The US central bank has made a major pivot away from talking tough about further interest rises and is now openly hinting at interest cuts in 2024.

On Thursday morning our time the Federal Reserve Bank kept US interest rates on hold as expected, but then said they were expecting to cut rates 0.75 per cent over 2024 if inflation kept trending down as expected. It was reinforced by Fed chair Jerome Powell at a press conference after the announcement.

Naturally the pivot sent financial markets into a spin. Sharemarkets leapt higher, bond yields dropped.

At the start of the year there were dire predictions of a major economic recession in the US, which simply hasn’t eventuated. The Fed has done a great job in bringing down inflation, keeping Americans in jobs and engineering a soft economic landing.

When will Australia follow?

Naturally, when the US starts hinting at interest rate cuts Australians gets excited about when we will follow. Pessimistic economists say not until 2025 while more optimistic economists are predicting cuts to starts from the middle of next year.

Given the way this year has panned out, you’d have to lean towards the optimists. But as I’ve been saying, 31 January, when the December quarter CPI figure is announced, is for me the crucial day and data point which will bring some clarity on rate cuts.

If December quarter CPI comes in below expectations, rate cuts shouldn’t be that far away. If the figure is above expectations, we’ll need to wait a bit longer.

It’s worth noting the impact of rate increases in Australia is a lot more severe than in the US because most Australians are on variable mortgages and feel the effects of a rate increase immediately. In the US, home owners are on fixed rate mortgages so the pain is delayed or not felt at all.

Consumers taking a conservative view from the bunker

Without stating the bleeding obvious, Australian consumers are feeling the pinch from rising interest rates and high inflation. They’re reigning in spending and being very cautious.

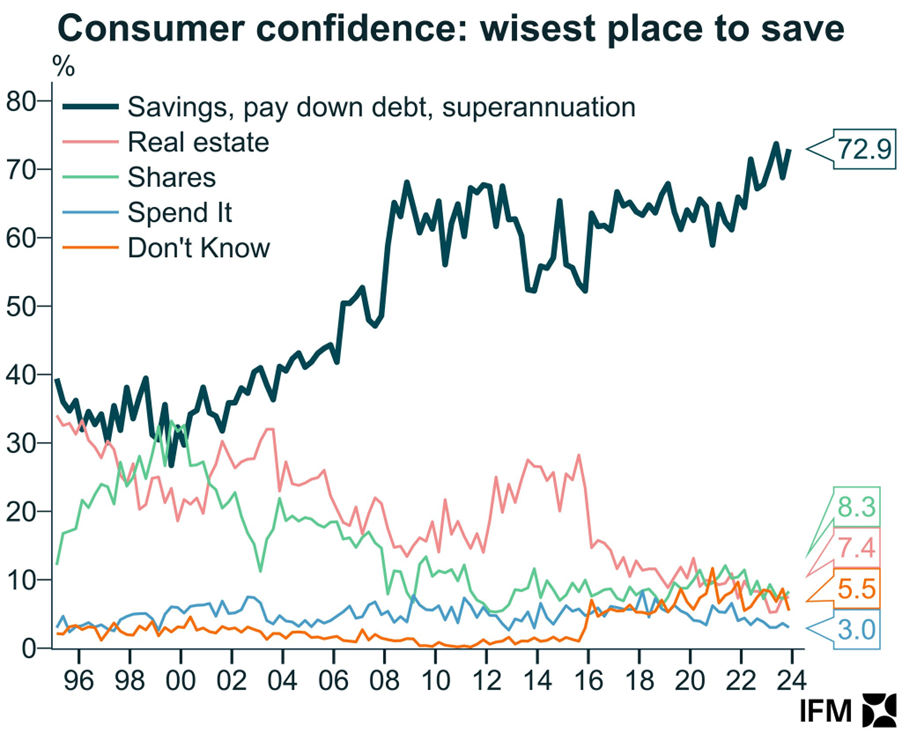

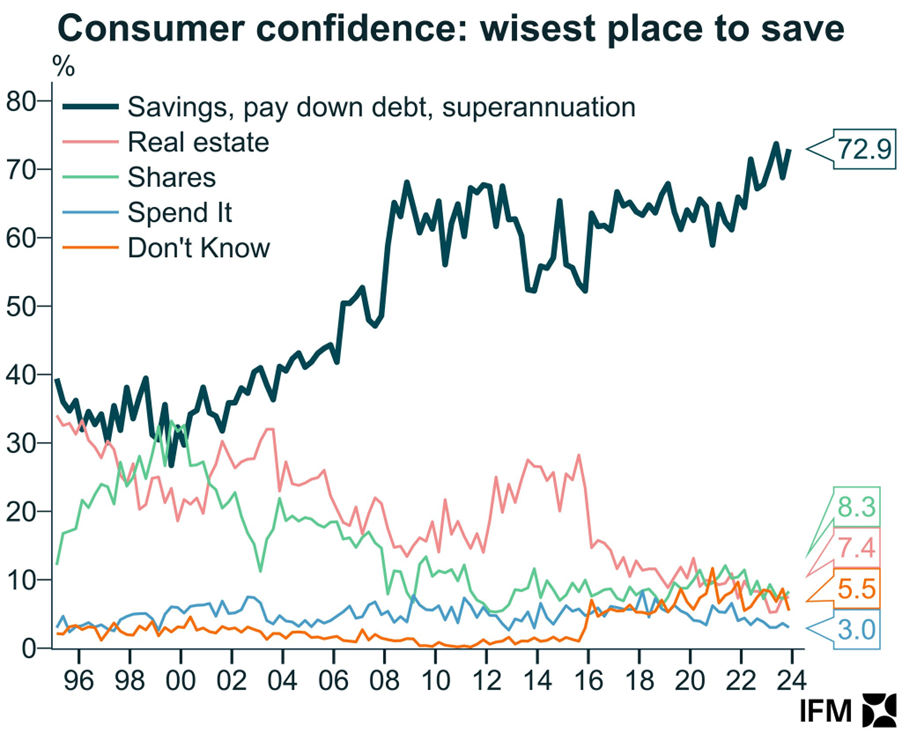

You can’t argue that there is a need for caution. That’s why I always follow one question in the consumer confidence figures: “where is the wisest place to save?” I reckon it says everything about how we’re feeling.

Look at this, a record number of Australians believe the wisest place to save is “savings, pay down debt, superannuation”. Can’t argue with that.

Source: IFM Investors

Investing in shares is now higher than in property.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Evidence is mounting of a recession here – but why not in the US?

Trending

Sorry. No data so far.