Profit reporting season is in full swing and more economic data is emerging that suggests, as expected, inflation is starting to peak and the prospect of an economic recession is fading.

Look, this isn’t new if you’re a regular reader of Your Money & Your Life. I’ve been trying to calm the farm around all the recent financial hysteria for quite a while now. Based on facts rather than sentiment.

So let’s quickly run through the key points here. This is why I think things are looking pretty good and an economic recession isn’t likely to happen.

1. Inflation

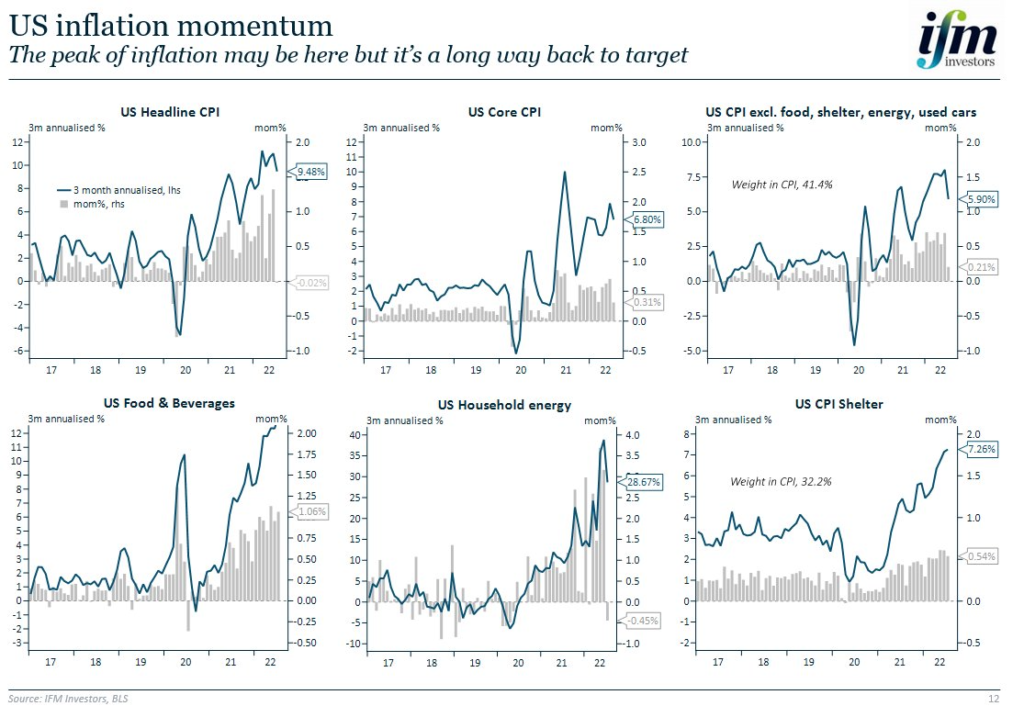

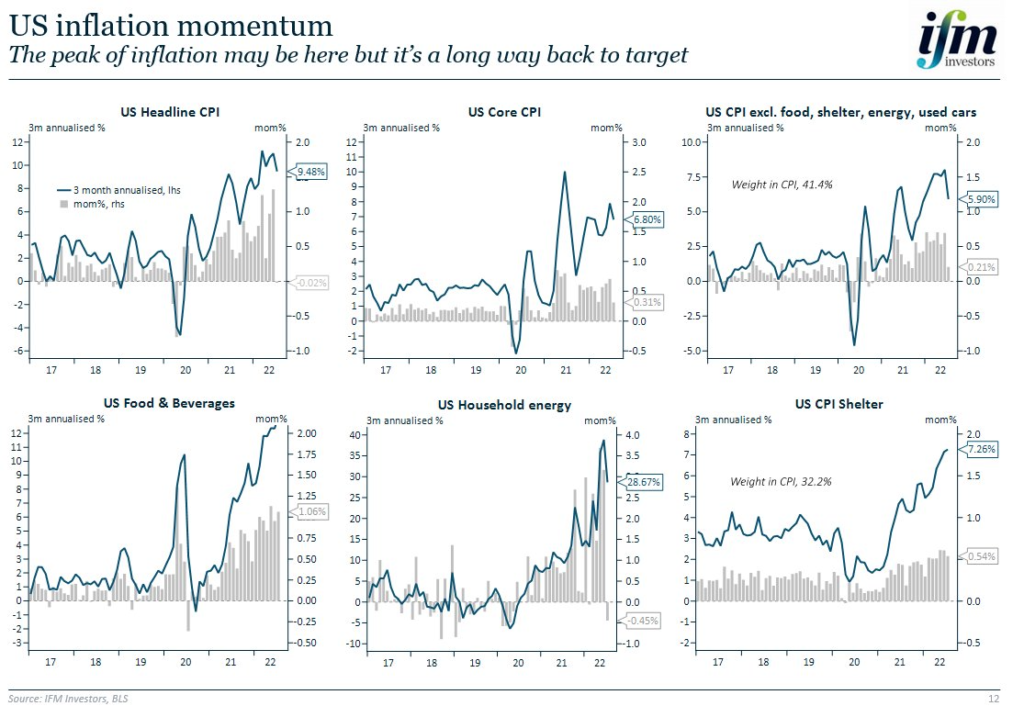

Financial markets were shocked this week when US inflation actually dropped. Leading the fall was an easing of the global oil price, which is an easy thing to follow. But it seems price increases more broadly are starting to slow, as evidenced by the graph below on US CPI excluding food, shelter, energy and used cars… it still turns down even when those volatile elements are taken out of the figures.

Food and housing prices are still rising rapidly, but there is an expectation they will start to ease as strong crop harvests and supply chains start to unclog for building materials.

As a lot of these reasons are global factors, they are expected to flow through to Australia and our inflation figures, which are now coming out monthly rather than quarterly.

The US sharemarket has had a strong week on the back of these inflation figures because slowing inflation eases pressure on Central Banks to raise official interest rates as high as expected. In fact, financial markets have revised their view on the next US rate rise down from 0.75 per cent to 0.5 per cent.

Source: IFM Investors

2. The CBA is feeling comfortable

I look forward to profit reporting season because I get to chat to the CEOs of our biggest companies who are at the coal face of how the economy is going. They see the effect through sales and consumer activity.

Commonwealth Bank is like the Bureau of Stats when it comes to knowing how consumers and business are feeling, acting and planning. The bank has more customers – and data on them – than any other company.

I chatted with CBA CEO, Matt Comyn, during the week and he had some fascinating perspectives:

- Matt reckons there is less than a 50 per cent chance of Australia falling into an economic recession as long as the Reserve Bank doesn’t overshoot on lifting interest rates. The bank is seeing inflation starting to ease and have a ceiling of 2.6 per cent for the official interest rate to rise (it’s now 1.85 per cent). If rates rise too much higher than that the chances of a recession rise as well.

- CBA is the nation’s biggest home lender and just 0.4 per cent of its home loans are under stress. Matt Comyn is confident most mortgage holders will be able to weather future rate rises… as long as they stay at that 2.6 per cent maximum.

