Research group SuperRatings have completed a fascinating, and important, lesson into the cost of panicking in a crash.

I know sharemarket crashes are stressful, but history tells us that those that keep their nerve come out winners. SuperRatings has proved the point.

They looked at the impact of switching out of a balanced or growth investment option in your superannuation fund and into the cash option at the start of the pandemic, when markets started crashing.

Significantly worse off if you switch

The study found that those with a balance of $100,000 in January 2020 who switched to cash at the end of March would now be around $22-27,000 worse off than if they had not switched and just stayed in the growth or balanced options. Because they missed out on the subsequent strong rebound in markets since then.

Source: SuperRatings

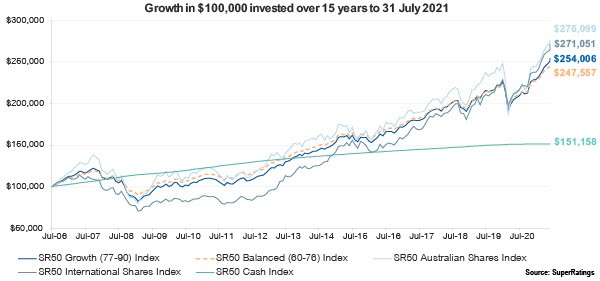

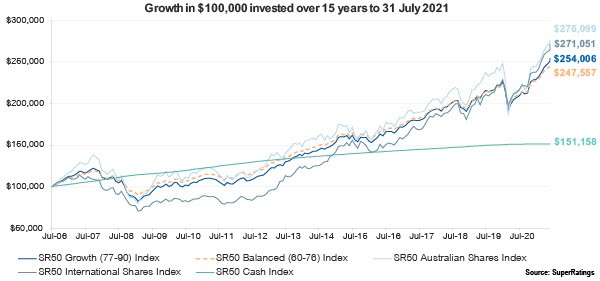

This effect of switching into cash as a response to market turmoil is also seen when looking at returns over the past 15 years. In this period, a typical balanced Super option has risen substantially, with a balance of $100,000 in July 2006 accumulating to $247,557, more than doubling in size.

Those members investing in a growth option have experienced an even stronger result, with a $100,000 balance growing to $254,006.

Though share focused options involve greater risks, they have delivered the highest returns of all. The median Australian shares option grew to $276,099 and the median international shares option grew to $271,051.

Over the same period, a $100,000 balance invested in cash would only be worth $151,158 today.

It’s a great lesson in how investing over the long term smooths out any short term crashes. The cost of panicking in a crash and selling up or changing your strategy can be massive. So the moral of this investment story is to hold your nerve and let your money work for you over the long term.

More recent returns

Data source: SuperRatings

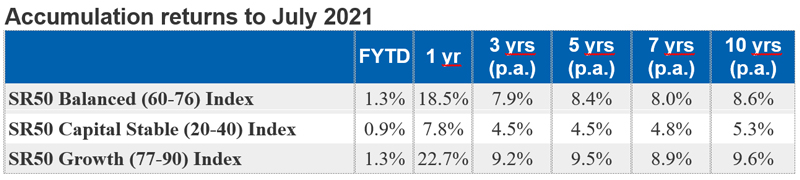

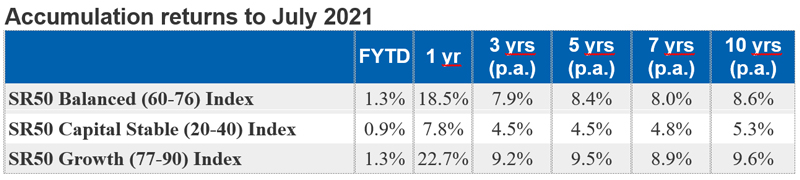

Looking at more recent returns, balances continued to grow in July. The typical balanced option returned an estimated 1.3 per cent over the month and 18.5 per cent over the year. The typical growth option returned an estimated 1.3 per cent for the month. The median capital stable option also increased 0.9 per cent in the month.

Trending

Sorry. No data so far.