This week gave us some critical economic signposts. The RBA decided to keep interest rates on hold and the latest economic growth figures were pretty anaemic – without the impact of migration the economy would be in recession.

As expected, at their meeting on Tuesday, the RBA Board decided to keep interest rates on hold at 4.35 per cent… but they still aren’t convinced inflation is under control and are ready to lift rates again. The Board won’t meet again until the first Tuesday in February, which is the week after the December quarter CPI is released.

As I said last week, the December quarter CPI announcement on 31 January is so crucial to interest rates next year.

While Tuesday’s rate pause was expected, the accompanying statement from RBA Governor Michele Bullock had a lot to say.

She noted, “the monthly CPI indicator for October suggested that inflation is continuing to moderate, driven by the goods sector; the inflation update did not, however, provide much more information on services inflation”.

The Board’s concerns on inflation at this juncture are centred around the services side of the economy… all services, not just dentists and hairdressers, which Bullock recently referred to when making the point.

In terms of wages, the Governor said, “wages growth picked up in the September quarter, but this was expected given that it captured the earlier Fair Work Commission decision on award wages.”

The rest of the Governor’s statement simply stuck to the script of the November statement.

Economic growth figures weaker than expected

The September quarter economic growth figures this week came in much weaker than expected… 0.2 per cent over the quarter against an expected 0.5 per cent. For the year, economic growth was 2.1 per cent. Probably best described as sputtering along.

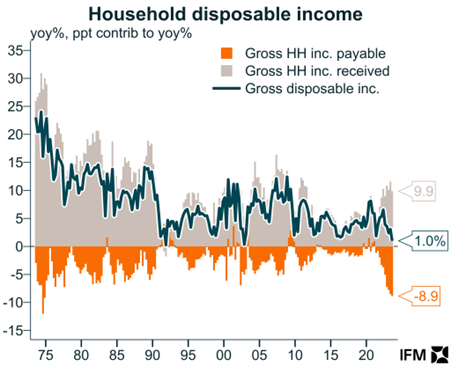

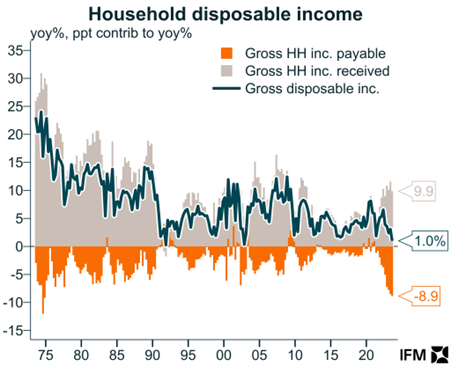

Migration levels are propping up the economy as household consumption is being squeezed by a huge increase in interest payments strangling disposable income.

Source: IFM Investors

Over the last four quarters, the economy is steadily slowing — the December quarter last year had growth at 0.9 per cent, 0.5 per cent for the March quarter, 0.4 per cent in the June quarter and now 0.2 per cent.

The six‑month annualised pace of GDP growth to the September quarter has slumped to just 1.3 per cent. In reality, the economy has gone backwards in per capita terms a lot over the past six months.

Looking at the bigger picture, growth in real consumer spending has slowed materially over the past year, given the squeeze on real household disposable income.

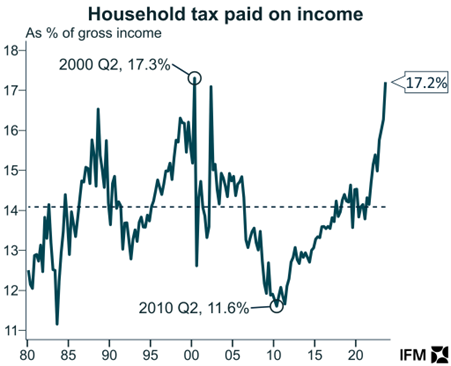

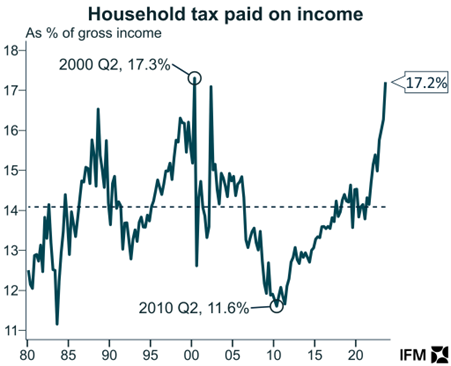

Which has also been hit by a record amount of tax we’re paying to the federal government.

Source: IFM Investors

Household spending is down and savings rates are hitting rock bottom.

Job market down and inflation up

Other past worries for the RBA have been the strength of the job market and inflation. But this week:

-

The ANZ-Indeed Australian job advertisements index fell 4.6 per cent in November, down for a third straight month. It was the steepest monthly decline in advertisements since the height of the pandemic in May 2020. The index is at the lowest level since October 2021, with ads down 16.8 per cent on a year ago. The biggest falls were in NSW and Victoria.

-

The Melbourne Institute Monthly Inflation Gauge rose by 0.3 per cent in November, driven by holiday travel & accommodation (up 2.9 per cent) and new dwellings costs (up 1.2 per cent), offsetting price declines across furniture and food. But the annual growth rate eased from 5.1 per cent in October to 4.4 per cent in November… the slowest pace in 19 months.

Complicating matters is the continued resilience of Australia’s housing market. In data released by the Bureau of Statistics the value of new owner-occupier home loans jumped 5.6 per cent in October 2023, the most since November 2021. And housing finance approvals to investors rose by 5 per cent, the biggest lift in five months.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.