A recent survey found that 17.5 per cent of Australian households couldn’t raise $2000 in an emergency. The question is, could you?

Booming shares, property and superannuation have lifted the wealth of average Australians, but not many of us are feeling it. Low wage growth has meant that we seem to be asset rich but cash poor.

Yes, wealth levels have gone up, but it’s still hard to pay the bills.

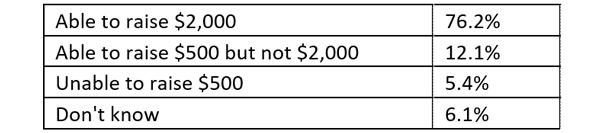

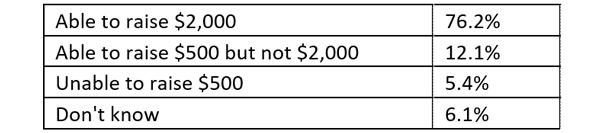

This has been backed up by research from the Australian Bureau of Statistics which shows 17.5 per cent of Aussie households can’t raise $2,000 in an emergency.

The ABS Household Impacts of COVID-19 Survey also found that 5.4 per cent of households couldn’t even get $500 cash within a week.

Recent lockdowns across the country have put many people on the back foot yet again. Businesses were forced to shut their doors and casual workers were stood down or saw their hours cut.

Household ability to raise money for something important within a week

(People aged 18 and over)

Source: ABS Household Impacts of COVID-19 Survey, May 2021 of 3,371 participants, released June 16.

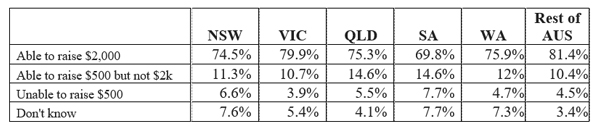

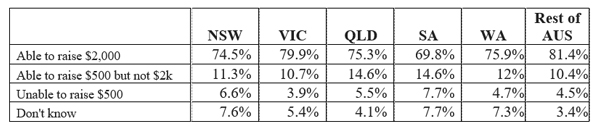

State by State

Many can’t afford basic living expenses

The ABS Survey also found that 20 per cent of Australians said their household needed to take financial action to pay for basic living expenses due to a shortage of money.

The most popular options were drawing on savings, increasing credit card spending, taking out a loan from family or friends and selling household goods and jewellery.

This is a big turnaround from the second half of last year when JobKeeper and JobSeeker support programs actually saw Aussies increase their savings. According to research group Finder, average monthly cash savings have declined through the June quarter.

After peaking at $953 in February, the figure remained around $800-900, before hitting $703 in June. This was the lowest level of average monthly cash savings since March 2020.

What to do if you’re in a cash squeeze

COVID has meant so many Australians are doing it tough. RateCity has come up with some great tips if you are in a cash squeeze:

- Ask for help from all your bill providers, not just your bank.

- Hit pause on non-essential spending.

- Check what government assistance you’re eligible for. COVID disaster payments are available to eligible people in a hotspot (currently Greater Sydney), with the government lifting the asset test for the third week of the Sydney lockdown.

- If you need emergency cash, see if you are eligible for a no interest loan from Good Shepherd or a crisis payment from Centrelink.

- Call a financial counsellor for advice. The National Debt Helpline is: 1800 007 007.

And how to raise $2000 in an emergency

A couple of quick thought starters on how to raise a quick $2,000:

Negotiate better deals: Go to comparison websites like Canstar and check whether you’re getting the best deal from your mortgage, internet, phone or gas and electricity provider. Read more about this here.

Turn stuff into cash: If you’re not in lockdown, jump on to Gumtree or Facebook marketplace and sell anything that might be gathering dust in your house.

Start a side hustle: Turn a hobby/passion into a money maker. A good cook could make things for the local café; a good guitarist can tutor others; a handy person can go on AirTasker and offer their services. Plenty more ideas here.

Cash in rewards points: If you don’t have a saving buffer, consider cashing them in for supermarket vouchers and put that money into your savings account instead.

Commit to a month of non-essential spending: Everyone needs to let their hair down, but if you can live frugally for a month or more you could save hundreds.

Find more ways to build your emergency stash here.

Trending

Sorry. No data so far.