Hi everyone… and to all those in Victoria, hang in there the whole country is supporting you and sending our love.

End of another week and more information coming out about the economic damage from the Coronavirus pandemic.

. Last night the US economic figures were released showing an 8 per cent contraction in the world’s biggest economy for the June quarter. Now a lot of the headlines are saying the economy contracted 33 per cent… that’s because the Americans have this quaint custom of multiplying the quarterly figure by 4 for an annual result.

But, as we all know, economies are opening back up and the September quarter US result will not be nearly as bad and could be close to a growth figure. So while the June quarter is bad, that 33 per cent contraction doesn’t really reflect reality.

So we’ve had 8 per cent contraction from the US in the June quarter (the worst since World War 2) which is a 9.8 per cent contraction quarter-on-quarter and a 10.1 per cent q-o-q contraction in Germany. So if Treasury’s prediction of a 7 per cent q-o-q contraction of the Australian economy is right then we’re pretty well by comparison.

But the experts are not expecting a quick rebound. Ratings agency Fitch reckons growth levels in the world’s largest advanced economies will remain subdued for at least the next five years following the impact of the 2020 coronavirus recession.

They say economic growth could remain around three-to-four per cent below their pre-virus trend until the middle of this decade.

Fitch said it expects a rise in long-term unemployment in the aftermath of the shock, with many workers in COVID-affected industries to struggle to find re-employment quickly.

. This week our Consumer Price Index… the main measure of inflation in Australia… fell 1.9 per cent in the June quarter. It was the biggest ever quarterly fall for the CPI (since 1948).

The last time we had Deflation when consumer prices fell as much was in September quarter 1931 during the Great Depression.

Deflation wreaks economies but thankfully this looks like a one off and the CPI in this current September quarter is expected to rise by 1.4 per cent.

The reason the last quarter CPI went backwards was because child care costs dropped by 95 per cent (because of the Government’s one off free child care program which has now ended), falling petrol prices (because of the oil price crash in April… remember when it went negative for a day) and rents dropping 1.3 per cent (that look as though it will continue).

The most significant price rises in the June quarter were tobacco (+2.7 per cent), other non-durable household products (+4.5 per cent) and furniture (+3.8 per cent).

Naturally we’re going into the bunker

Everything is so uncertain at the moment so it’s understandable most of us staying pretty cautious.

Consumer insight company J.D. Power has done a new survey to understand the financial implications of the current stage of the COVID-19 pandemic in Australia.

Key findings are;

. the effect of COVID-19 on personal finances has worsened: 39 per cent say the worst is yet to come compared with 35 per cent two months ago

. 25 per cent say their personal financial situation has been either devastated or severely hurt as a result of social restrictions, and 67 per cent have been negatively affected across all income bands

. 8 per cent of Australians say they will delay retirements; 12 per cent for those aged 60 and over

. 22 per cent are delaying the purchase of a car, 19 per cent are delaying a home renovation and 17 per cent are delaying the purchase of a home.

. 67 per cent of Australians support extending JobKeeper and JobSeeker.

. 13 per cent of Australian adults have applied for early access to super, with 16 per cent of those aged 45 – 59.

Speaking of Superannuation… most people who have withdrawn money have done it wisely

This week the Treasury revised its estimate about how much money will be withdrawn from the super system under the early release scheme from $29.5bn to $41.9bn.

This equates to about 1.5 per cent of the $2.7 trillion invested in superannuation and about 2.6 million Australians taking advantage of the $20,000 total withdrawal under the early release scheme.

The superannuation industry has naturally been opposed to the scheme saying Australians would just squander the money and their retirement payouts will be hit hard.

But the squandering allegation does not seem to be true.

Interestingly Government analysis of banking sector data shows the “vast majority” of the early release payments are being saved, placed in offset accounts to reduce mortgage interest payments or put towards debt repayment.

About 58 per cent of early release payments are classified as “saved/unspent” and remain in workers’ accounts.

Almost 60 per cent of those accessing their super early have used it or plan to use it to meet essential day-to-day expenses, including paying down debts, with another 36 per cent adding the money to their savings.

Savings rates fall even further… terrible returns

Savings rates continue to tumble, despite no move to the reserve Bank’s cash rate. NAB the most recent big four bank to cut its rates by up to 0.10 per cent.

Australia’s fifth largest bank, ING, also dropped the maximum rate on its popular Savings Maximiser account, while CBA has cut the bonus rate on its GoalSaver for balances over $50,000.

NAB iSaver: introductory rate cut by 0.10% to 0.95% (first 4 mths). Ongoing rate unchanged at 0.05%

NAB Reward Saver: bonus rate cut by 0.10%. Max rate is now 0.90%.

ING Savings Maximiser: max rate cut by 0.15%. Max rate is now 1.65%

CBA GoalSaver: max rate cut by 0.05% for balances over $50K.

