The Westpac-Melbourne Institute Consumer Sentiment survey has found that Australians haven’t been this gloomy since the 1990s recession.

The last Reserve Bank Board meeting pointed out that the key economic indicators it is following for future interest rate decisions are the labour market (which, as we now know continues to be tight) and household confidence and consumption.

Well, Aussie consumers remain gloomy, with the Westpac and Melbourne Institute’s measure of consumer sentiment now 21 per cent below the long-run average. The index has now been below the neutral 100 mark since March 2022, the longest gloomy streak since the early 1990s recession.

A lot of economists, including CommSec, believe confidence is unlikely to improve until the inflation threat has receded, and interest rates start falling sometime next year.

Employers are feeling more optimistic

But while consumers are gloomy, employers are getting a bit more positive, with business conditions above ‘normal’ levels; basically because the job market remains strong and migration continues to lift. So spending has continued, even if it’s at a more cautious pace.

Remember, last week I talked about how the huge migration levels are inflating our economic growth, with a lot of that through consumer spending. That’s why retailers are doing better than expected, because migration is boosting the sheer number of shoppers.

Migration driving positive outlook

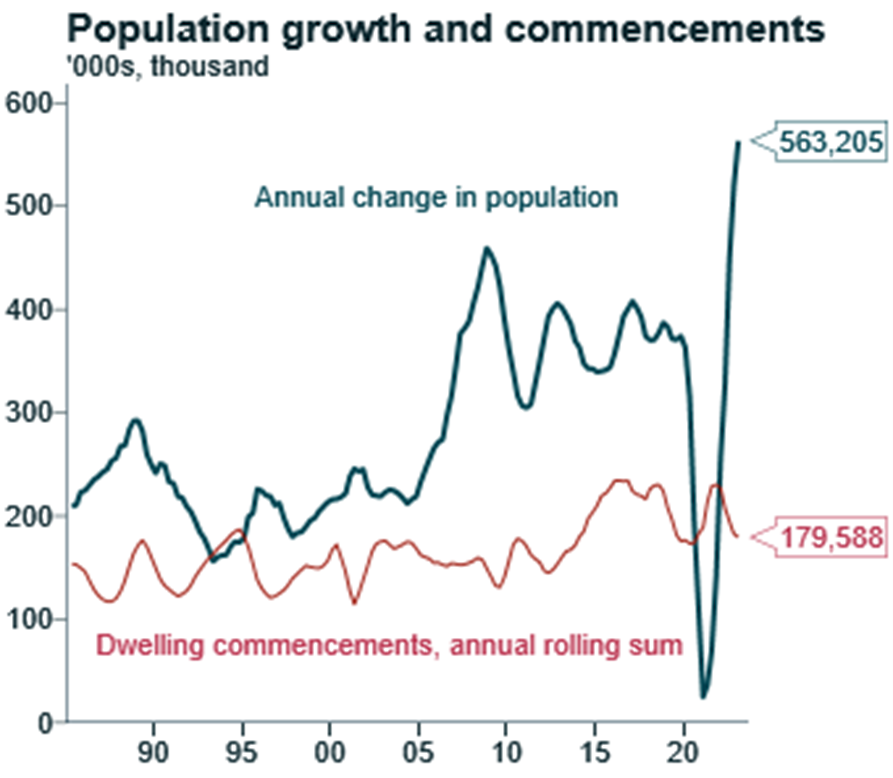

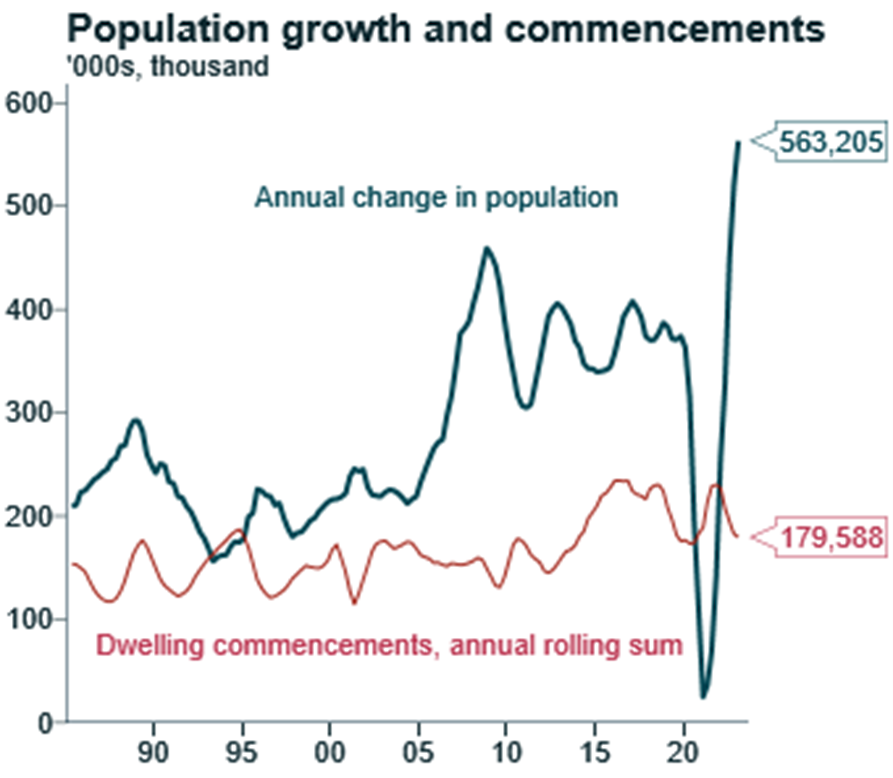

The Bureau of Statistics population data for the March quarter showed Australia’s population rose 563,205 over the year to March – the largest annual increase on record. Our population was 26.5 million people on 31 March 2023.

The quarterly growth was 181,600 people (0.7 per cent) and the annual growth was 563,205 people (2.17 per cent). Our annual natural increase was 108,800 and net overseas migration was 454,400.

In fact, at 108,800 the natural increase in Australia’s population over the past year (births less deaths) was the slowest annual growth since quarterly records were published 42 years ago.

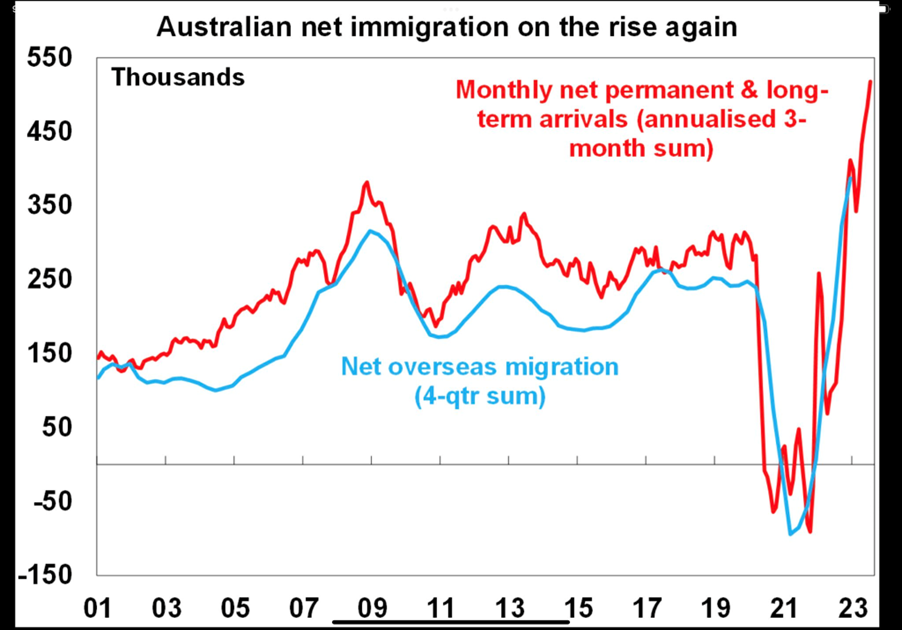

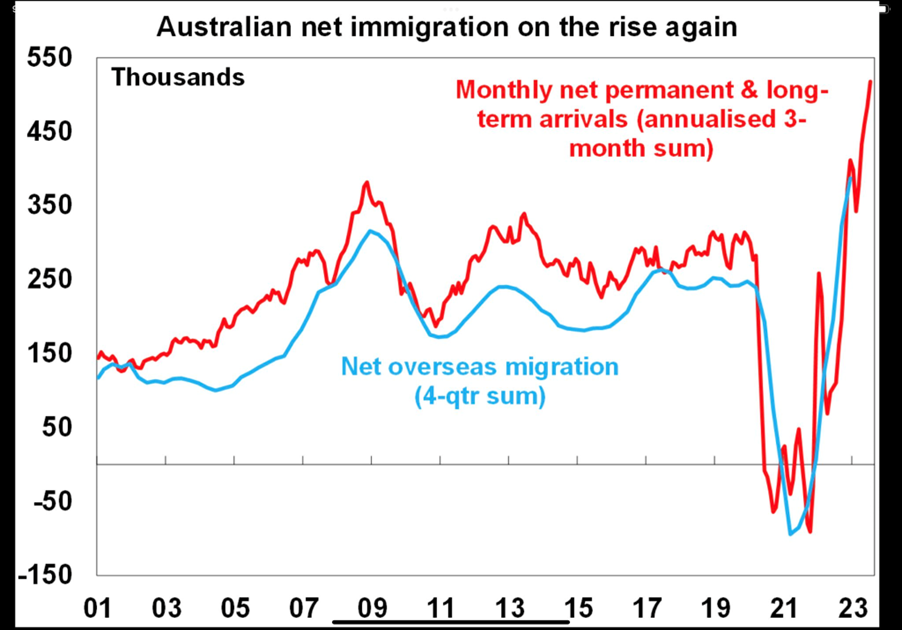

This graph which AMP chief economist, Shane Oliver, posted on X (the rebranded Twitter) puts into perspective just how big this immigration boom is.

Source: ShaneOliverAMP/ X

But where will they live?

We have a massive immigration-led surge in population growth, but buildings commencements are falling. This graph alone sums up the residential property market and why a continuing shortage of new homes will underpin home values for the next couple of years at least.

Source: AMP

We’re just not building enough homes to meet the demand from migrants.

Interestingly, the Westpac-Melbourne Institute Consumer Sentiment survey also includes a question on the wisest place to put new savings. It’s a good barometer of how people are feeling and whether they are confident enough to come out of their bunker.

In the latest quarter, the proportion of people saying they ‘don’t know’ the best place for savings jumped to the third highest level in 26 years of records. On the back of higher deposit rates and borrowing costs, over half of all consumers nominated either ‘bank deposits’ (32.5 per cent) or ‘pay down debt’ (23.3 per cent) as the wisest place for savings. Conversely, very few consumers favoured “riskier” options. Just 7.4 per cent nominated real estate and 7.2 per cent shares.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.