Most superannuation funds lost money in 2022. That’s just not good enough.

In my mind superannuation fund returns were frankly terrible in 2022. Every working Australian pays big fees to have their retirement savings compulsorily managed by superannuation funds, which pay big salaries to their chief executives and investment managers for doing the work.

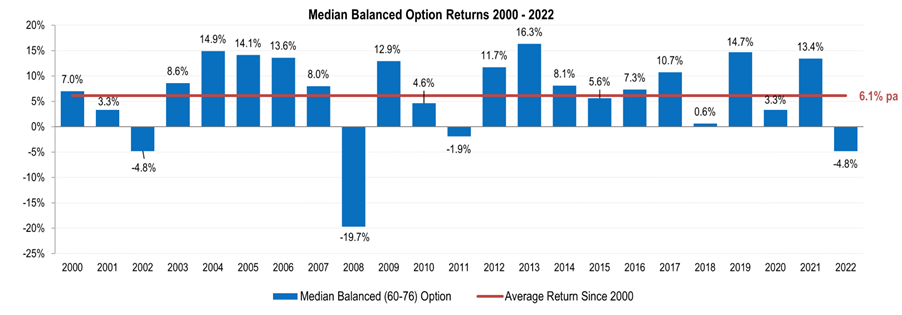

These highly paid professionals are meant to be the experts but could only deliver a median return on a balanced super fund of -4.8 per cent in 2022. Yep, they lost money.

In assessing the results, research group SuperRatings said: “Super funds experienced a turbulent 2022 with heightened inflation driving ongoing interest rate rises and throwing international markets into periods of significant uncertainty.”

Last week in my newsletter (you can subscribe here) I showed that the Australian sharemarket, when dividends are added back in, only fell 1 per cent in 2022.

How come balanced super fund returns fell 4.8 per cent? The fourth time since the year 2000 that returns have been negative.

These chief executives and investment managers are meant to be experts and they can’t even beat the general market. Why are super fund chief executives being paid $500k-$1.2m a year and investment managers $400k-$1.7m when they’re not beating the market average?

This year’s returns have been driven by declines in property and international shares and was further impacted by fixed interest failing to act as a safety net. All good reasons, but isn’t it their job to do better than the market average in good and bad times?

The long-term average return since 2000 is 6.1 per cent a year.

Source: SuperRatings

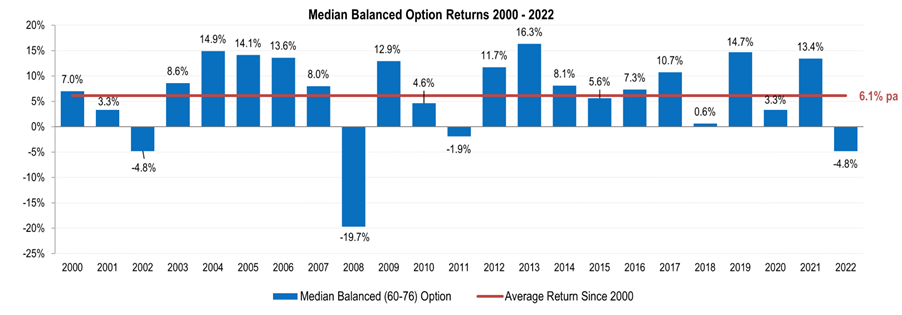

The Perpetual Balanced Growth Fund provided members with the highest return of 1.7 per cent over the year, while First Super also provided a slight positive return of 0.1 per cent to its members.

The biggest superannuation fund manager, which pays the highest salary to its CEO and Chief Investment Officer, didn’t even make the list of top 20 best super fund return performers and lost 4.8 per cent on its balanced option.