Analysis of the RateCity.com.au database shows that 64 per cent of banks have cut at least one savings rate in the last two months, despite no move to the cash rate since March.

The exception is Westpac offering 3 per cent on balances of up to $30,000 for anyone aged between 18 and 29.

Highest ongoing savings rates on the RateCity.com.au database:

| Bank | Max rate | Base rate | Conditions for max rate | ||||

| Australian Unity | 1.75% | 0.25% | Deposit $250+/mth and no withdrawals. | ||||

| MyState Bank | 1.75% | 0.15% | Deposit $20+/mth and make 5+ purchases in linked account. | ||||

| 86 400 | 1.70% | 0.25% | Deposit $1k+/mth in linked account |

Big four banks: highest ongoing savings rates

| Bank | Product | Base rate | Max rate | Conditions | |||||

| CBA | Goal Saver | 0.10% | 0.50% | Deposit $200+/mth, no withdrawals. | |||||

| Westpac | Life (30 and over)

Life (ages 18 to 29) |

0.40%

0.40% |

1.00%

3.00% |

Balance needs to be higher every mth* | |||||

| NAB | Reward Saver | 0.05% | 0.90% | 1+ deposit and no withdrawals per mth | |||||

| ANZ | Progress Saver | 0.01% | 0.85% | Deposit $10+/mth, no withdrawals |

Note: based on a balance of less than $50K. CBA has higher rates for higher balances. For the Westpac Life account for 18-29 year olds you also need to make 5+ transactions on a linked transaction account.

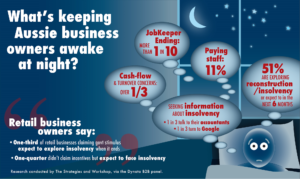

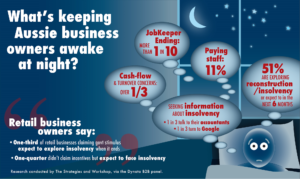

What’s keeping small business owners awake at night

Cashflow issues… not JobKeeper… is what’s keeping Aussie business owners awake at night, according to new research from national business recovery and insolvency firmJirsch Sutherland… and many businesses are either already exploring insolvency or expect to in the next six months.

The survey of over 1000 business owners/directors identified the key sources of current stress. Just 10 per cent of respondents said JobKeeper ending was their primary concern. More than a third (36 per cent) cited cashflow and turnover as the key causes of their stress. West Australian directors are most worried about cashflow while NSW directors are the least worried.

But small business remains optimistic

Small-business accounting platform, Xero (XRO), has found Australian small businesses are optimistic about the outlook for the remainder of 2020 despite the difficult economic conditions at present.

Xero MD, Trent Innes, attributes this to Australian small businesses being “inherently optimistic” with “green shoots coming through”.

One in 10 small businesses reported they actually grew during this time, so it’s definitely not all doom and gloom, and there are some parts of the economy that are growing.

For example, between March and May demand for web developers went up 217 per cent as business looked to going online and also connecting with staff working remotely.

Not surprisingly, arts, recreation and hospitality were the sectors worst hit by the lockdowns.

Once in a lifetime reporting season

Forecasting the path of the global economic recovery is the biggest challenge in forecasting the direction of sharemarkets over the next six to 12 months according to Head of Australian Equities Research at JP Morgan, Jason Steed.

“I think we will have to get used to the idea that there is going to be this rolling negative news flow around a second wave,” he says. “The question is how quickly it can be contained.

“That’s really crucial to growth for the remainder of calendar 2020, which is obviously critical when we look into fiscal ’21… The second wave, sadly, is a reality but I think the action that has been taken is going to give us some pathway through to the recovery.”

Jason says he has lowered his economic growth/contraction forecast, with the question becoming, to what extent can the economy recover that lost output?

“Our forecast is certainly down to account for the Melbourne lockdown. We stated [Melbourne accounts for] about 20% of national GDP and then if you’re shut for six to eight weeks, the math suggest that’s 30 to 40 basis points off GDP.”

Jason adds that his forecast accounts for a pick up in activity once the lockdown is lifted, which partially offsets the drop.

He says that with the AUD driven up by a high iron ore price and the fact that it’s a ‘risk-on’ currency, it has “put a bit of a brake on those companies that sit within the offshore-earner bucket”.

“For long period of time, those companies, whether it be CSL, Brambles, Resmed, James Hardie etc they have had this benefit of a long drawn-out decline in the Aussie dollar over a multi-year period.

“That being said, when we look back over time, the average dollar rate is not that different this year so far as compared to last year… clearly, however, if we were to see the dollar continue to rise and push back into the mid seventies, even up towards US80 cents, that changes the picture somewhat.”

“The question is whether they can maintain these high-levels of sales growth.”

Trending