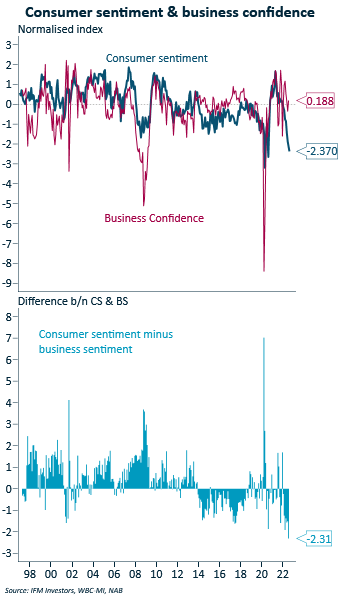

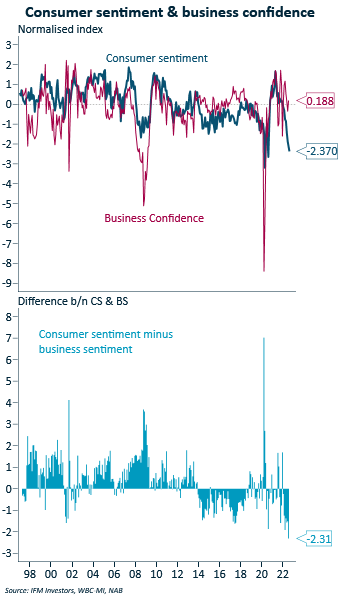

- The bank is seeing a big discrepancy between business and consumer sentiment. Consumers are starting to reduce their spending and go into the bunker on the back of inflation and rate rises. While business customers are a lot more confident and buoyant. That’s not surprising given the grim media headlines about the economy. As I’ve said before, it’s the media not the RBA that will send us into recession.

This graph explains the situation beautifully. Consumer sentiment has fallen off a cliff while business is still more optimistic. I am heartened this could turn around though. After the last official interest rate rise the media coverage was a lot more subdued… probably because the Commonwealth Games were distracting us.

