Well, where to start when it comes to interest rates and the Reserve Bank (RBA)?

Major speeches this week from the RBA Governor and Deputy Governor, plus the Federal Treasurer orders an independent “review” of the RBA’s performance, governance, mandate and inflation settings.

Let’s start with the review. As you know, I’ve been scathing of the RBA’s very vocal advice to Australians late last year to keep borrowing as much as they like in the comfort of knowing the RBA would not lift interest rates until 2024. The financial markets were saying inflation was about to explode and interest rates would have to rise in 2022. To paraphrase, the RBA publicly said, “don’t believe the markets, believe us.”

We all know how that turned out… and all those Australians who followed the RBA’s advice are now caught in a debt trap of rising interest rates and falling property prices (in Sydney and Melbourne).

And because the RBA was one of the slowest central banks to start lifting rates, inflation is skyrocketing – although, to be fair, not by as much as overseas markets (at the moment).

The RBA’s advice has been diabolically bad

In short, the RBA’s advice has been diabolically bad over the last year and it deserves to be held to account. As a result, along with a lot of other people, I’ve lost confidence in the RBA.

On Sunrise this week I asked Federal Treasurer, Jim Chalmers, whether he’d lost confidence in the RBA and whether the bank was negligent and derelict in its duty by giving that advice late last year. His response, as you would expect, was very polite. He pointed out that the review wasn’t about taking pot shots at the RBA, rather making sure it was properly positioned to take on the economic challenges ahead.

While the RBA must remain independent of party politics, it does have to be accountable for its actions.

The RBA Governor Phillip Lowe welcomed the independent review (he didn’t have much choice!) in a speech on Wednesday titled “Inflation, productivity and the Future of Money”. Not the most riveting title, but he did say official interest rates would rise to 2.5 per cent to get back to a “neutral” setting. That’s about double the current 1.35 per cent.

He did say the neutral rate will depend on the inflation outlook.

So you can bank on at least a 2.5 per cent official interest rate by the end of the year, even higher if inflation doesn’t look like subsiding.

But it was comforting that he sees inflation subsiding by early next year. Fingers crossed that 2.5 per cent official rate is the peak.

So, how are we placed to cope with the rate hikes?

Earlier in the week, RBA Deputy Governor Michelle Bullock hosed down the doomsayers who reckon rate rises will send Aussie households broke and the economy into recession.

“I would conclude that as a whole households are in a fairly good position. The sector as a whole has large liquidity buffers, most households have substantial equity in their housing assets, and lending standards in recent years have been more prudent and have built in larger buffers for interest rate increases,” said the Deputy Governor.

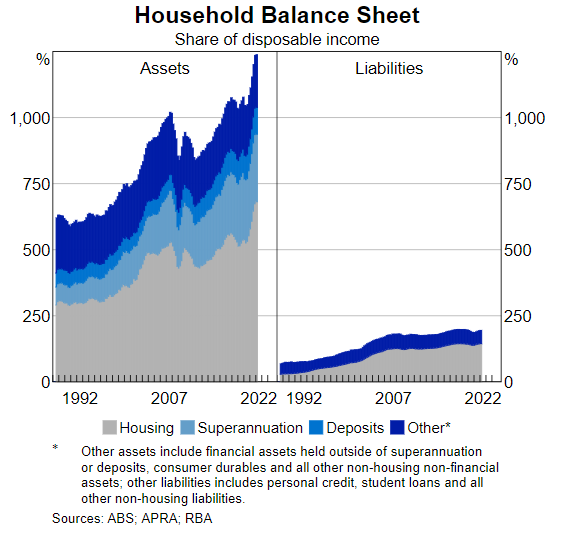

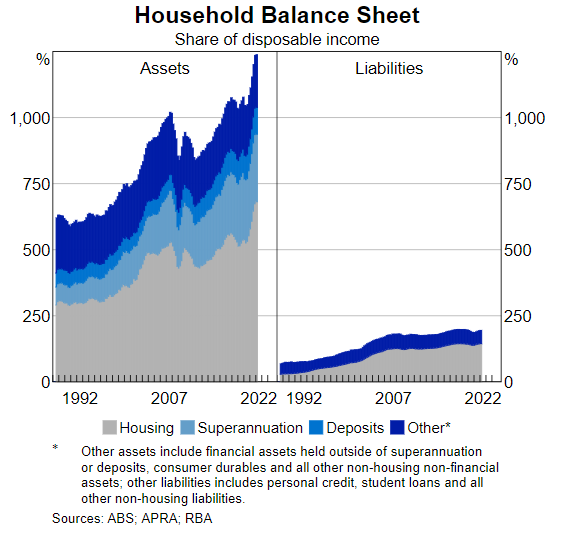

Bullock showed this graph of the balance sheet of the average Australian household, where assets far exceeded liabilities.

It’s impressive, but remember the liabilities side will increase as interest rates rise (even so, there is a very healthy buffer). Also, the vast majority of Australian households don’t have a mortgage.

I would suggest the balance sheet of households with a mortgage (and those with a recent mortgage) would look a lot different and be more exposed to rate rises.

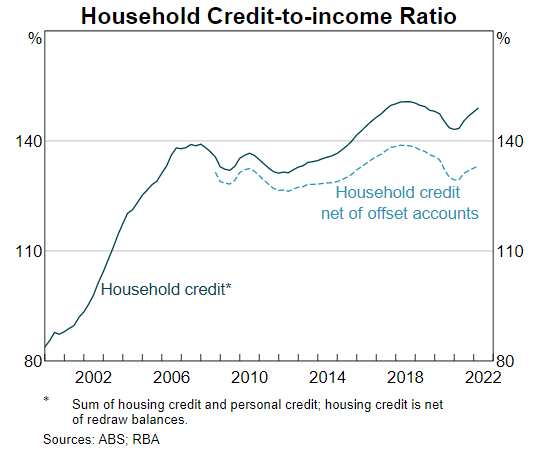

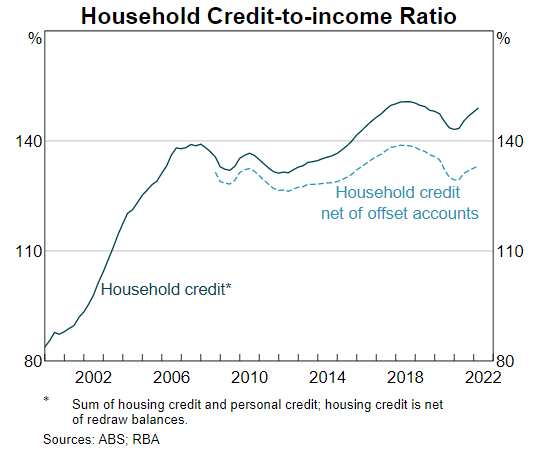

This graph from the Deputy Governor’s presentation also shows that household credit levels have been pretty stable over the years.

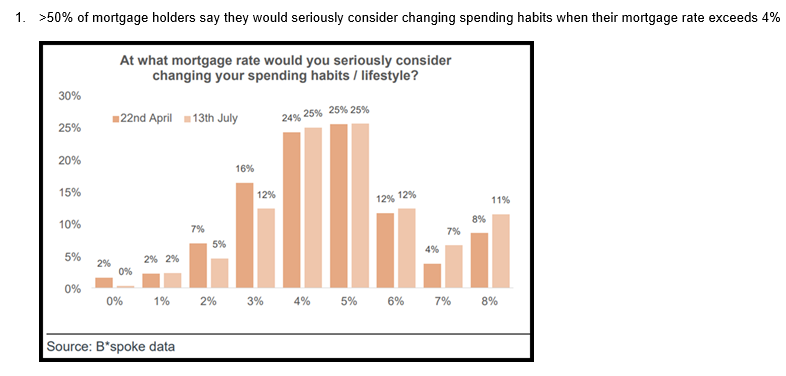

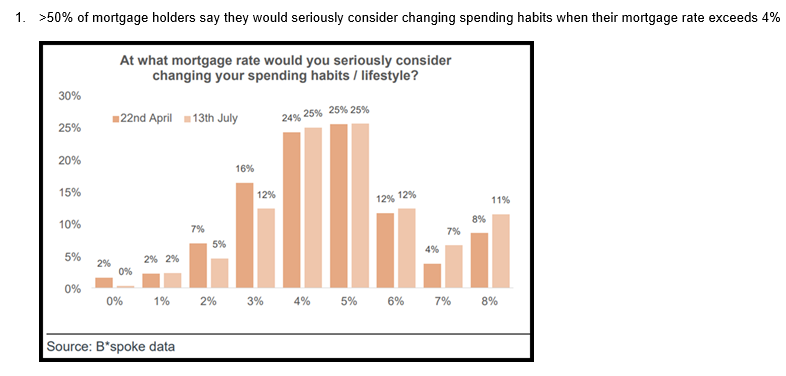

And a question many people have been asking is how rising interest rates will affect consumer spending, and the subsequent ripple effect to slowing the economy. It seems a home loan mortgage rate higher than 4 per cent will start seeing people cut spending.

Trending

Sorry. No data so far.