Going guarantor on your child’s loan is a family minefield for so many reasons. I generally don’t recommend it, but if you have to do it, be cautious.

Australian parents are incredibly generous when it comes to supporting their adult children. I agree, we should be supporting them EXCEPT if it puts our finances, our retirement or our lifestyle in jeopardy.

The Bank of Mum and Dad must have a limit. Which is why talk of home loan borrowers getting into trouble worries me. Consider this:

- Guarantor loans jumped over 70 per cent across Australia in six years. The Bank of Mum and Dad (BOMD) is now the ninth biggest lender in Australia at around $35 billion of outstanding loans.

- Average contribution from Mum and Dad is $134,000.

- Roughly 30 per cent of Aussie parents help their kids buy a home… and close to 70 per cent don’t expect to be repaid for their contribution.

- Two thirds of the recipients of BOMD funding are currently concerned about their ability to meet repayments in the rising interest rate environment.

This last bit worries me. If you’ve gone guarantor for your child’s home loan and they get into trouble with their lender they will come for you first. That’s because generally you have more assets to sell if there’s a shortfall.

Often the only options parents have is to dip into their own savings, cut back on expenses, sell assets, delay retirement, or borrow equity out of their own home. Or a combination of all of these.

Not only is there a financial hit but there are also the emotional consequences of financial hardship, a strained relationship with the child involved and the reaction of other children seeing their inheritance being lost.

It can be a family minefield.

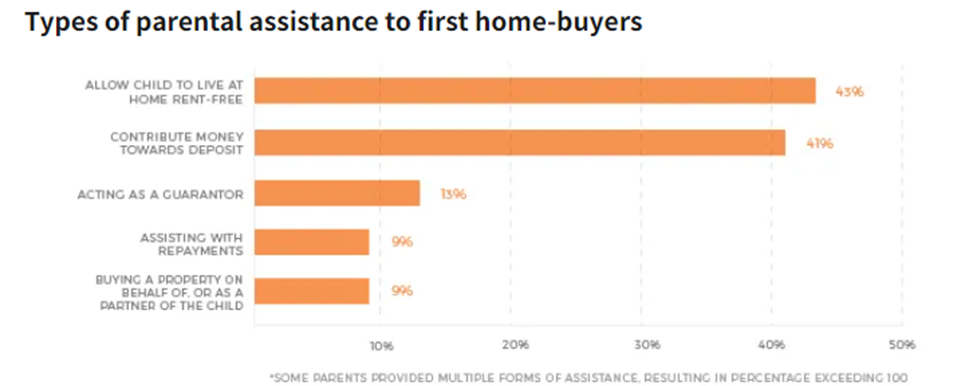

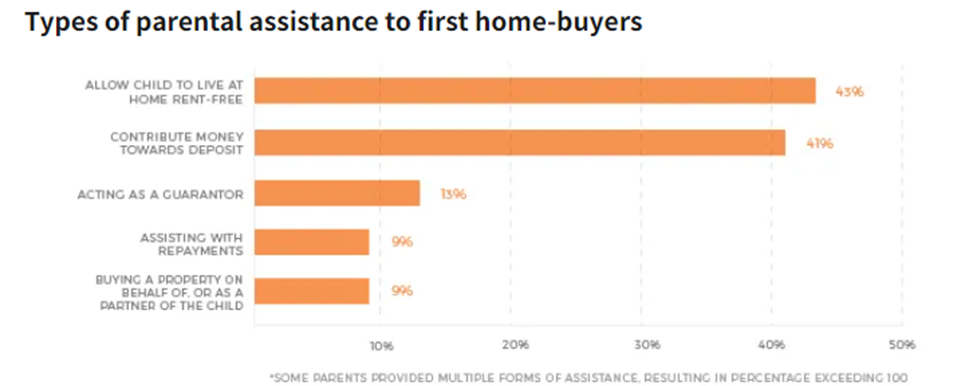

How parent’s support their child’s loan

The majority of parents contributing to their child’s first home buyer loan allow them to live at home, rent free. This helps the child increase savings towards the purchase. Bear in mind that having your child remain at (or even return) home needs careful discussion. Some questions to ask are:

- What are the expectations for family time and privacy?

- Who will be responsible for what around the home?

- Will your child pay board or contribute financially in other ways?

Source: Mozo.com.au

A huge 41 per cent of parents financially contribute towards their child’s home loan with 13 per cent acting as guarantor. I’ve written before about how perilous going guarantor can be. I urge you to read this before you even consider: Why you should be careful when going guarantor for a loved one.

Take steps to protect yourself

If you do want to help the kids, I believe there are some key steps to take before committing:

- Review your own expenses and make sure you can comfortably afford to assist while still maintaining your lifestyle.

- Never give, or guarantee, more than what you can comfortably afford to lose.

- Put it all in writing. Contracts are important for those giving more or guaranteeing large amounts.

- Set out your expectations, terms, repayment schedules (if any) and ownership stake.

- Determine whether it is a handout or a loan as this can affect the age pension asset test.

- If you are going guarantor, make sure it is a limited guarantee and not an open ended guarantee.

Alternatively, toughen them up

I wrote here about a controversial alternative for some, but one that I stand by: tell your kids that they have to suck it up and go it on their own.

There’s no doubt that it’s much harder to buy your first home in today’s economy. But as parents, we paid a whopping 17 percent interest, went without the flashy cars or gadgets and put overseas travel to the side until we built a stable financial foundation for ourselves.

And there are plenty of millennials doing it the same way today… it can be done.

Sometimes, making sure your kids know there isn’t any help coming can be the greatest help you’ll ever give them.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending