I’m starting to get a lot of anecdotal evidence that the hot property market, particularly in Sydney, is cooling.

Last weekend the combined capitals auction market experienced its second busiest week of the year, with 3,562 homes taken to auction – up 8.2 per cent.

This week properties for sale are up again to 3,810. So, the spring selling season is certainly in full swing.

With lockdown restrictions having eased in Sydney, Melbourne and Canberra, auction volumes have increased by 79.4 per cent since the first week of October.

It is certainly testing the strength of the red-hot property markets.

Last week the preliminary clearance rate was 75.5 per cent, down from its recent peak of 84.4 per cent in the week ending 3 October.

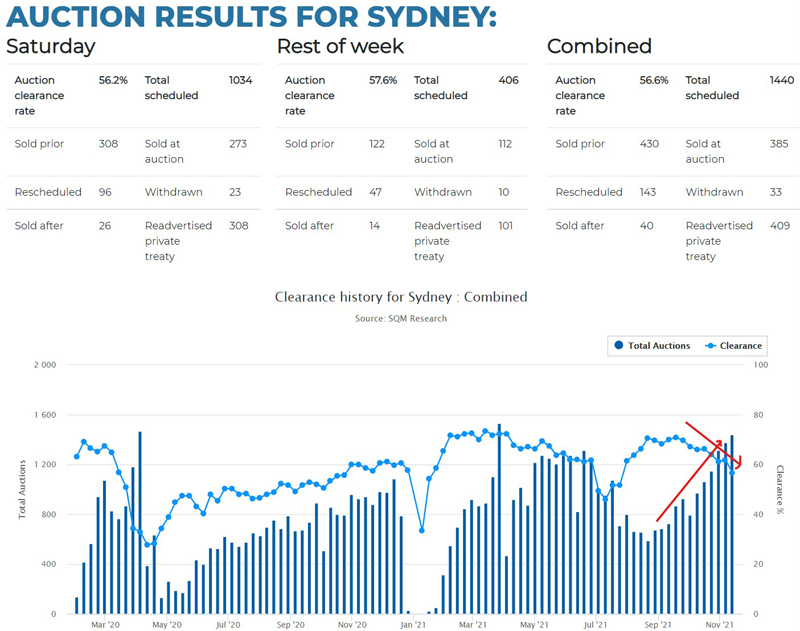

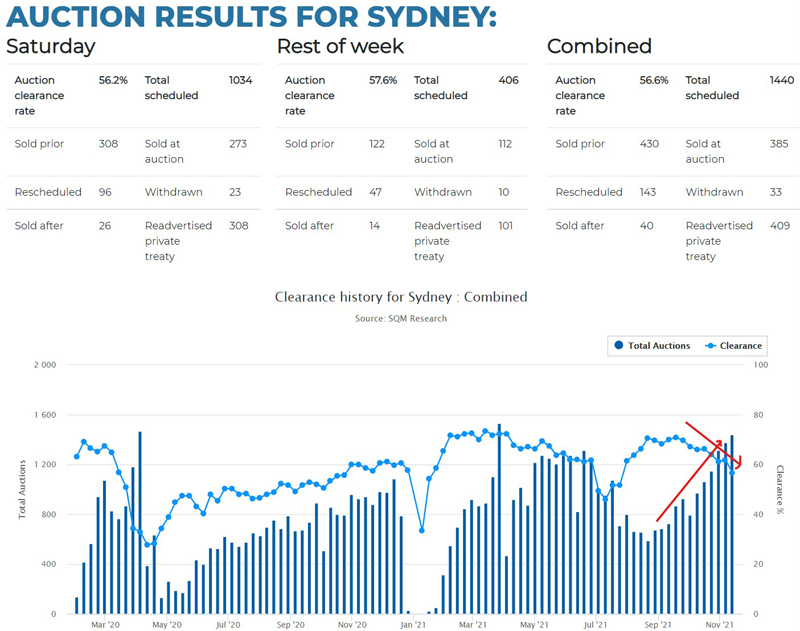

BUT, Sydney’s final actual housing auction clearance rate was back below 60 per cent. So SQM Research’s Louis Christopher says the trend is looking weak.

