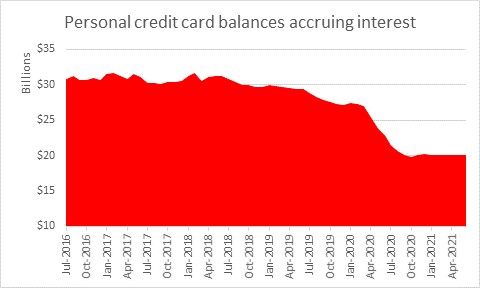

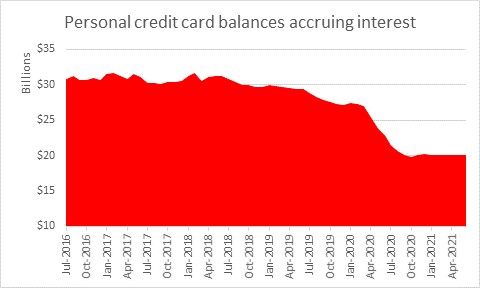

Australians are in a credit card rut. We’re currently paying interest on $20 billion worth of outstanding credit card balances every month.

That figure seems to be stuck at that level, despite the number of actual credit card accounts dropping by 751,916 in the last year. The lowest number since February 2007.

Source: RateCity: RBA June 2021 data, released 9 August 2021, original data, excludes commercial cards.

It seems higher debt is accruing on fewer cards because people are feeling the financial pinch of lockdown. If you’re struggling to pay the bills, pick up the phone. Ask for help instead of digging yourself even further into a credit card rut.

Putting your bills on the credit card, or taking out a payday loan, just makes a bad situation worse.

There are support packages from the government, loan deferrals, rate reductions and fee waivers from the banks, crisis payments from Centrelink and hardship programs from essential service providers to help see you through.

Here are my four steps to get started on your credit card debt reduction program.

1. Make extra repayments

Paying more than the minimum repayment saves money on interest charges and ensures debt disappears faster.

If you’re not sure where the extra money will come from, build a budget. Lay out all of your income and expenses on a weekly, fortnightly and monthly basis. This will give you an overall picture of where it’s all going.

It doesn’t matter how, it could be old fashioned pen and paper, a spreadsheet, or even an app like Pocketbook.

Once that’s done it will be much easier to work out where you can scrimp and save and ‘find’ some extra cash to pay your way out of the credit card rut.

2. The snowball strategy

Snowballing debt involves paying off smaller debts first by making extra repayments, and gradually working up to larger loans.

The genius of this strategy is that once a smaller debt is paid off, the money that was being used to cover it is added to the repayments on the next largest loan. This then pays the next loan off quicker.

It’s a structured, goal-based approach to debt reduction, which also has strong psychological benefits.

Not only does paying off the smaller loans quickly feel great, there are less bills each month. This relieves some of the debt stress.

As an example, someone struggling to repay four credit cards would switch the three cards with the highest balances to the minimum repayments. Then they’d funnel all their extra money into paying off the card with the lowest balance.

Once the smallest debt is paid off, all the money that was going towards repaying it is then used to start chipping away at the card with the next largest balance.

3. Dig into the savings

Keeping ‘savings’ sitting in an online account earning a maximum one per cent return when you owe money on a credit card charging 17 per cent interest is madness.

While it might be a psychological blow to use that hard saved cash to pay off debts, it makes good financial sense.

Once the debts are done it will be much easier to start saving again. Without creditors chasing all your extra cash.

The exception to this rule is money set aside in a ‘rainy day’ account to cover you in an emergency… this is important to maintain and shouldn’t be touched.

4. Minimise interest payments

Do everything in your power to minimise the interest charges on existing debts.

For example, many credit card providers will offer zero per cent interest on balance transfers for a period of time if you open a credit card with them.

You can also attempt to negotiate better terms with an existing loan provider, who’ll be much more interested in getting payments than having a bad debt on their hands. Also consider consolidating multiple debts into one if it’s possible to achieve a lower rate.

At the end of the day, you’ll probably have to make some tough decisions on what to cut and what constitutes essential spending, and it’s not going to be fun.

Just keep in mind the reward is a faster path to financial freedom.

Trending