Each week we ask a question to help you focus on an area of your finances that might need a closer look. This week: How healthy is your super balance?

The fact is, most Australians aren’t on track for a comfortable retirement. They simply don’t have enough super in their account to see them through.

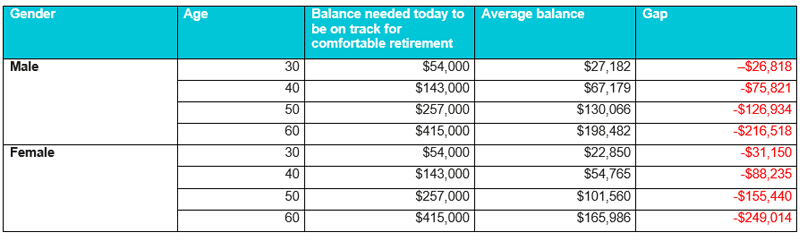

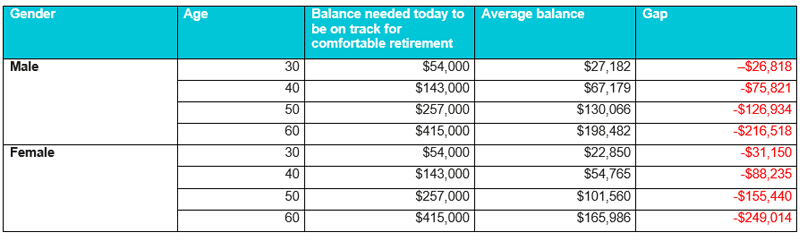

Based on the average balance that people hold at each age, there’s a big gap. This is especially true for women, whose superannuation lags well behind men.

This is how that super gap translates age by age:

Data source: Canstar

Looking at the table, are you on track? How healthy is your super balance compared to average? And what’s the gap between how much super you should have and how much you do have?

Nobody wants to be poor in retirement, so it makes sense to set some time aside to look at where you’re at. Here are the steps you can take this week to revive your super to ensure you have enough when you need it.

1. Check your super statement

Most people would have a rough idea of the value of their home, but do you really know what your superannuation is worth and whether your fund is delivering the best value for you?

It all starts with that annual superannuation statement you receive. It is one of the most important bits of paper you’ll receive all year. While finance nerds like us run through their statements every year with a fine-toothed comb, we reckon that’s not the case for most people. Many of you probably never read your superannuation statement, preferring to file it away the moment you receive it. Don’t make that mistake.

Click here for everything you need to know to understand your super statement.

2. Work out how much super you’ll need

Use a calculator like the one at Canstar or MoneySmart to figure out the balance you’re aiming for at retirement. Among other things, the calculator will factor in your current age, super balance, annual income and expected retirement age. You should also be able to plug in any additional investments you currently hold (like shares or property).

The calculator will give you an estimated retirement income. Only you can figure out whether it’s ‘enough’. You’ll need to factor in the age you plan to retire at, plus any costs you’ll have during that retirement (you might still be paying a mortgage or rent, or have other large commitments).

Then you’ll need to figure out what kind of lifestyle you want to lead in your dotage. Do you have big travel plans? Will you need particular health care? Want to move house? Plan on opening a vineyard? It all needs to be considered.

Click here to find out more about how much super you’ll need.

3. Develop a plan to revive your super balance

Most of us will have worked out by now that we actually don’t have enough super in our account for our age. Sobering news, but that’s exactly why you’re taking the time to do this exercise. Now you know, you can take steps to bring your super back into balance. So, how do you start administering the CPR?

Click here for loads of ideas to supercharge your super.

4. Special considerations

It’s not fair, but for women the answer to the question “how healthy is your super balance?” is more likely to be “flatlining” than it is for men. There are many reasons for this, all of which we cover in this article:

Women and superannuation: Why women need to work harder.

Freelancers and those who own their own business are also at risk of not having enough money to fund the retirement they’ve worked so hard for. We’ve done the research for you and you can find loads of strategies to help you out in this article:

A super strategy for self-employed entrepreneurs.

Another thing to consider: check that your employer is actually paying you the super you deserve. A recent report from Industry Super Australia (ISA) report has found almost 3 million workers lose on average $1,700 in super each year. And those ripped off on super can end up retiring with up to $60,000 less. Blue-collar workers and young people are more likely to be underpaid, so if you think it could be you, read this:

Check your super balance – you could be getting ripped off.

Finally, if you’re nearing retirement age and you’ve just worked out that you’re not on track, don’t panic. There are many ways you can supplement your income in retirement to increase your wealth. Check here:

How retirees can supplement their retirement income online.

Find the rest of our Money Focus series here.

Trending

Sorry. No data so far.