“Market[s are] tested by the weight of auctions. Keep in mind it is the spring selling season, so [there’s] some seasonality here. The scheduled volumes go up by another 50 properties this week,” says Louis.

I’m starting to get a lot of anecdotal evidence that the hot market, particularly in Sydney, is cooling.

Source: SMQ Research

Is fear of rising interest rates cooling the property market?

As you’ll see shortly, the banks are continuing to increase rates on fixed term home loans, and there is all the speculation the media about the RBA hiking official rates early.

So is this spooking buyers?

Sure, the cost of financing a property is a major consideration for buyers, but does it always deflate property values?

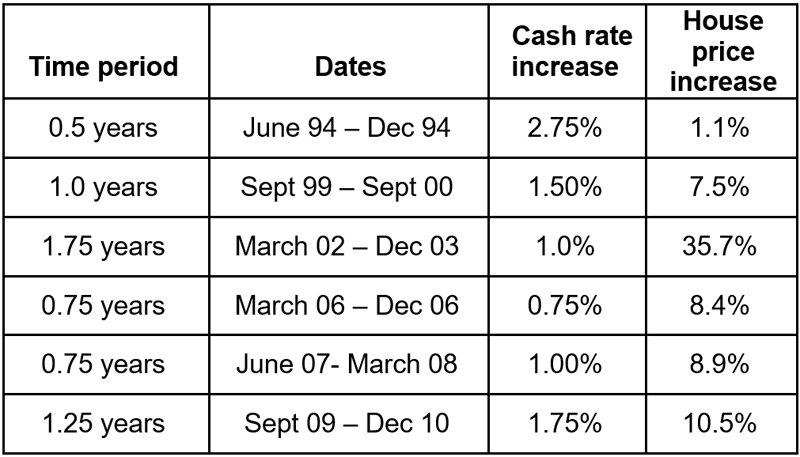

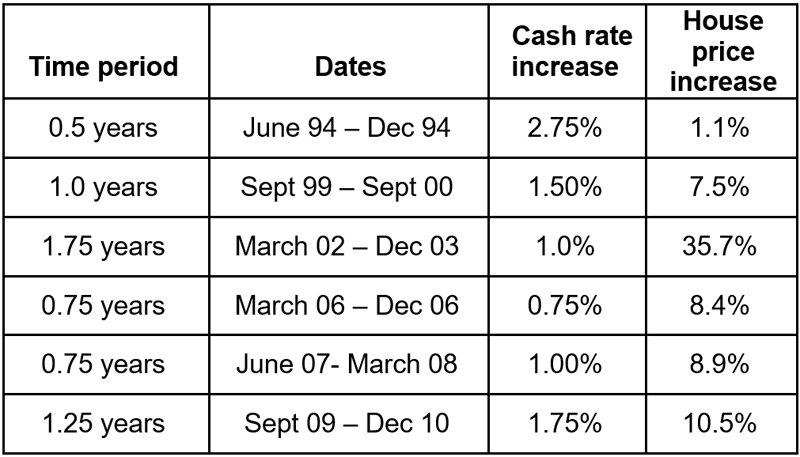

According to research from Property Investment Professionals of Australia (PIPA), history shows that interest rates do not force property markets into booms or busts. Rather, it’s often affordability, local economic conditions, consumer sentiment, or access to lending that does.

PIPA analysis of five periods of increasing cash rate movements since 1994 has shown that house prices continued to rise – sometimes significantly – even after rate rises of up to 2.75 per cent over just six months.

Cash rate rises and house price movements

Data source: RBA and ABS Residential Property Price Index

There are clearly a number of factors at play here, including some buyer hysteria. But one of the main reasons for our booming market conditions is easier access to credit. This was simply not the case two years ago when rates were also low.

Which means the APRA’s recently introduced tougher lending restrictions should further cool the property market.

Trending