Consumers have gone so deep into the bunker and reigned in their spending so much that we are all but in an economic recession, except by name.

Don’t be fooled by the latest economic growth figures for the March to June quarter. Yes, it’s looking in the rear-view mirror a fair way back, but that’s just the way it is.

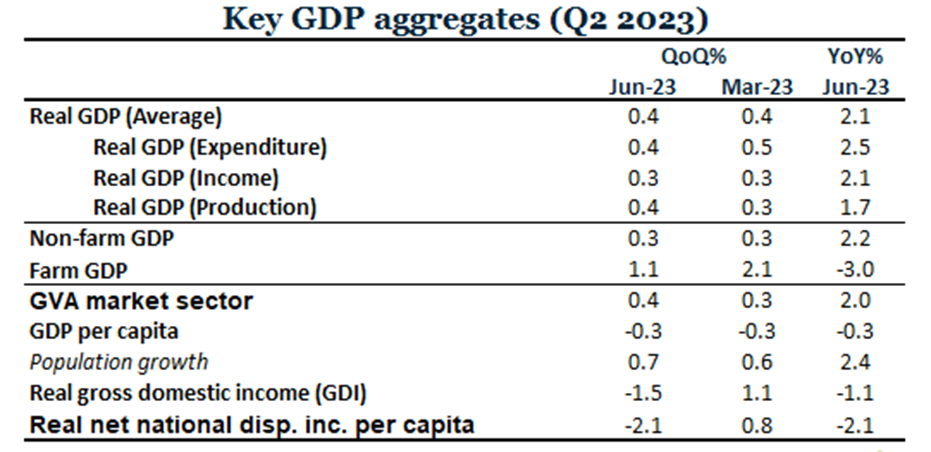

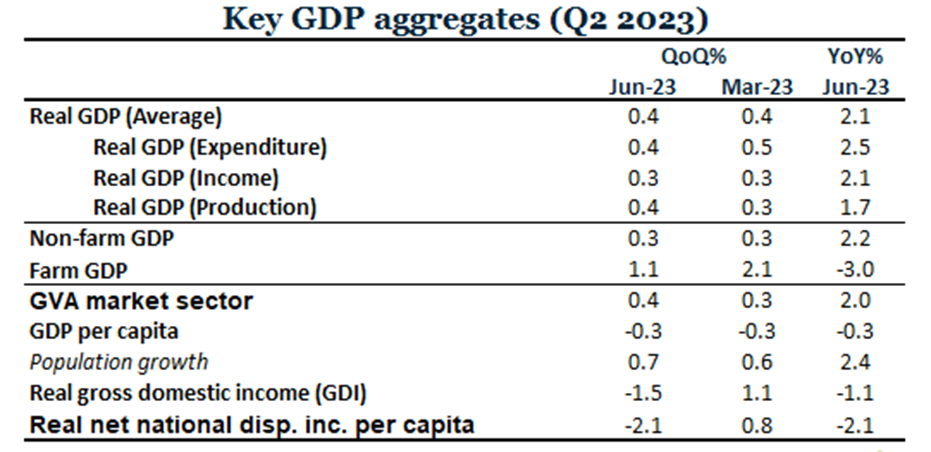

According to the data, the economy grew 0.4 per cent in the quarter (after an upwardly revised 0.4 per cent lift in the March quarter) for annual growth of 3.4 per cent. Looks good as it is well above the decade average of around 2.4 per cent.

Beyond the rosy figures

However, the economic growth figures (officially called the national accounts) were driven by our massive trade surpluses, as exporters continue to excel, and also strong investment figures.

Look behind those rosy figures and a different picture is emerging. Productivity is down sharply by 3.6 per cent for the year. The result was driven by solid exports and investment.

Source: RBA

And Australian households are tightening their spending belts and have almost used up all the savings they built during lockdowns. Household spending in the national accounts figures was up only 0.1 per cent for the quarter, and savings ratios are at a 15-year low – that’s how much higher interest rates are hurting.

Impact of immigration

While, on the surface, quarter economic growth looks solid, remember we have a massive immigration program underway. In fact, population growth added 0.7 per cent to the economic growth figures. That’s a huge impact and one we haven’t seen since 1974.

Take the impact of population growth out of the figures and, on a like-for-like basis, the economy contracted by 0.3 per cent; the second quarterly contraction in a row if you take out the population growth stimulus.

The definition of an economic recession is two consecutive quarters of negative economic growth. That’s why even though the economic growth figures look good they don’t feel good to average Australians.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.