Superannuation is the third most important weapon you have in your ability to build wealth, behind your capacity to earn income and owning your family home. The issue is that because it gets compulsorily deducted from our wages each month, we often don’t give it the attention it deserves.

It grows almost by stealth. But it deserves better attention from us… so let’s do it right now.

This week the end of financial year superannuation fund performance figures were released. So very soon you will receive the annual or bi-annual (depending on your fund) performance figures from your super fund manager.

Promise me you’ll open the letter or email and read how the fund has performed.

Read your superannuation statement

Many of you probably never read your superannuation statement, preferring to file it away the moment you receive it. Don’t make that mistake.

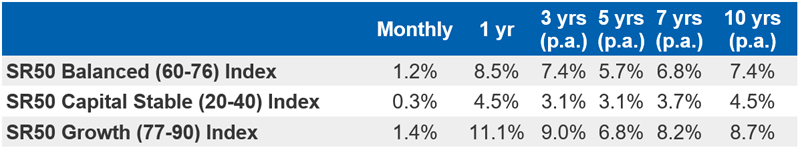

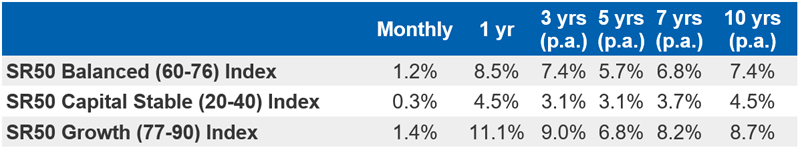

To give you a benchmark on whether you’re in a dud fund or not, leading superannuation research house SuperRatings estimates that the median balanced option returned 1.2 per cent over the month of June, for an annual return of 8.5 per cent for the year to 30 June 2023. Note that in the previous financial year balanced funds went backwards -3.4 per cent.

If you’re in a balanced super fund option you’re looking for an average return of 8.5 per cent on your statement. If it’s higher, great, you have a fund doing better than the average. But if it’s lower, you need to find out why and, if it’s consistently lower, maybe you need to switch to a better fund.

According to SuperRatings if you’re in a growth oriented super fund it should have produced a return of at least 11.1 percent for the financial year and 4.5 per cent for a conservative capital stable fund.

Accumulation returns to June 2023

Source: SuperRatings estimates

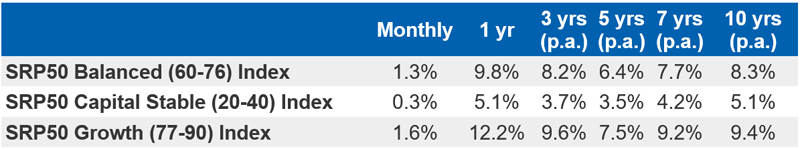

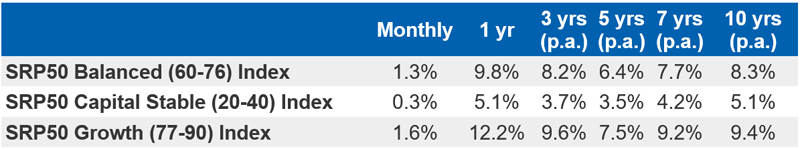

Pension returns also ended the financial year strongly, with the median balanced pension option up an estimated 1.3 per cent over June. The median growth option rose by 1.6 per cent, while the median capital stable option is estimated to deliver a 0.3 per cent return for the month.

Pension returns to June 2023

Source: SuperRatings estimates

While it’s important to check the annual performance, as we all know superannuation is a long-term investment. A fund needs to be measured on how consistent its returns are over the long term, during both good and bad investment markets.

The chart below shows that the average annual return since the inception of the superannuation system is 7.1 per cent, with the typical balanced fund exceeding its long-term return objective of beating inflation by more than 3 per cent.

That’s pretty good… a “real” return of 3 per cent.

How to read your superannuation statement

Here’s my jargon-free guide to help you decode your super statement.

1. The snapshot

The first page of your super statement is generally a snapshot of your account.

Your account balance will be shown at the start of the statement period, usually 1 July on the previous year.

You’ll then see a record of all the contributions and withdrawals you’ve made over the year. Then you’ll see the total value of fees, insurance premiums and taxes you’ve paid. And finally your total investment earnings.

2. Preservation status

Super is classified either as preserved, meaning you can’t touch it, or non-preserved, meaning you can (another classification, ‘restricted non-preserved’, may also apply to contributions made before 30 June 1999).

Your super will be preserved until you meet a condition of release such as reaching your retirement (or preservation) age, or in a small range of special circumstances. One of the recent special circumstances was COVID-19 early release of super.

3. Investments

This section provides important details on how your money is invested. See my notes above.

Remember, most super funds offer a number of different low to high risk options, so make sure you’re comfortable with the strategy you choose.

In a confusing twist, you’ll also see a ‘unit value’ and ‘unit price’ next to the balance of your investments. That’s because super funds pool your money together with other investors before they invest it in the market. This pool of money is divided up into units, which you’re allocated based on how much money you have invested.

4. Fees

High fees can have a huge impact on how well your fund performs over the long-term.

Most funds will hide fee information after a long list of the transactions on your account. It’s almost like they have something to hide…

Remember, when it comes to fees, the lower the better.

5. Insurance

Most super funds automatically provide some level of insurance , known as default cover. This is generally a combination of life, disability and income protection insurance.

It’s important to review this cover on your statement. Check the total benefits and review the premiums you’re paying,

6. Beneficiary nomination

If you don’t make a beneficiary nomination, your super fund will decide how your account is distributed in the event of your death. So ensure you nominate where you’d like it to go.

And finally, remember to review your personal details to make sure your fund has up to date contact details on file. That way you won’t end up ‘losing’ a super fund down the track.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending