Evidence is mounting of an economic recession here… but not in the US.

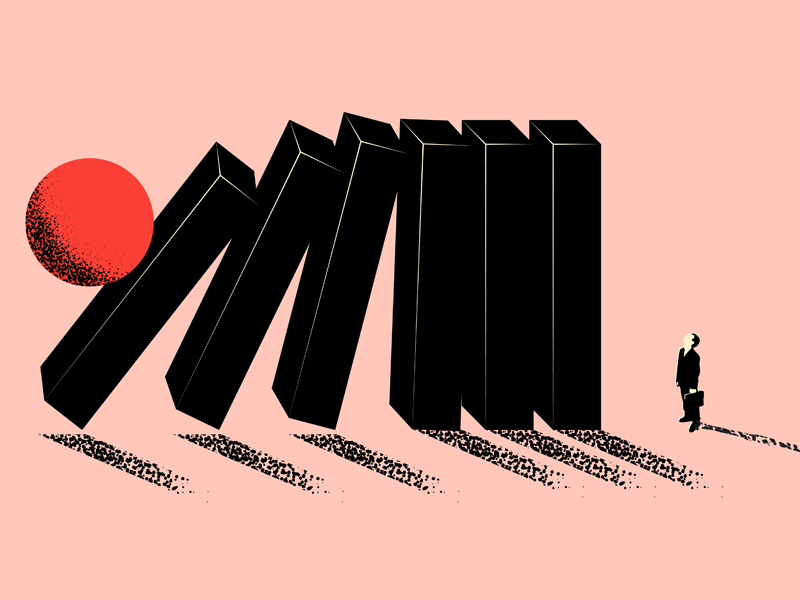

As I’ve previously explained, the prospect of an economic recession in Australia is very real – not certain, but a good chance.

And the economic data this week is reinforcing the possibility.

An economy is a living, breathing temperature check

I often say we make the mistake of talking about the economy as an inanimate object of financial theory. But an economy is a measure of a bunch of living, breathing human beings; what they’re producing and how they’re feeling. And it’s fair to say they’re not feeling too flash at the moment.

The latest consumer sentiment figures out this week remained at very low levels, while business confidence and conditions deteriorated further. The sentiment data is showing increasing signs that the job market is easing, with consumers’ unemployment expectations ratcheting higher and businesses expecting to reduce headcount.

The Westpac–Melbourne Institute Survey of Consumer Sentiment Index remained in the doldrums in June at 79.2 points, well below the 100 mark that separates optimists from pessimists.

The NAB Consumer Sentiment Survey revealed that both business confidence and business conditions fell last month. Confidence fell from 0 to ‑4 and conditions decreased from +15 to +8. While +8 is still a solid result, the series is on a solid and steepening downward trajectory.

Employers are doing it tough

Business conditions across the board fell; trading (down 7pts to 14), profitability (down 5pts to 7) and employment (down 6pts to 4) all registered solid declines. Forward orders, which typically leads other activity components, fell 6pts to ‑4 in the month. This indicates that conditions are likely to continue to soften this year. NAB also noted forward orders were particularly weak in the consumer sectors of retail and wholesale trade.

So, employers are doing it tough across the board and a gloomy boss usually translates to job and spending cuts.

But then we had yesterday’s jobs figures which show 70,000 new jobs created and the unemployment rate dropping back to 3.6 per cent. You could be forgiven for thinking things aren’t that bad. Remember though that unemployment usually lags economic decline, but when it turns it turns quickly.

These stronger employment figures will play into the RBA’s interest rate decision, which is to say wage rises and a tight labour market are keeping inflation stubbornly high, so interest rate rises are needed.

Why has the US Federal Reserve paused their rate hikes?

Simple: their inflation rate is coming down quickly and ours isn’t.

This week the Fed’s preferred inflation gauge, the Personal Consumption Expenditures Price Index, rose just 4.4 per cent in April from a year earlier, down from 5.4 per cent in January. Core prices, which exclude volatile food and energy prices, have been more stubborn, but is still well below Australia’s inflation rate of 6.8 per cent.

So America is heading to its 2-3 per cent inflation target a lot quicker than us. The difference is that the US doesn’t have big wage growth like we do which, in turn, keeps inflation higher for longer and therefore pushes up interest rates.

The Federal Government and Treasurer have to stop being the good guys promising wage rises to everyone. They can’t blame the RBA for putting up rates if they’re causing the inflation problem. The Federal Government has to do some of the heavy lifting as well.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending