I thought to kick off the year, it would be a good idea to start with a big picture look at the key economic drivers and investment markets.

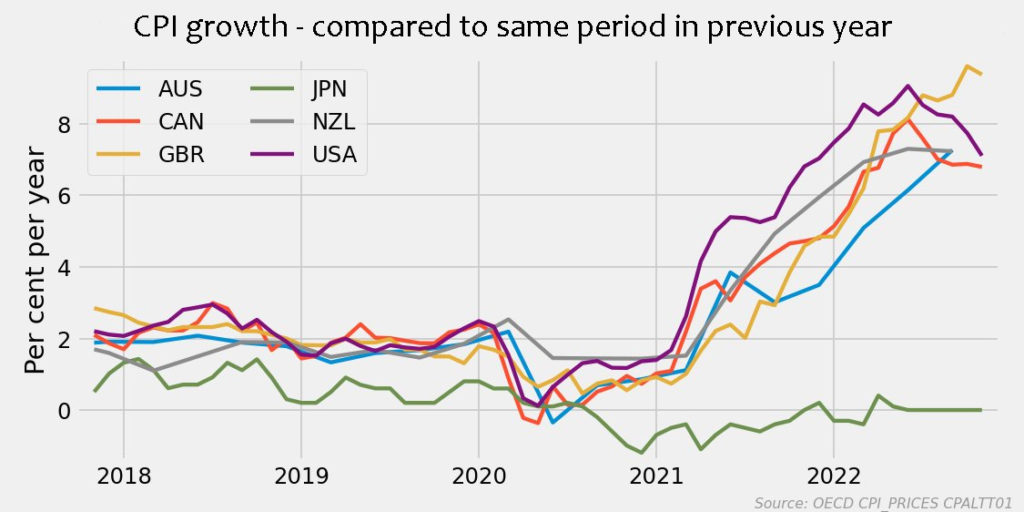

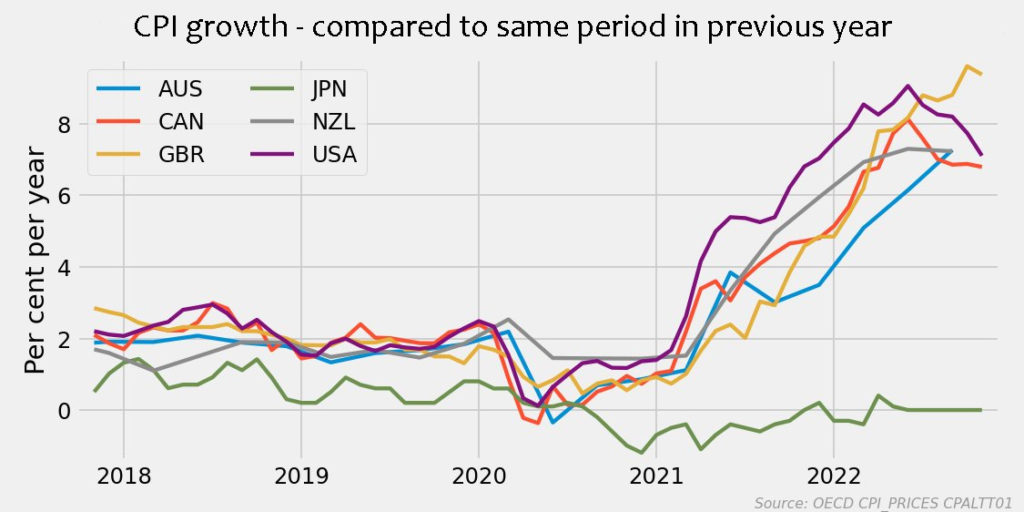

The fight against inflation is the focus of governments and central banks around the world. Over the Christmas break there have been a whole string of indicators which show inflation has peaked and is turning down in most advanced economies… including Australia.

This table shows that, compared with the rest of the world and our major trading partners, Australia’s inflation rate is on the low side while the Reserve Bank has been less aggressive than other central banks. When you look at this data it shows the RBA hasn’t needed to be as aggressive as our inflation lowers.

The important thing to remember is that inflation figures around the world could start falling pretty quickly over the next few months. That’s because those high monthly rates of 10-12 months ago (because of supply chain issues, early stages of the Ukraine war, and high energy prices) will start to drop out of the annualised figures.

We’re starting to see that happen already in the US, UK and Canada. If the last six months of inflation results in the US were annualised, its inflation is back closer to 2 per cent.

There is no doubt the higher interest rate cycle brought in to fight inflation is having a big impact on household finances and decision making.

Despite spending up big in the lead up to Christmas (celebrating the first relatively COVID-free festive season in three years), consumers have become gloomier as their loan repayments have risen steeply.

A lot of analysts are warning not to be sucked in by strong retail sales figures in December (and good December trading updates from retail companies) because they fear a sharp downturn to mirror the consumer sentiment figures.

