Everyone wants to get the best possible interest rate from their bank. And this is the best home loan bargaining tool you’ll ever get.

Okay, listen up if you have a home loan or know someone with a mortgage. I constantly encourage you to negotiate with your financier to get a better deal, to ask for a discount… because today you’re a mug if you’re paying the advertised variable rate.

But none of us have ever really known what, if any, formula the banks use to determine the discount. Is it loyalty with customers who have lots of products with them? Or is it credit score? Perhaps it’s the amount of equity you have in the property?

Well, now we know

Well, now we know… at least for the Commonwealth Bank which has slashed its advertised package rates by up to a whopping 2.03 per cent for new customers with big deposits. Over 2 per cent, that’s huge.

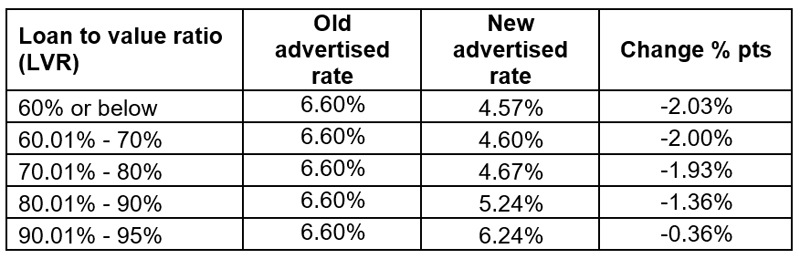

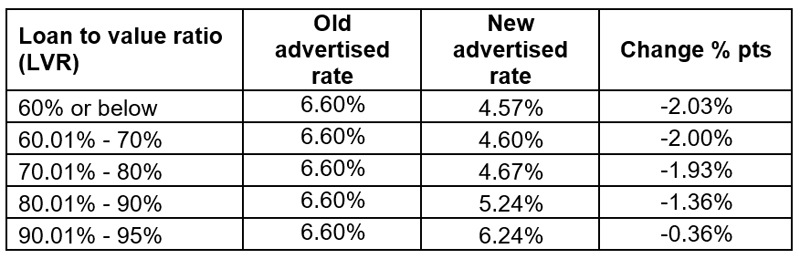

CBA has restructured its Wealth Package with massive discounts listed for customers if they own a decent proportion of their property. The advertised rate for the bank’s Wealth Package is 6.6 per cent for owner-occupiers paying principal and interest… but there are no advertised discounts for customers with big deposits.

In other words, the discount still has to be negotiated, but this rate is now as low as 4.57 per cent for new customers who own at least 40 per cent of their home (in bank-speak that’s called a 60 per cent loan-to-value ratio), or existing CBA customers looking to increase their loan.

Package rate cheaper than no-frills

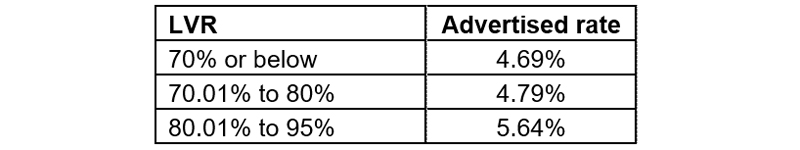

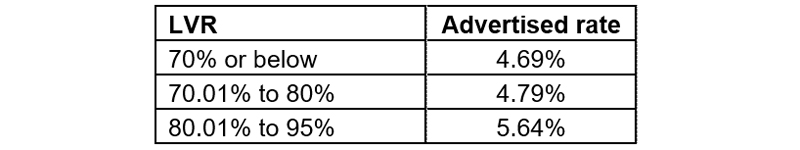

As a result many of CBA’s advertised package rates are now lower than the bank’s no-frills options. For larger loans this will mean the package rate could be cheaper than the basic option, even when the annual fee is taken into account.

Package home loans include an offset account but typically have higher advertised rates than the bank’s no-frills option, alongside an annual fee of $395. While the rates are higher, the banks often hand out undisclosed discounts to select borrowers and brokers.

CBA Wealth Package rates – includes offset account and $395 annual fee

for owner-occupiers paying principal and interest

Source: RateCity.com.au.

CBA Extra Home Loan – no offset account, no ongoing fees

for owner-occupiers paying principal and interest

Source: RateCity.com.au

So, there you have it. The home loan bargaining tool you need to negotiate your rate.

If you’re a CBA home loan customer with a decent equity in your property make sure you’re negotiating for the above rates which apply to you.

If you’re NOT a CBA customer, use the table above and negotiate with your bank for the same deal. And if they don’t play ball, go and refinance with CBA.

It’s great intelligence isn’t it?

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.