This week Australia’s national savings scheme, the superannuation guarantee system, celebrates 30 years since inception by then Treasurer Paul Keating.

Superannuation was a genius idea that has underpinned the wealth of every Australian and the stability of our financial system and economy.

Keating’s legacy has been enormous. He also deregulated the financial system, floated the Australian dollar and wound back tariffs to make Australian industry globally competitive. They were all brave, ground-breaking policy initiatives that set the country up for generations.

Despite all the market volatility over that 30 years, $1 of super invested on 1 July 1992 in the median balanced option, with 60-70 per cent growth assets, is estimated to be worth $7.67 today (depending on fees). So over the long term super has been a wealth winner.

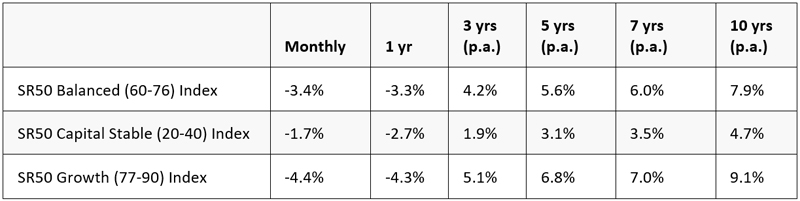

Accumulation returns to June 2022

It’s a good history lesson at the moment during these uncertain times. Especially as over the past 30 years there have been a lot of similar market ructions. Leading superannuation research house SuperRatings estimates a negative return of 3.3 per cent for the median balanced option for the financial year ending June 2022. This is the fifth time financial year returns have been negative since the inception of superannuation in 1992, but it follows the second highest annual return last year of 17 per cent.

The median balanced option declined by an estimated 3.4 per cent over June, while the median growth option reduced by an estimated -4.4 per cent. Capital stable options, which hold more traditionally defensive assets such as cash and bonds, only fell by an estimated -1.7 per cent.

Source: SuperRatings estimates

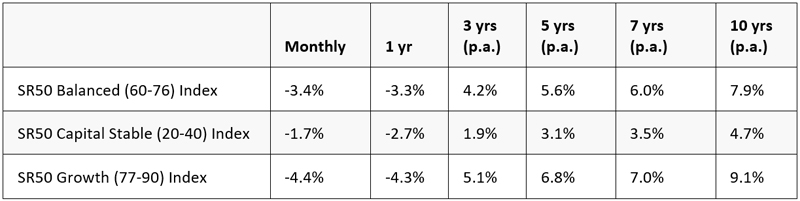

Pension returns to June 2022

Pension returns also declined in June, with the median balanced pension option down an estimated 3.9 per cent. The median growth option fell by 4.8 per cent, while the median capital stable option saw an estimated 2 per cent drop.

Source: SuperRatings estimates

Keep your super growing

It seems the worst thing an investor can do is panic during a market crash. Super Ratings found that a member who had a $100,000 balance and switched to cash from a growth or balanced option at the onset of the pandemic in March 2020 would be $35,000 to $45,000 worse off as at the end of June 2022.

Over the last 15 years, a member in the typical balanced option would have seen a balance of $100,000 in June 2007 grow to $206,769. A member in a growth option saw their balance accumulate to $205,647.

International Shares options have performed the strongest with the median option rising to $209,107, though it has been a bumpy ride across global markets in the last few years. While the median Australian Shares option sat slightly below its global counterpart at $207,525.

How to supercharge your super

A good way to celebrate super’s 30th birthday is to make the most of its wealth accumulation benefits.

1. Choose the right fund

Probably your most important decision to supercharge your super is putting it into the right fund. It’s tempting to just tick the box and go with whatever fund your work is signed up to, but this might not be the best option. Especially as you can be locked into your employee’s super choice if you don’t change it.

To see what fund options are available to you, head to Canstar, RateCity or YourSuper. Then do your research to determine which funds best suit your super mandate.

2. Watch those fees

Most super funds charge annual fees (check the comparison websites above to see who charges what). This money is paid directly out of your super account and the amount you pay can really make a difference to your balance come access time.

Make sure you take fees into account when you’re comparing super funds. As demonstrated by the superannuation 30-year figures above, it’s not just about the five or ten year return (and certainly not about the one year return). You should also make sure you’re only paying one set of fees. It makes zero sense to have more than one super account, so consolidate into one.

3. Find your lost super

This is probably the easiest way to supercharge your super of them all. Many Australians have super tucked away in accounts they’ve forgotten exist. In fact, there’s estimated to be almost $14 billion in lost super out there, in over 2.2 million super accounts. If you’ve changed jobs over the years, some of that money could be yours.

You can find out if you have lost super here. You can then roll your lost super into your chosen super account, increasing the balance.

4. Tap into government benefits

The Australian government encourage different superannuation contribution strategies. These incentives vary from tax incentives to dollar matching. Find out more on the ATO website.

5. Make direct contributions

As well as making pre-tax contributions from your salary, you can also make after tax contributions from your bank account. You can then claim this money as a deduction at tax time.

6. Up your risk

Don’t rely on the ‘default’ investment option for your super scheme. Unless you tell them otherwise, most super funds will sit you in a balanced, or even conservative, investment mix that aims to reduce risk. While these options offer lower risk, the also offer lower returns over the long term.

If you’re 10 years or more off retiring, it makes sense to go for a high growth strategy. You’ve got time to ride out short term market fluctuations and take advantage of the higher returns a more risky strategy brings. You can always choose a more conservative approach as you near retirement.

Remember that you can also split your super across different investment strategies. You might opt for putting a certain percentage of your money onto a high growth track and the rest into a balanced strategy. Talk to your financial adviser and super fund to see what works best for you.

Trending