The home loan war between financiers is really hotting up. In a bid to win over new customers, lenders are offering up to $5,000 cashback on home loans with rates under 2 per cent.

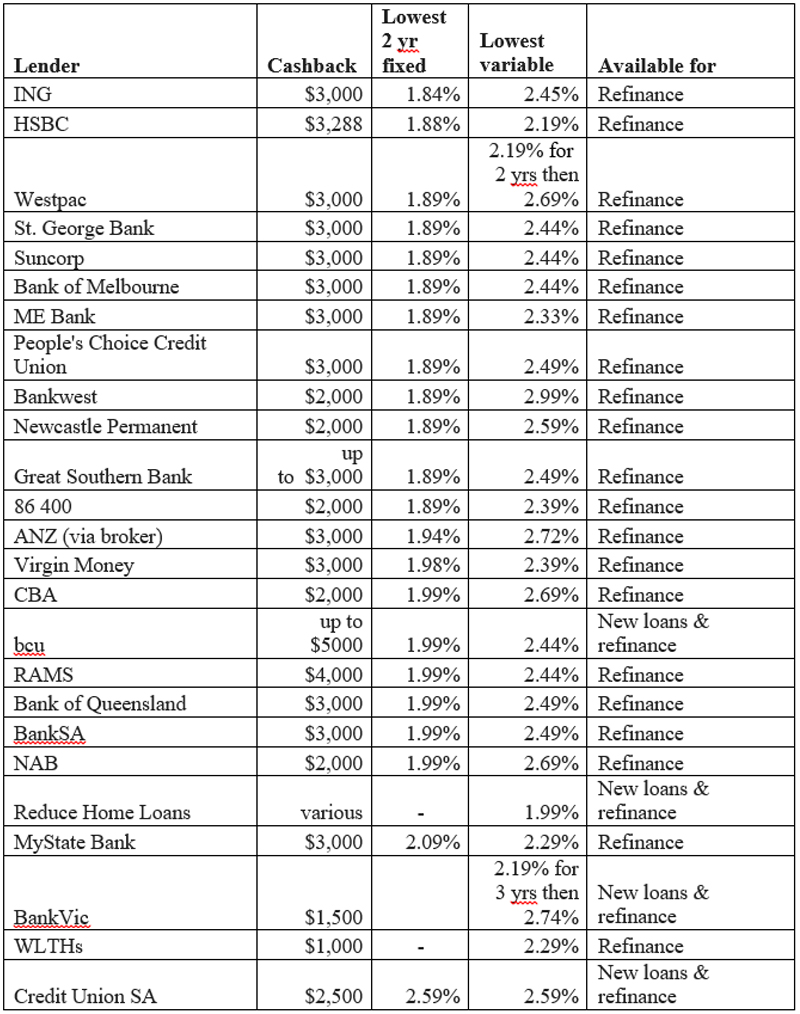

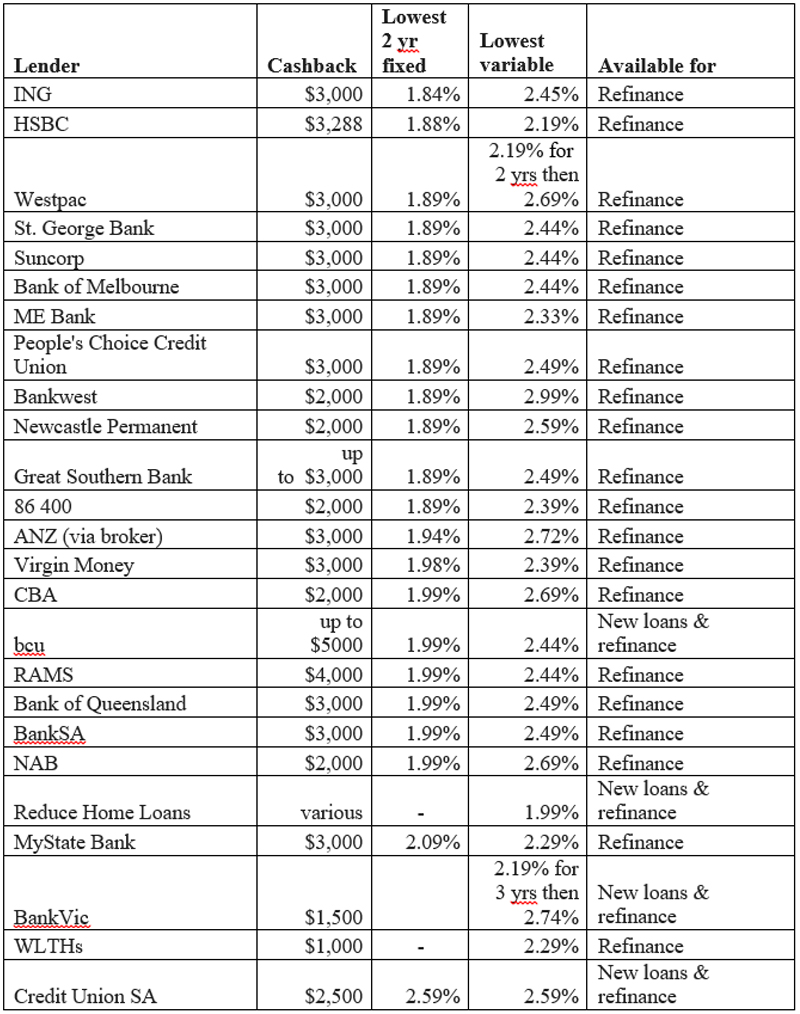

New analysis by financial research group RateCity shows there are 25 lenders offering cashback deals. In addition to the cashback on home loans, 21 of these lenders are also offering at least one home loan rate under 2 per cent for owner-occupiers refinancing.

Cashback on home loans plus low rate

With property refinancing hitting a record high in June, cashbacks are a popular perk being offered by lenders to attract new customers.

In the past, a low ongoing interest rate used to lure customers more than a cash back. But now banks are offering both low rates and cashback deals.

“Cashback deals can potentially work in a person’s favour if they commit to finding the best deals and refinance regularly,” says Sally Tindall, research director