As these next two charts show, much of that boom in spending was consumers using their savings, increasing personal loans and using their credit cards. That will stop as the economy slows and interest rates rise.

Source: RateCity.com.au

Aussie sharemarket

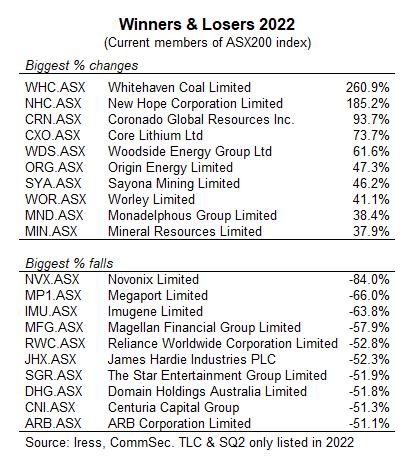

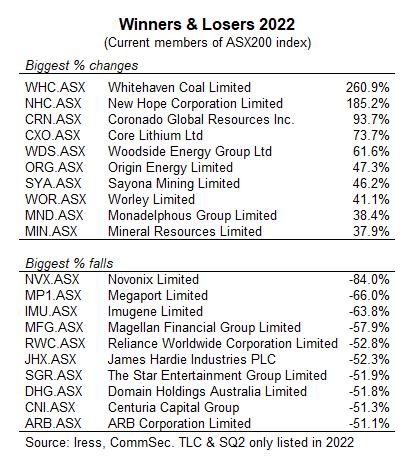

2022 was a pretty wild ride when it came to global equities markets. Rising interest rates saw the three year boom in growth and tech stocks fall off a cliff, while commodity and energy stocks went on a strong run.

But despite the regular headlines of a “shares bloodbath” at different times of the year, the Australian sharemarket actually did pretty well.

As this table shows, a 5 per cent decline on the ASX200 for the year is among the best results of global equities markets. Interestingly, look at the UK’s FT-100 – it was actually up for the year despite its energy crisis and forecasts of a deep economic recession.

And those tech stocks as measured by the NASDAQ are down 33 per cent… ouch. Same thing in Australia where tech stocks were massacred as interest rates rose.

Looking more closely at the Australian market, even though the ASX200 was down 5 per cent for the year, if you add back dividends, returns were down just 1 per cent. Which is a terrific outcome particularly when compared with the last 20 years. Notice we haven’t had two consecutive down years over that time, which hopefully will hold true for 2023.

Source: CoreLogic; AMP

But while overall the Australian sharemarket did pretty well, your portfolio needed to be overweight in commodities and energy to get any major upside. Thankfully during these turbulent economic times, the world wants what we produce.

The list of the major stock winners and losers for the year really sums it all up. It was all about mining, energy and lithium.

The losers were tech and industrial stocks which disappointed the markets on earnings. Interesting to see the price fall for fund manager Magellan which for so long has been regarded as a rock star of the market.

I should caution here that this list isn’t a pointer of where you should be investing now. Don’t go out and, say, buy coal stocks automatically because you may very well have missed the boat. Get good independent advice on what could make up this year’s winners and losers list, which is likely to be very different to 2022.

