Afterpay Money is launching in October, but how does it stack up compared to bank offerings already in the market?

While Afterpay shares have been a stellar performer in the past, they are stagnating at the moment because of increased competition from the likes of PayPal and CommBank. There’s also criticism that it is a “one-trick pony” based on having only a single Buy Now, Pay Later (BNPL) product.

That is all about to change. Afterpay will soon offer its 3.3 million Australian customers (they have another 5.6 million in the US and one million in the UK) new financial products from October. They are basically turning into a bank.

Afterpay Money offeres fee-free transactions

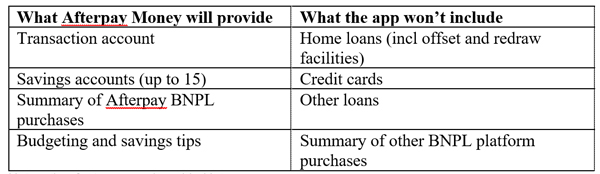

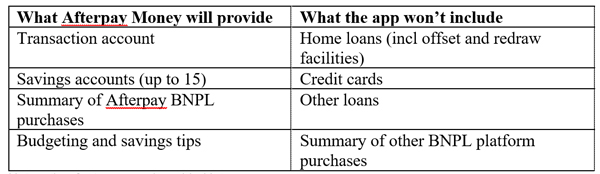

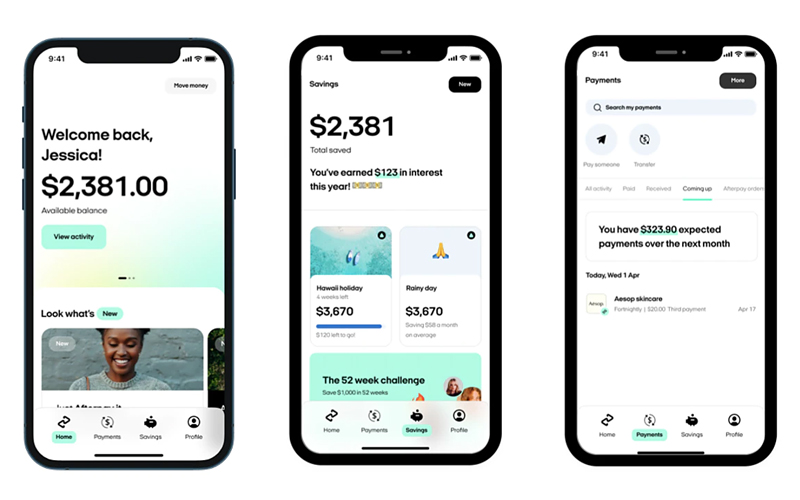

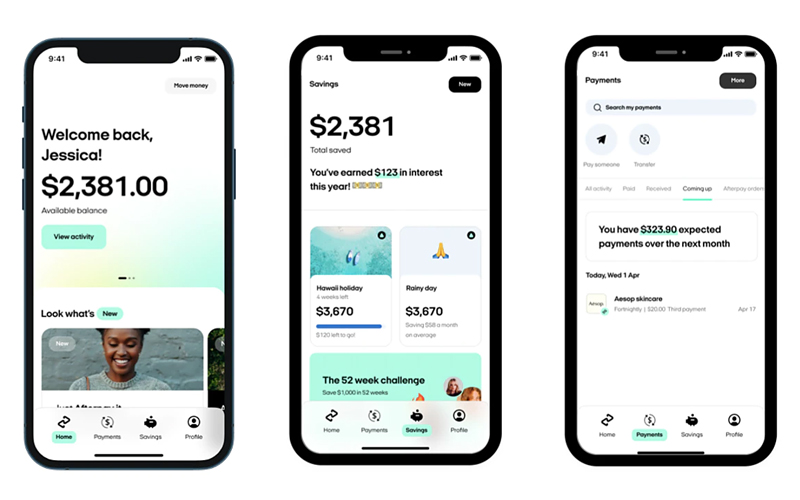

Afterpay Money will offer fee-free transaction and savings accounts in its new app. The app will also provide customers with an overview of their spending and saving.

Customers will need an Afterpay BNPL account to apply, but the bank accounts will be managed by Westpac, with Afterpay acting as the distributor.

Note: other features may be added later.

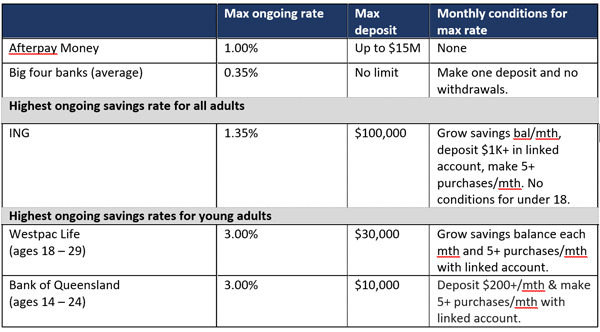

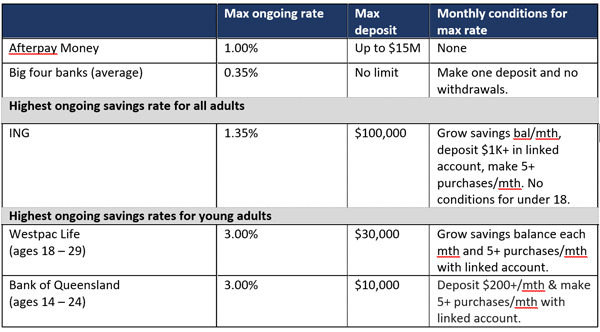

Research group RateCity has analysed Afterpay Money’s new transaction and savings accounts and compared them to what’s already on offer.

Afterpay Money will offer one per cent interest on its savings account. This is much higher than the average 0.35 per cent offered by the big four banks, but less than the 1.35 per cent offered by ING.

It’s also interesting that Westpac and BOQ pay three per cent on accounts targeted to young Aussie savers, who are Afterpay’s traditional customer base. But Afterpay Money has no monthly terms and conditions to earn the maximum interest, whereas most market-leading savings accounts do.

Afterpay Money will also offer a transaction account but won’t charge customers fees. As it is, eight ba

Image: Afterpay

nks don’t charge any standard fees and most don’t charge account keeping fees.

Only ING waives all standard fees and refunds third party ATM fees in Australia and overseas, if terms and conditions are met. The big four banks charge account fees for currency conversion and overseas ATMs. CBA, Westpac and ANZ also charge account fees in some cases.

Afterpay savings account vs the competition

Source: RateCity.com.au Note: Big four accounts are the average of their goal saver accounts. Terms and conditions for max rate differs slightly between the big four banks. Max deposit listed is the maximum you can put in and still get the highest rate listed.

How to avoid getting into trouble using BNPL platforms:

- Read the terms and conditions and understand which fees you could get hit with.

- Set yourself strict spending limits.

- Limit yourself to one platform and one purchase at a time.

- Don’t impulse buy. Sit on any major purchases for at least 24 hours.

- If you get into trouble, pull the pin and call for help. Each platform should have a hardship policy to help you get out of trouble.

- More tips to avoid overspending here.

Trending

Sorry. No data so far.