Do you know if you’re on track for a comfy retirement? How much super should you have in your account already? And what should you do if there’s a gap (because trust me, there’s probably going to be a gap)?

Not many 20-year-olds get their first job and think, “Yippee, I’m on my way to saving for my retirement!” More likely they are on their way to the pub to celebrate their first pay check.

But the fact is, when your employer starts paying your superannuation that young, you are on your way to a good retirement. Then life happens. You might stop working for a period of time to travel or raise children or start a business. Or you might stop working because you can’t find a job.

When you do return to work (or get your business off the ground), it might be in a part-time or casual capacity. You might even have found yourself dipping into your existing super at the start of the COVID crisis.

All of these scenarios show that even if you were on track when you started working young, it’s easy for super to veer off the rails.

So, how much super should you have at your age?

According to The Association of Super Funds of Australia (ASFA), the average superannuation balance needed to have a comfortable retirement is $640,000 for a couple and $545,000 for a single person. They assume that you would withdraw that amount in a lump sum and receive a part Age Pension when you reach eligibility at 66 years and 6 months old.

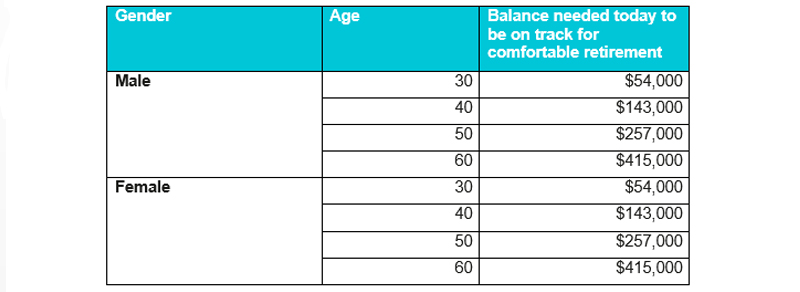

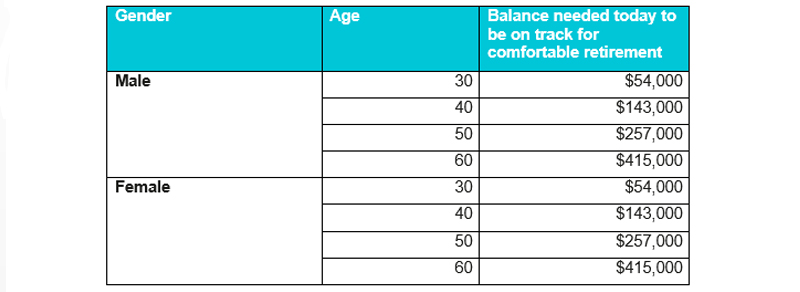

To be on track for these figures, Canstar estimates that you would need to have around $54,000 in your super account at age 30, $143,000 by age 40, $257,000 by age 50 and $415,000 at 60 years. This is how much super you should have in your account at each age:

Data source: Canstar

Check your current superannuation balance against these estimates to see whether you’re on track or not.

Most Aussies aren’t on track

The fact is, most Australians aren’t on track for a comfortable retirement. They simply don’t have enough super in their account to date. Most likely for some or all of the reasons we listed above.

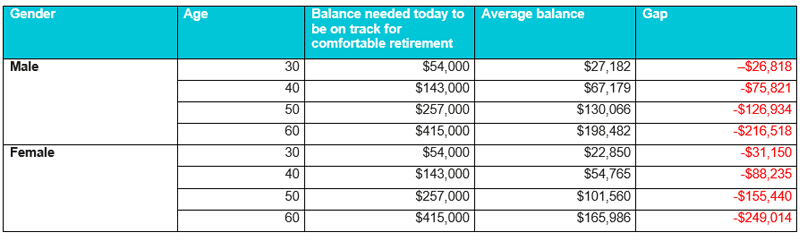

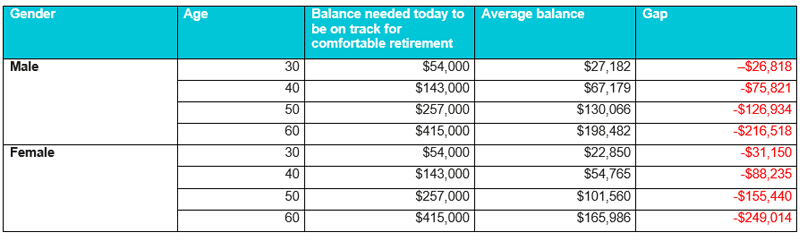

Based on the average balance that people hold at each age, there’s a big gap. This is especially true for women, whose superannuation lags well behind men.

This is how that super gap translates age by age:

Data source: Canstar

How does your super balance compare to the average? And what’s the gap between how much super you should have and how much you do have?

Filling in the gap

Most likely, you’ve got a gap to fill along with most other Aussies. Here are a few tips to start bridging the gap and getting yourself back on track for a comfortable retirement. After all, you’re working way too hard right now to deserve to hit the poverty line in your old age.

Choose the right fund

The quickest way to get your super on track is to put it into the right fund. It’s tempting to just tick the box and go with whatever fund your work is signed up to, but this might not be the best option. Funds charge different fee levels and insurance premiums and have various investment strategies. To see what fund options are available and do your research, head to Canstar, RateCity or YourSuper.

Consolidate your super

If you’ve got more than one super account, you’ve got one or more too many. Consolidate your superannuation into the best account for you. You can also find out if you’re one of the many Australians how have lost track of super here. You can then roll your lost super into your chosen super account, increasing the balance.

Tap into government benefits

The Australian government encourage different superannuation contribution strategies. These incentives vary from tax incentives to dollar matching.

There’s the first home super savers scheme which allows you to save money for your first home inside your super fund.

Or concessional contributions that let you contribute up to $25,000 pre-tax dollars (this includes money contributed by your employer and is soon to be increased to $27,000).

If you’re a low to middle income earner and make personal (after tax) contributions to your super fund, the government will make a co-contribution up to $500.

Take advantage of whatever concessions and tax benefits you’re eligible for to get your super balance back on track.

Make direct contributions

As well as making pre-tax contributions from your salary, you can also make after tax contributions from your bank account. You can then claim this money as a deduction at tax time. It’s a straightforward, tax-savvy way to boost your superanuation balance.

Up your risk

Don’t rely on the ‘default’ investment option for your super scheme. Unless you tell them otherwise, most super funds will sit you in a balanced, or even conservative, investment mix that aims to reduce risk. While these options offer lower risk, the also offer lower returns over the long term. If you’re ten or more years away from accessing your super for retirement, you might want to opt for a higher growth strategy.

As always, talk to a qualified financial adviser to get advice that’s tailored to your personal circumstances and financial goals.

Trending