You might have noticed some buzz lately around something called Non-Fungible Tokens or NFTs.

They are essentially a digital certificate of ownership for digital assets, such as images and video. For some, NFTs might be an entirely new concept, but they have actually been around since 2014. They have become more widely recognised recently thanks to some sizeable sales and increasing interest from celebrities and influencers.

What are they all about?

Physical art has long been traded and is recognised as an investment, albeit a speculative one. NFTs are a way to do the same for intangible artforms – essentially, to own the original. This can include any digital collector’s item, from video footage of iconic sporting moments to GIFs, digital artworks, and even video game items.

Non-fungible simply means that it can’t be exchanged like-for-like. Unlike cryptocurrencies, where one Bitcoin can be traded for another, a digital asset (just like physical art) is unique, so you can’t trade an NFT like-for-like.

Previously, it was difficult for digital artists and creators to sell their creations because there was no trading system to prove ownership. It was therefore difficult for them to take royalties from the resale of their work. An NFT recognises ownership and keeps a record of ownership and trading value via secure blockchain technology.

Although you might still see the image of a digital asset on a Google search, the owner of the NFT essentially owns that piece of art and all the rights to use it.

How are they bought and sold?

Typically, NFTs are traded using cryptocurrencies like Bitcoin and held in digital wallets. As mentioned above, trades are tracked via blockchain. That means there is a clear and secure chain of ownership.

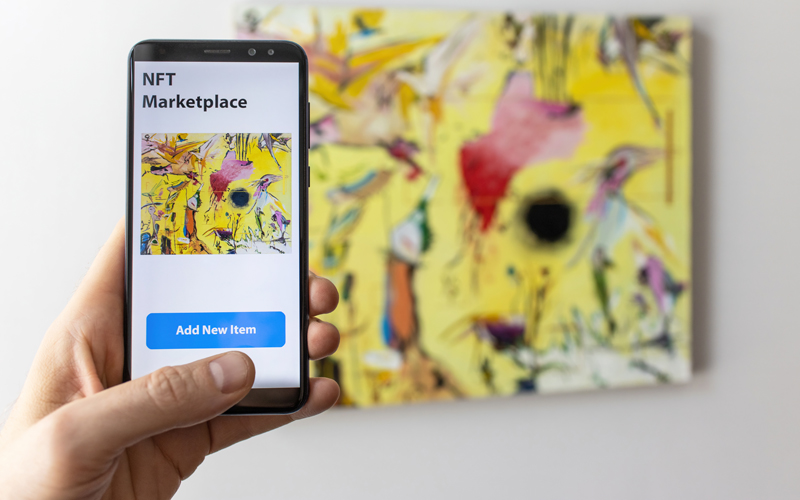

They are bought and sold entirely online via NFT marketplaces, and there are many cropping up in response to the increasing demand.

So, are NFTs really an investment?

Just like any other collector’s item, the value of an NFT is entirely dependent on what someone else is willing to pay for it. You don’t own a physical item, but unlike some other intangible investments, such as shares, there is no intrinsic value, so it is a speculative investment.

NFTs are an “overblown speculative bubble inflated by pop culture”

For those of us used to physical art forms, it might be hard to see the value of NFTs. But among many younger audiences who are used to doing everything online, they are a considered collector’s item and, yes – an investment.

Like a Monet that you might hang on your wall, owners are promoting their NFTs on their social channels. Many people are aspiring to own NFTs from prominent digital producers and artists.

Just like any investment, selling an NFT can incur capital gains tax, so it’s important to understand how they align with your risk profile and the potential financial impacts.

Should investors seriously consider NFTs?

There’s no doubt that NFTs are risky. While many commentators say they are here to stay, there’s every chance that an NFT may sell for less than you paid or may not even sell at all.

Despite the risks, many are touting NFTs as the future of investing, and, in an increasingly digital world, it’s not out of the question. One of the basic tenets of good investing is to avoid investing in things you don’t understand, so for now, they may be best left to those with an interest in and understanding of the digital asset market.

They are, however, an intriguing development in the investment space and one that will be interesting to watch as it unfolds.

This is an edited version of an article that originally appeared on Apt Wealth Partners and is republished here with permission. This article contains general information only. This should not be relied on as independent finance or tax advice. If you are after specific professional advice, speak to your registered tax agent/financial advisor or reach out to Apt Wealth Partners.

Trending

Sorry. No data so far.