at RateCity.com.au. “However, anyone who doesn’t look past the lure of instant cash could potentially shoot themselves in the foot if they’re not careful.

“It all comes down to your personal circumstances, including the type and size of your loan, the rate you’re switching to, any fees, and whether you’re likely to refinance regularly.

If you’re thinking about taking out a cashback deal, do the maths to make sure you’re going to end up ahead when compared to the lowest rates available.”

How cashback deals stack up

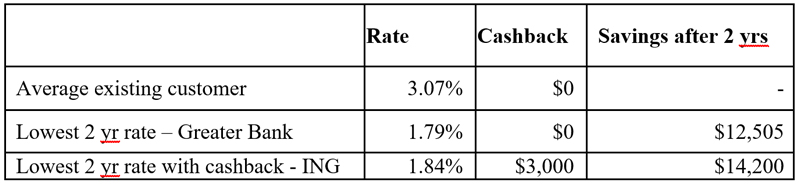

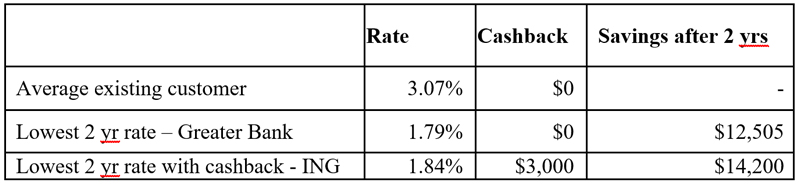

RateCity.com.au compared the cashback specials to the lowest rate options on the market, based on a typical refinancer (see full assumptions at end).

Fixed rates

The lowest 2-year fixed rate on the market is 1.79 per cent, however, on the average-sized mortgage of $500,000, 17 lenders are offering cheaper 2-year deals over the fixed rate term when cashback, interest charges and fees are included.