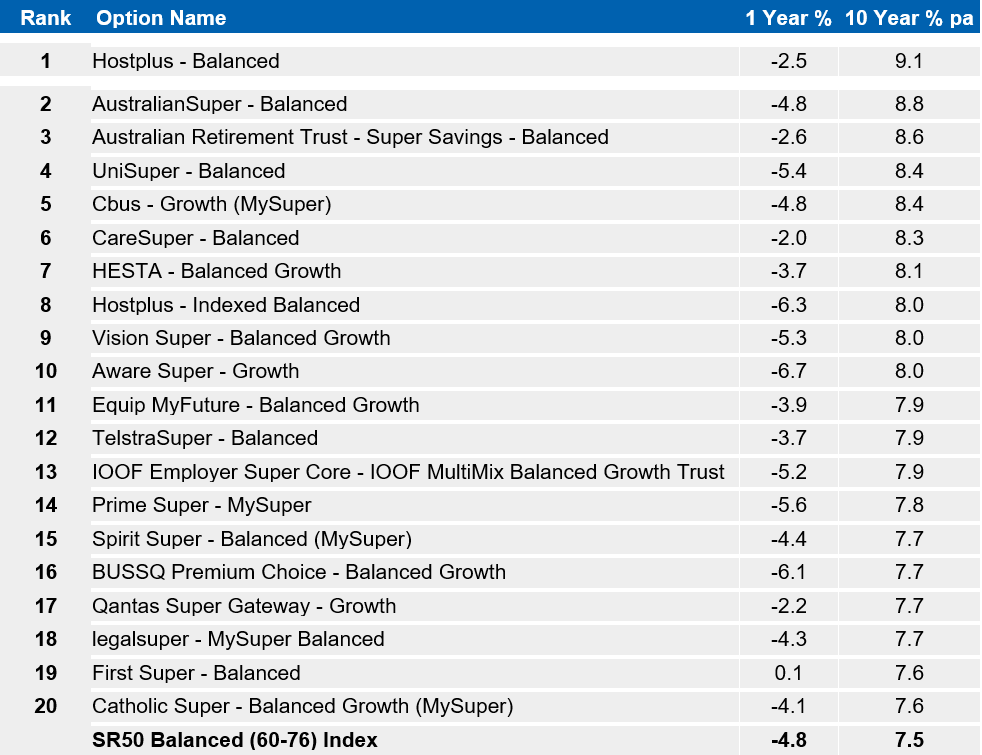

Top 20 balanced options over 12 months

Source: SuperRatings

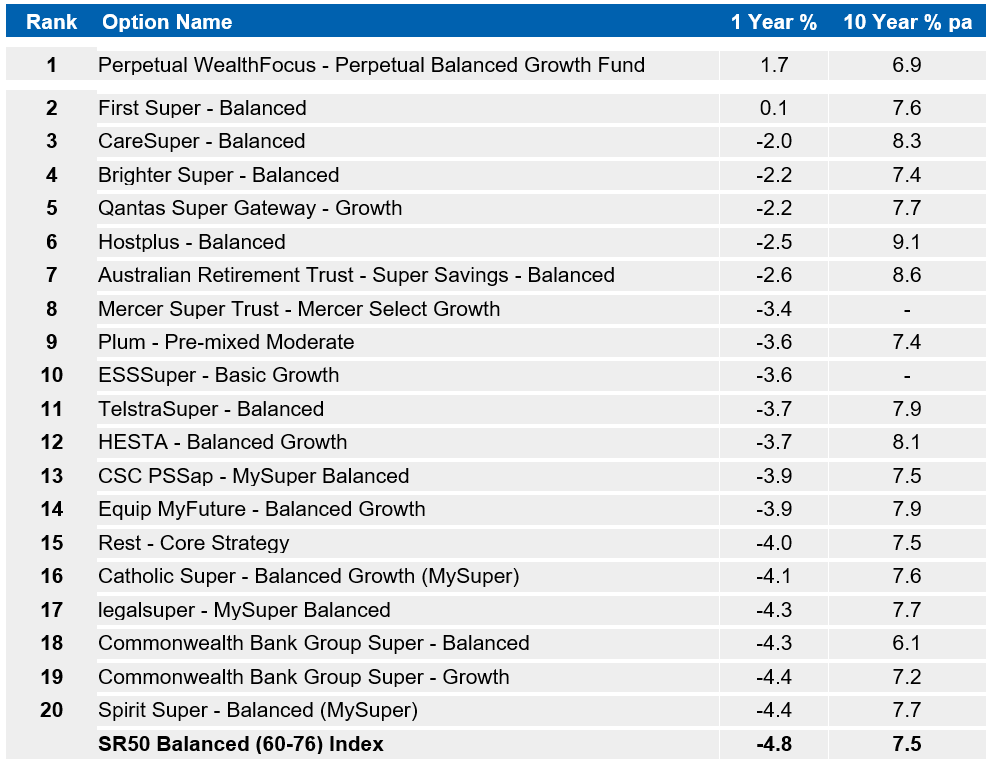

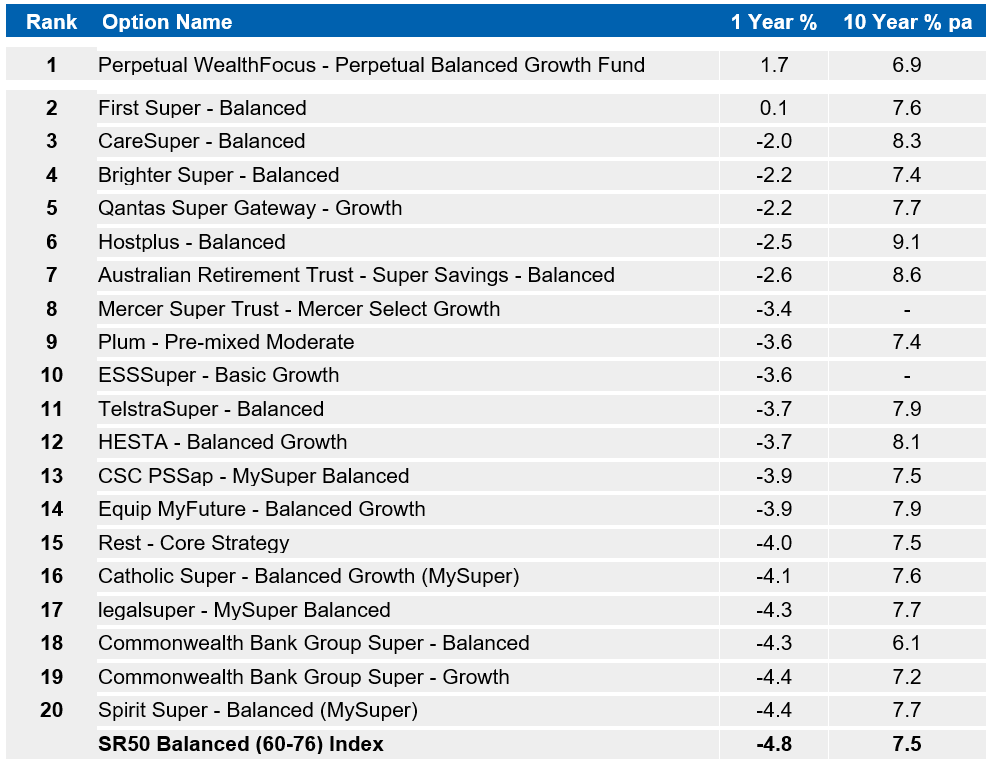

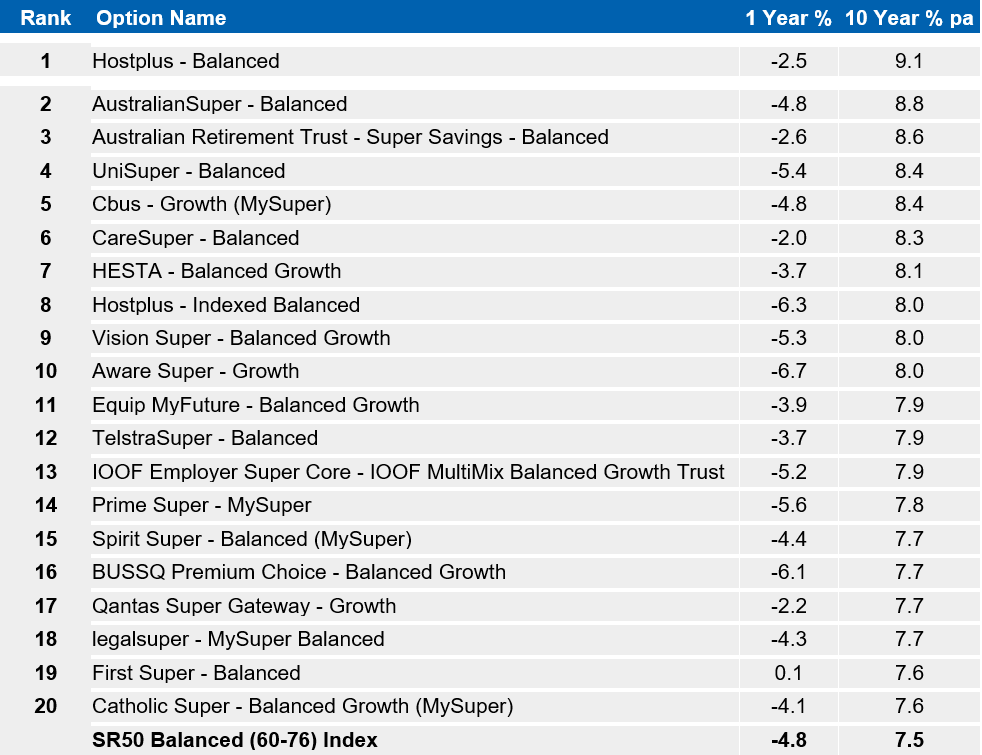

The top 10 super funds all delivered 8 per cent a year or higher over the last decade with the Hostplus – Balanced option the top performer over the long-term, with an average annual return of 9.1 per cent.

Top 20 balanced options over 10 years

Source: SuperRatings

It begs the question whether super funds are just getting too big and too lazy. Do superannuation fund clients need to start demanding better from their fund managers, just like shareholders are doing with listed companies?

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending