend your money on the rich things.

If you’re too tied up with being rich, you’ll most likely never be truly wealthy. And if you don’t have the peace of mind that wealth can bring, you’re definitely self-sabotaging your finances.

3. You think too short-term

Building wealth is a long-term game. That’s not just because of compounding, either (though if you don’t know about the mighty power of compounding, get straight onto it!).

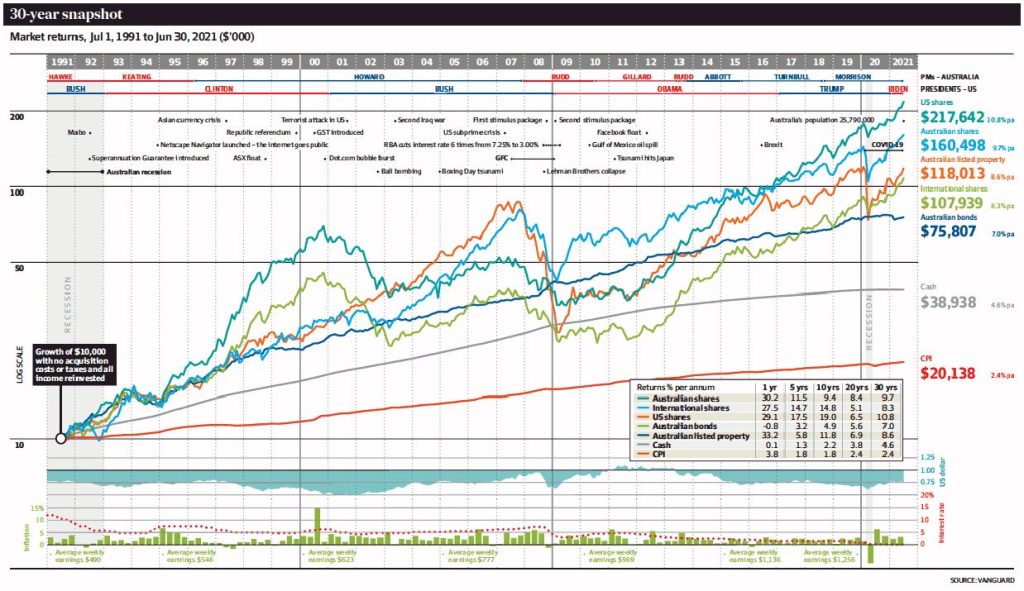

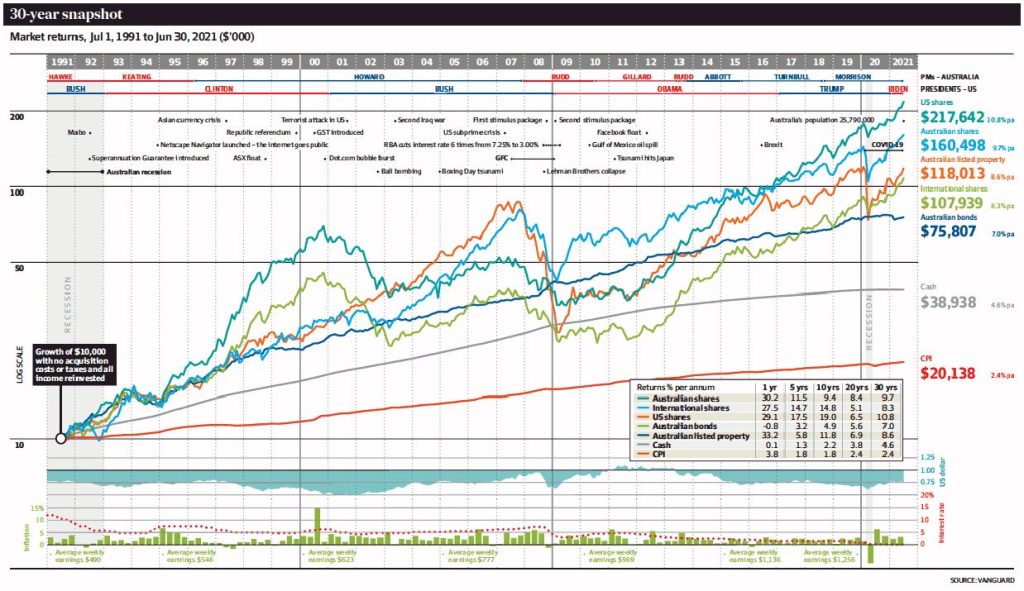

Long term investing smooths out any short term market fluctuations. A recent annual performance report from global fund manager Vanguard showed that a $10,000 investment in US shares at the beginning of 1991 – with income reinvested – would now be worth nearly $218,000 – an annual compounded return of about 10.8 per cent. That’s more than five times what the equivalent investment in cash would have made.

Compare that to someone who invested in US stocks in 2000 – when the dot.com boom was pushing the market to record highs and markets were irrationally exuberant. They would have been smashed by the subsequent crash and have taken 14 years to achieve a zero return.

Source: Vanguard

“Short term, it is very difficult to time markets,” Balaji Gopal, head of the personal investor business at Vanguard says. “Our view is investors should be focused on the long term, stay invested and not react to adverse markets by pulling out.”

Moral of this tale: don’t panic in a crash.

4. You’re not prepared to take risks

Sure, you could save enough in the bank to have peace of mind, but it’s doubtful you’ll ever grow wealthy that way. Low risk generally means low returns. If you plonk your money in a bank account and do nothing else with it, you’ll currently earn a rate of less than one per cent interest. That’s under a buck for every $100 you save.

Maybe you won’t run into financial trouble today that way, but chances are you might tomorrow. It will be very hard to fund a retirement on such a measly rate of return. So if you’re not putting your money to work by investing extra in your super, or buying an ETF, or building an property portfolio, things are looking grim.

Besides, simply leaving your money in a bank account is surprisingly risky anyway. You’re more likely to fritter it away when it’s not off working hard somewhere else.

5. The more you spend, the more you earn

Lifestyle inflation is a genuine threat to your financial happiness. That’s when you get a pay rise (or a bonus or inheritance or a second job, etc) and you immediately increase your spending to accommodate for it. We’ve all done it, but some are much better at it than others. In a nutshell, here’s how to zip it:

- Be clear on your long-term goals

- Define your wants and needs

- Lock in your budget

- Treat yourself, but just the once

- Allocate extra cash immediately

- Reverse your current lifestyle inflation

Find the details of this plan here.

6. You don’t have a solid financial plan

If you don’t know where you’re going, you won’t know how to get there. Stop making excuses why you still haven’t deep-dived into the numbers and just dive. Even if you’re too tired, too overwhelmed and too “bad at Maths”. All of these self-sabotaging excuses are putting you in financial trouble. Here’s your 1, 2, 3 reminder – hop to it.

- Make a planning date with yourself.

- Give every cent you earn a purpose and automate it.

- Make another planning date with yourself.

Keep the loop going.

7. You’re relying on general advice

Ahem, that’s me. I’m responsible for this one. While articles like this one are helpful (and hopefully inspire you to action!), they’re much too general. I don’t know your particular circumstances and opportunities. I’m not across your financial goals or your life dreams. I don’t know whether you’re single or how many kids you’re planning or whether you’ve got an inheritance coming, or if you’re currently battling a degenerative disease.

To get really good financial advice, you need to get personal. In order to go personal, you need a financial adviser. Or a very big brain that’s happy to learn everything a financial planner knows about finance. Which is a lot.

Becoming your own certified financial adviser is certainly an extreme way to stop self-sabotaging your finances, but you do you!

Trending

Sorry. No data so far.