As property prices rise, don’t forget to negotiate your interest rate on your home loan.

For years I’ve been encouraging Aussies with a home loan to ring your bank and negotiate your interest rate. So many wait for the RBA to cut official interest rates to save on their home loan when the reality is you can do it yourself right now – just by picking up the phone.

Generally, people don’t believe me, until they do it. Well, now there is statistical proof that it works.

Financial research group RateCity surveyed over 1,000 mortgage holders, and of those on a variable rate, 52 per cent had haggled with their bank for a lower rate. Over 73 per cent of these people were successful in getting at least one rate cut. Yep, three quarters.

And it can make a huge difference.

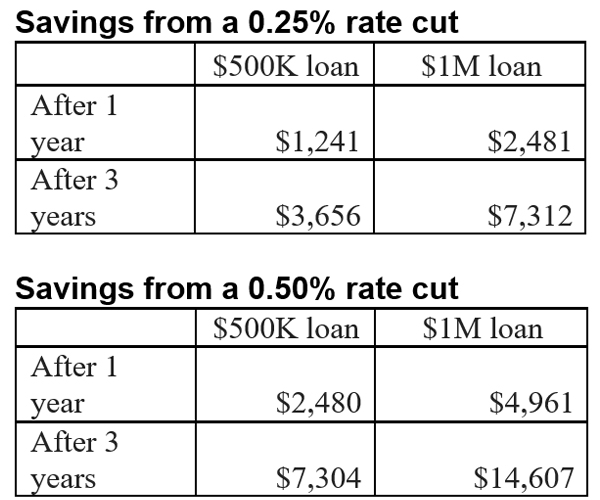

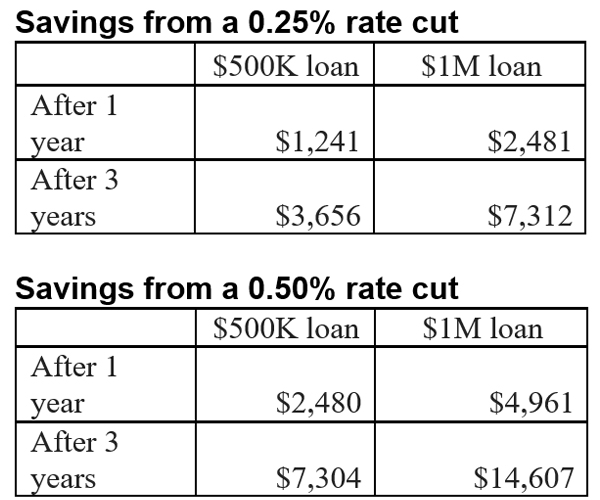

It adds up quickly

A rate reduction of 0.25 per cent could save the average mortgage holder $1,241 in interest after one year, and $3,656 after three years. This is based on a $500,000 loan balance with 25 years remaining at an existing variable rate of 3.08 per cent.

Source: RateCity.com.au. Calculations are based on the RBA’s average existing owner-occupier variable rate of 3.08%. It assumes the rate cut is for the life of the loan and the rate remains steady over the following three years.

Variable home loan rates are at record lows, but most of these deals are reserved for new customers, not existing ones… unless you specifically ask.

Tips to negotiate your interest rate

Before you call to get a better deal, check what rate your bank is giving new customers for the same home loan. And find out what other lenders have on offer.

Comparison websites can make this a reasonably quick job. Try one of these:

If you are paying significantly more than a new customer, pick up the phone and ask your bank why.

If you have a good track record of paying down your debt, and the bank thinks you might switch to a more competitive lender, they’re likely to play ball.

A lot of people think a small cut in rates won’t make much of a difference but, if the discount is permanent, then the savings can potentially run into the thousands in just a few years.

Remember, too, that bank fees can really add a lot to the money you pay on your mortgage. There are a range of mortgage products that carry no monthly fee, so figure that into your planning when you are comparing across home loan products.

Once you’ve negotiated a better rate, do everything you can to pay your mortgage down quickly. That way you can really take advantage of the new lower rate. The quicker you can pay off the principle, the less interest you’ll have to pay to the bank.

Trending

Sorry. No data so far.