For example, if the average variable rate customer refinanced to the lowest 2-year fixed rate on the market (Greater Bank, 1.79 per cent), they could potentially save up to $12,505 in the first two years. However, if they went with the lowest 2 year fixed rate loan offering cashback (ING, 1.84 per cent), they could save $14,200, which is $1,695 more.

Warning: if any fixed rate loan rolls on to the bank’s revert rate, which is usually significantly higher, the person’s savings are likely to start depleting.

Potential savings refinancing to the lowest 2-year fixed rate loan – $500,000 loan balance

Source: RateCity.com.au. Notes: the average existing customer variable rate is from the RBA, calculations are based on an owner occupier paying principal and interest with $500,000 owing and 25 years remaining. Savings calculations are interest paid, plus switching and ongoing fees, minus any cashback.

Variable rates

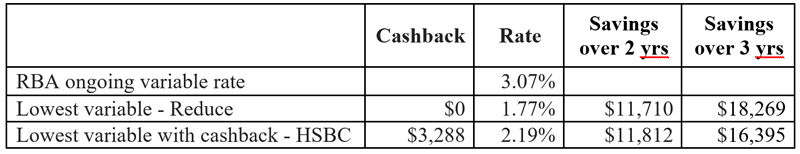

It’s a different story when comparing cashback deals on variable loans. After just two years, only two cashback deals (one other lender) come out ahead against the lowest variable rate on the market. After 3 years, none of them trump the lowest ongoing rate (assuming these rates stay the same).

For example, RateCity.com.au analysis shows if the average refinancer switched to the lowest variable rate on the market (Reduce Home Loans, 1.77 per cent), they could save $11,710 in two years. If they went with HSBC instead, which is offering the lowest variable rate with a cashback, they could save $102 more in the first two years, even though the rate is 0.42 per cent higher.

Potential savings from refinancing to the lowest variable rate – $500,000 loan balance

Refinancing for a cashback deal

Before you refinance to take advantage of a cashback deal, be sure to ask yourself these questions.

- Is the interest rate competitive? The lowest variable is 1.77% and the lowest 2-year fixed is 1.79%.

- Have you made sure you’re eligible for the cashback? Read the terms and conditions carefully

- Are the fees high? Ask the new lender to waive them if they are.

- Does the loan offer the flexibility you need? This may include an offset account, ability to make extra repayments.

- Are you in position to refinance? This typically includes having a steady job and owning at least 20 per cent of your home. You also need to make sure that you’re not currently on a fixed rate, as break fees may apply.

- Can you put the cashback bonus into your mortgage? Extra repayments help reduce your interest charges over the years to come.

Remember to refinance your mortgage regularly

Don’t set and forget your loan. Especially if you are on a fixed loan, as potentially high revert rates may quickly eat away at any savings you’ve made.

Compare your mortgage regularly and renegotiate with your current lender if you’re not getting the best deal.

Staying on top of your mortgage can save you thousands.

Full list of cashback home loan specials on RateCity.com.au

Source: RateCity.com.au. Notes: Rates listed above are the lowest advertised home loan rates for owner occupiers paying principal and interest that qualify for the cashback offer. Note some lenders do not offer cashback on their lowest rates including Reduce Home Loans and Credit Union SA. Suncorp cashback only available on loans over $750K. Credit Union SA offers up to $5K for first home buyers taking out lenders mortgage insurance. Bcu is offering 0.75% of the loan up to $5,000. Great Southern Bank offers a separate, $2,000 first home buyer offer, with the funds added to deposit instead of cashback at settlement and is not on offer for any customer taking out a loan under the Federal Government’s first home loan deposit scheme. Reduce Home Loans is offering cashback of between $1K and $10K, depending on loan size. Westpac rates are for loan to value ratios of 70% or lower. WLTH cashback is for investors only.

Trending

Sorry. No data so far.