I think we need the weekend to recover from the barrage of information we’ve received this week about the economy and Government stimulus.

It has been overwhelming and some of the numbers are downright scary.

But, keep it in perspective. Before I get into some of the detail can I make some big picture comments because some of the media commentary would have scared the pants off you.

Media attracts readers, viewers and listeners by spreading panic and drama. They do tend to overdo it a lot.

So what do I think you can take out of all the data this week?

– the Australian economy is one of the best positioned in the world to cope with this economic recession. The International Monetary Fund says we are way better off than most other industrialised economies.

– there is nothing wrong with a Federal Budget deficit… don’t get fixated on budget surpluses. Government’s must spend more than they earn during an economic crisis like now because they need to keep people in jobs and help business survive.

– why? Because economic recessions and high unemployment destroys families and lives. You don’t wish that on anyone. So Government’s spend money on economic stimulus measures (like JobKeeper and JobSeeker) to put in people’s pockets to spend in businesses which then employ people.

– the aim is to keep people working and businesses operating because the economic recovery will be built on people working… and paying taxes, and businesses making profits… and paying taxes.

. the budget deficit last financial year and this financial year will be the biggest since the end of World War 2. That’s appropriate because the economic impact of the Coronavirus is on a similar scale to a war.

– Government debt will obviously rise to pay for these budget deficits. Gross debt will be equivalent to 45 per cent of the total value of the Australian economy and net debt 35 per cent. Again, that’s among the lowest levels of Government debt in the world.

– the Government is paying less than 1 per cent interest on the money it is borrowing. So while it’s borrowing a lot, it’s not paying much in interest.

Bottom line; the economic recession is going to be really bad so the Government has an obligation to spend as much as possible to keep Australians in jobs and businesses afloat. And the country’s finances are in good shape to support the initiatives which will, hopefully, see a quicker and stronger economic recovery.

What’s ahead for the economy

Remember these are all estimates from the Government. They are conservative and, I dare say, hopefully a worst case scenario so the Government can claim they are good economic managers in the lead up to the next election. That’s politics… or am I a cynic?

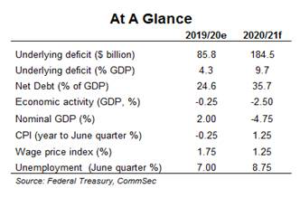

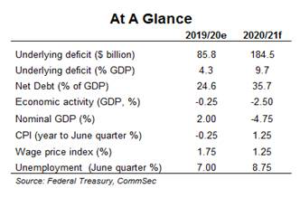

Anyway here’s the snapshot of the economic update;

Economic Contraction; the sharpest fall on record in the June quarter but expected to pick up in this September quarter with the easing of restrictions in most parts of the country. On an annual basis the economy is expected to contract 0.25 per cent in the last financial year and 2.5 per cent this financial year.

In the June quarter, the economy is expected to have experienced its largest quarterly fall on record of 7 per cent. Economic activity is expected to pick up in the September quarter, by 1½ per cent.

Unemployment rate; forecast to peak at around 9.25 per cent in the December quarter 2020. It is expected to gradually decline from the start of 2021 to be around 8.75 per cent in the June quarter 2021. Remember people on JobKeeper are not classed as unemployed even though they may not be working. So the “effective” unemployment rate is really around 15 per cent.

Budget deficit; in 2019-20 is now expected to be $85.8 billion (4.3 per cent of GDP). The estimates for 2020-21 have also been revised down significantly, with an expected deficit of $184.5 billion (9.7 per cent of GDP).

Gross Government debt; was $684.3 billion (34.4 per cent of GDP) at 30 June 2020 and is expected to be $851.9 billion (45.0 per cent of GDP) at 30 June 2021. Net debt is expected to be $488.2 billion (24.6 per cent of GDP) at 30 June 2020 and increase to $677.1 billion (35.7 per cent of GDP) at 30 June 2021.

You would have heard a lot about “V” or “U” or “W” shaped rebounds for the economy after the worst of this pandemic is over.

This chart from the Government’s economic update tends to point to “V” recovery… big plunge followed by a big recovery. But unemployment always takes longer to improve.

I’ve shown this chart before but it, again, illustrates that Australia’s Government debt levels were in much better shape going into this economic crisis than that of most other countries. This chart is from the last Reserve Bank board meeting.

And while Government Debt is rising significantly… it’s paying less than 1 per cent interest on the borrowings

I mentioned this a couple of weeks ago and few people didn’t believe me. So here’s the proof.

This is the summary of this week’s auction of $2 billion in Treasury Bonds which will mature in 2029.

You can see 42 investors (big overseas financial institutions or governments) made bids for the Treasury bonds with interest rate offers of between 0.8625 per cent to 0.83 per cent. While only $2 billion of bonds were put on offer, the investors wanted $6.245 billion worth… so there was no shortage of offers.

The reason why the Australian Government can pay less than 1 per cent interest on borrowings is because of our Triple-A credit rating. To the global financial world we are a rock solid investment.

Trending