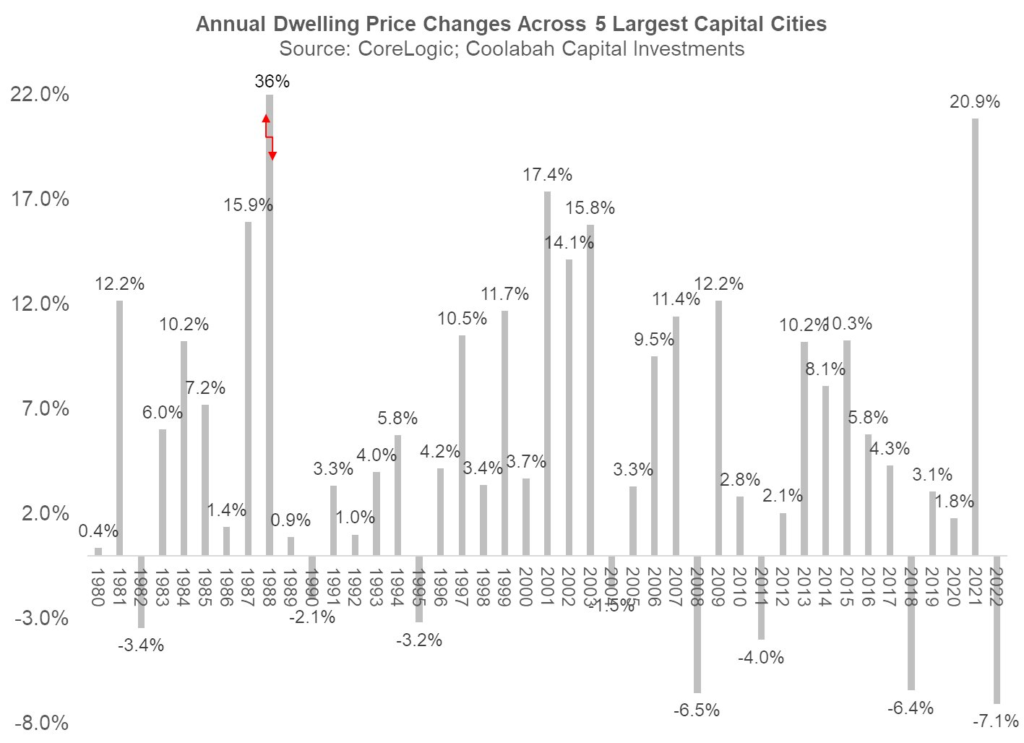

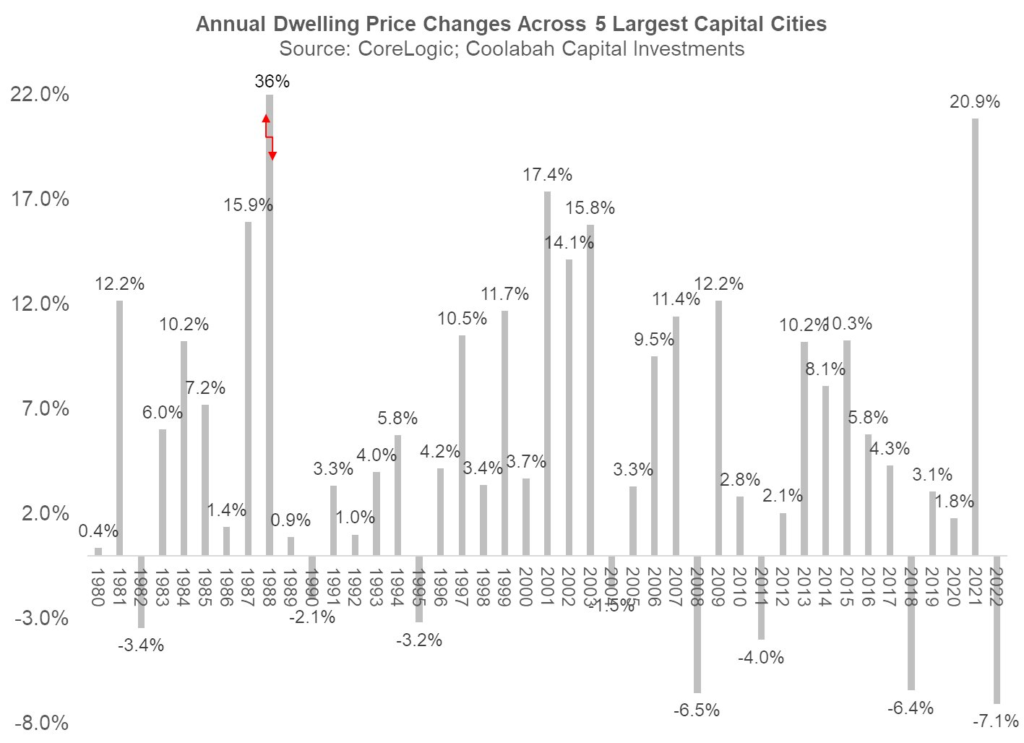

Property does go down

It has always amused me the way property promoters often quip that “property never goes down”. It does, and it always has, as last year showed and is continuing into 2023.

When this happens those same “property never goes down” promoters say that you just never sell property and crystallise those losses… I suppose that’s true, but that same logic could apply to every investment.

As this chart shows, Sydney and Melbourne residential markets have led the spiral down but other capital cities have turned more recently as well… and it seems the hardest hit suburbs/regions were the ones which made the biggest gains during the COVID boom.

Source: CoreLogic; AMP

What has been surprising is the pace and size of the falls in property values. This chart gives you an idea of how this downturn compares with previous downturns. It is faster and deeper than anything we’ve seen in the last 40 years.

Source: CoreLogic; AMP

And the expectation is that it will keep going for the rest of the year and end up being the worst property slump we’ve seen in a generation. That is pretty scary… BUT… it follows one of the biggest property booms we’ve ever experienced.

As I constantly say, all markets move in a cycle. A boom is always followed by a bust, which is always followed by a recovery. And the bigger the boom, the bigger the bust which follows. For investors, the key is knowing where we are in the cycle.

But back to perspective, and this chart presents it well. Since the start of the pandemic property values are still up strongly, even after the 7.1 per cent fall in capital city values last year, and will still be ahead even if there is a similar sized fall in 2023.

The key to how much further the slump has to go is, of course, interest rates. If inflation starts to fall sharply as expected, and the RBA stops further interest rate increases as a result, then that will be a huge tonic for the economy and the property market.

Hopefully that’s given you a big picture view of the last year and perspective for taking on 2023.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.