Source: IFM Investors; WBC MI; NAB

3. These are a pretty good set of numbers

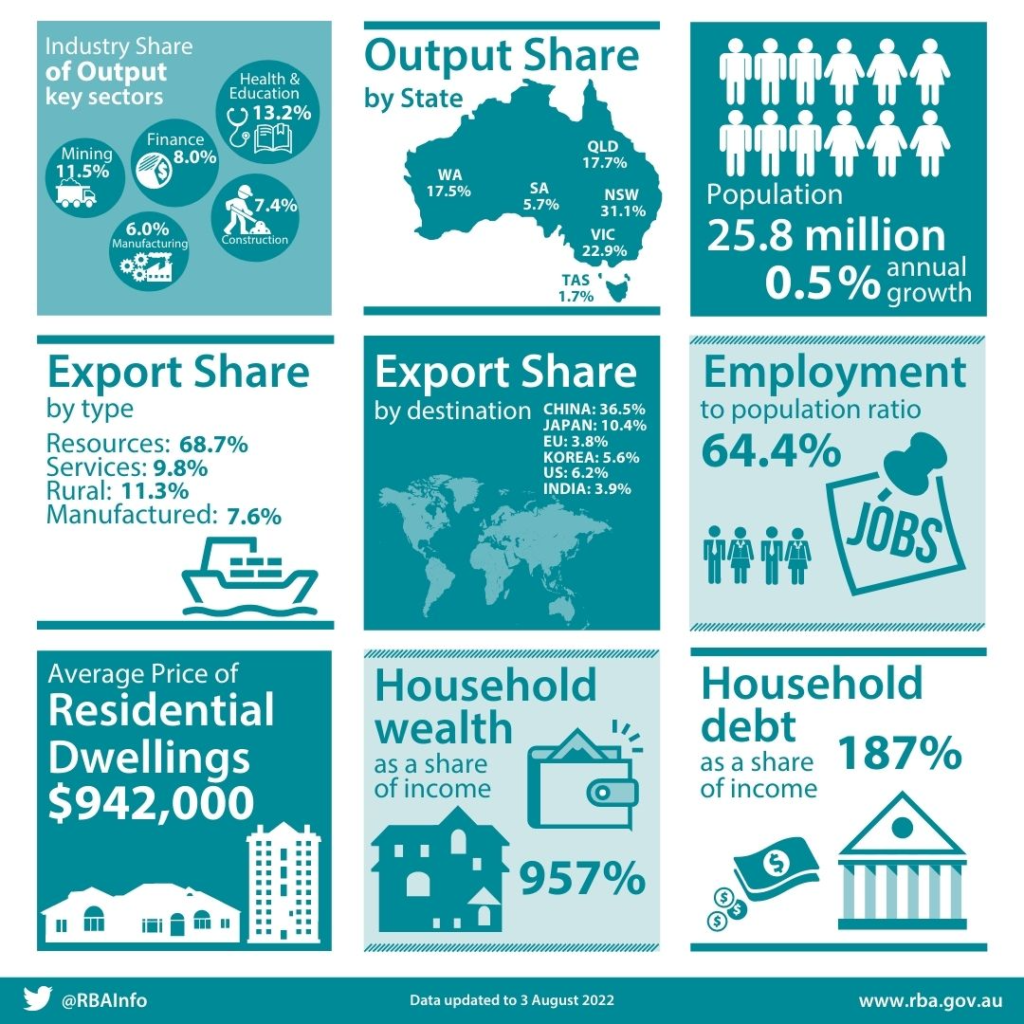

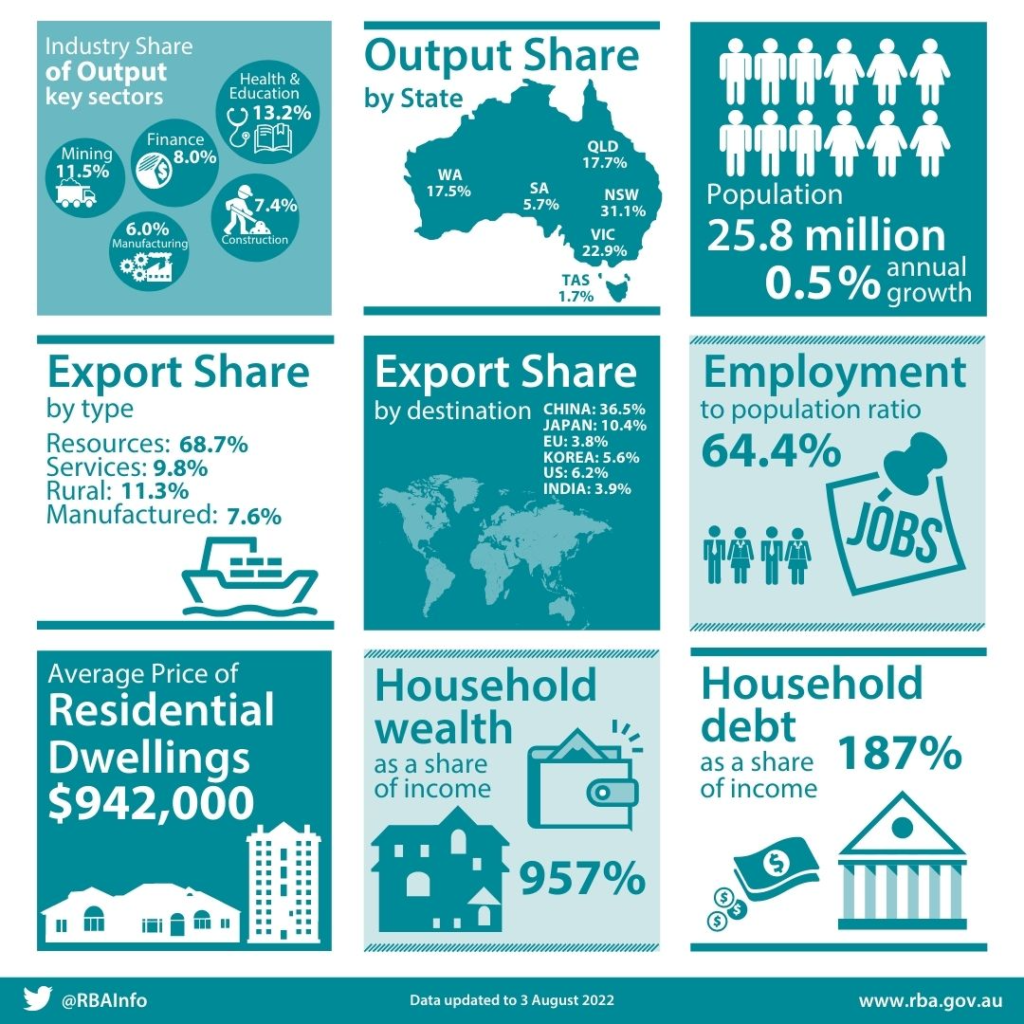

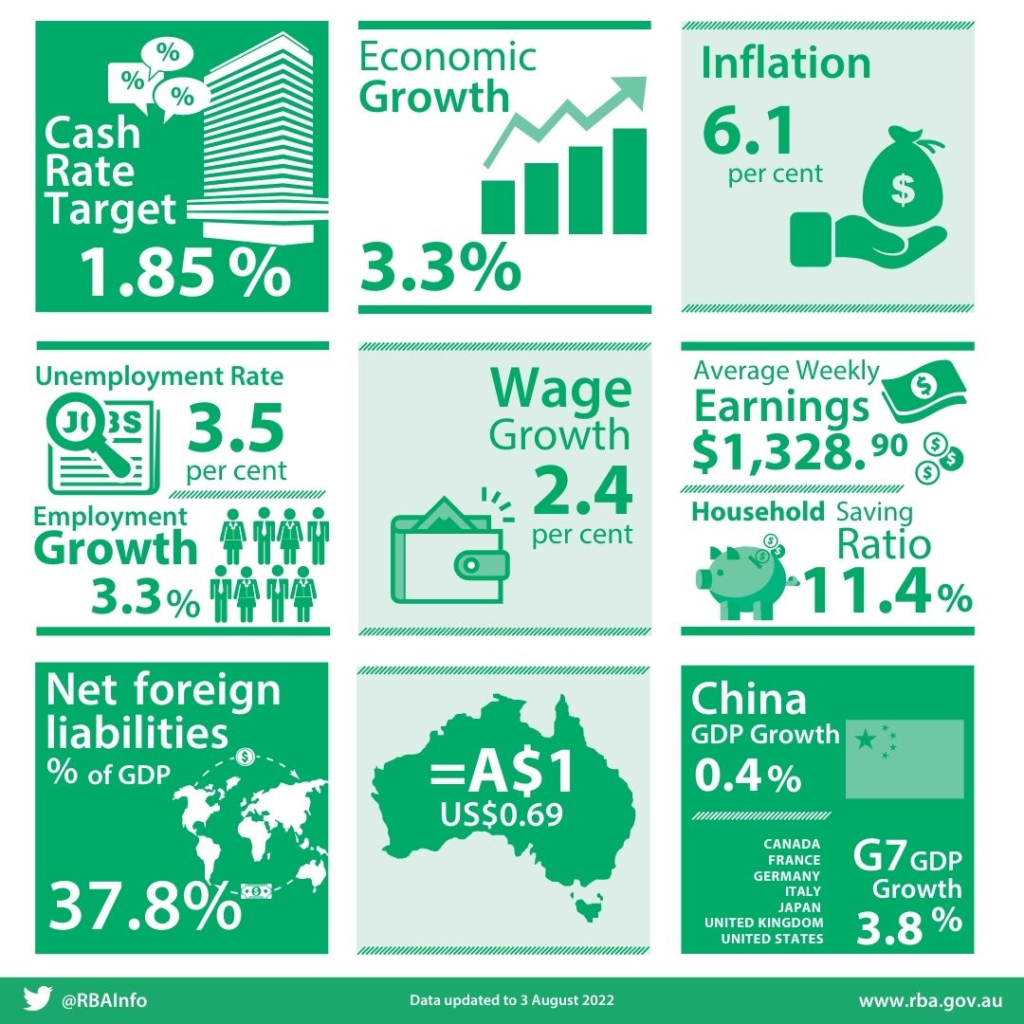

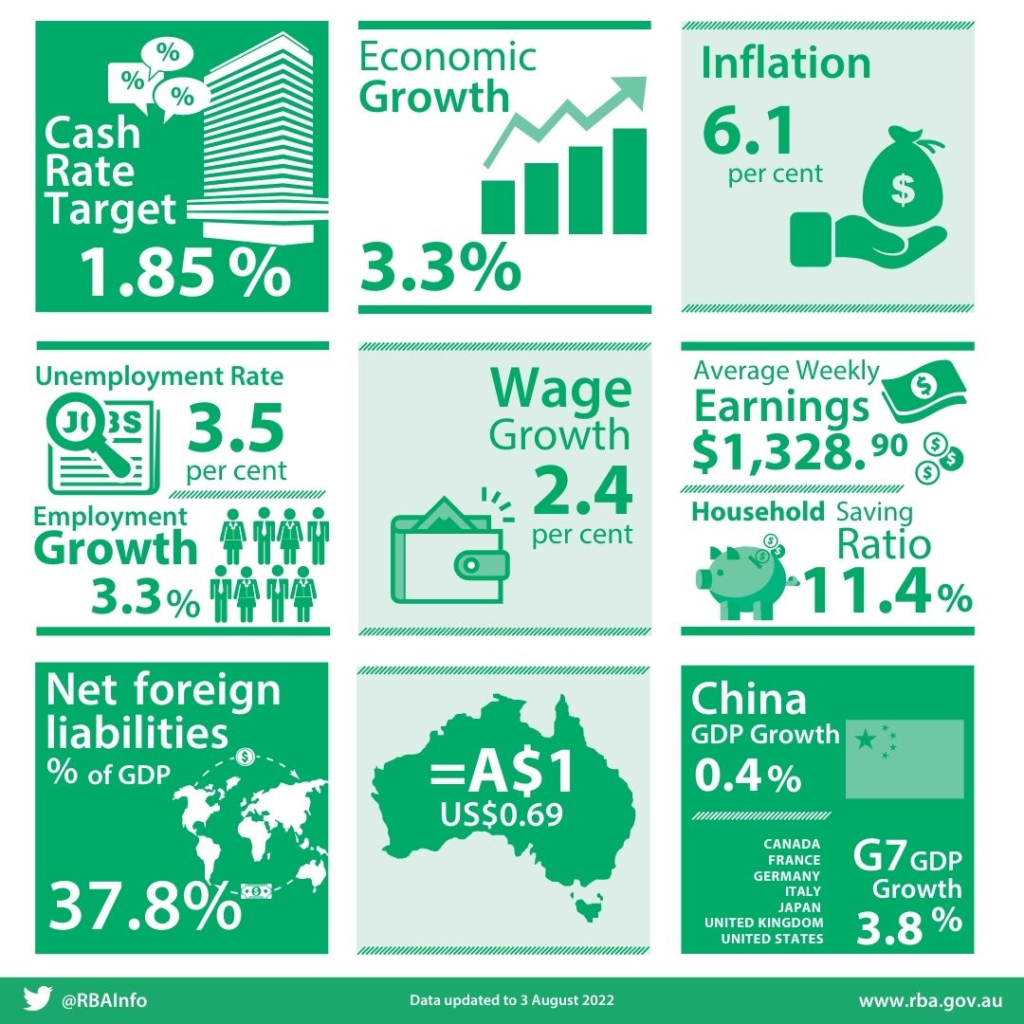

I reckon these economic summary snapshots from the Reserve Bank give a terrific big picture of how the economy is going. I know these are all backward-facing indicators, but they certainly don’t paint a picture of economic recession.

Source: RBA

Source: RBA

A couple of points to focus on:

- Unemployment at just 3.5 per cent. I don’t think there’s ever been a recession during full employment. The number of unemployed at the moment is matched by the number of job vacancies. The 64.4 per cent of adult Australians with a job (called the participation rate) is at record levels.

- The household savings ratio shows that Australians have a nice cash buffer stashed away for any tough times. This is reinforced by household wealth being a record 10 times higher than household income. Yes, household debt is high, but it is secured against a high level of assets.

- Exports continue to boom and China (despite all the political rhetoric) is still our biggest customer. Exports are being driven by commodities, which China will try and reduce their dependence on over the next decade. But we’re already preparing for that.

Trending

Sorry. No data so far.