Beware: easier eligibility for a home loan doesn’t necessarily translate to a better deal.

Higher interest rates not only bring higher mortgage repayments but, for new borrowers, the amount that can be borrowed falls.

That’s because when the banks assess a borrower’s eligibility to repay the loan they stress test the applicant by assessing their ability to service the same loan with a 3 per cent higher interest rate than what they’ve applied for.

Many potential borrowers would need to dramatically cut the amount borrowed to meet the stress test.

CBA lowers the stress test

But now, CommBank (CBA) has announced it will lower the stress test on select refinance applications from 3 per cent to just 1 per cent.

The guidelines from regulator APRA require banks to stress test all new mortgage applications to ensure the borrower can still afford their repayments if rates climbed 3 per cent above the original rate they applied for, even if the application is a refinance.

As a result, some borrowers, typically those who bought at capacity when rates were at record lows, can no longer refinance to a cheaper lender because they don’t pass this serviceability test at higher rates.

From today, refinancers who do not pass CBA’s standard serviceability test on a 30-year loan term, can be re-tested using the bank’s new “Refinance Alternate Assessment”, which includes a 1 per cent buffer, provided it is above the bank’s floor rate, which is currently 5.40 per cent.

CBA’s lowest variable rate for an owner-occupier paying principal and interest with a 20 per cent deposit is currently 6.34 per cent. This means a potential refinancer applying for this loan could be stress-tested at 7.34 per cent, rather than 9.34 per cent.

To qualify, refinance customers must have a loan-to-value (house value) ratio of at least 80 per cent, a good track record of paying down all existing debts in the last 12 months and be refinancing to a principal and interest loan of a similar or lower value.

Critically, the loan must be refinanced back out to a 30-year term, which has the capacity to cost some borrowers thousands of dollars in the long term.

Refinancing to a longer loan term could cost you

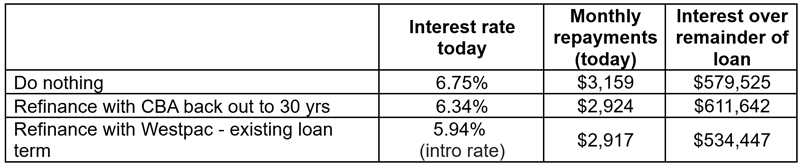

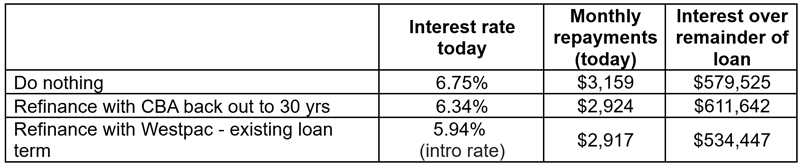

RateCity.com.au research shows that someone who took out a $500,000 loan three years ago in June 2020 with a big four bank could see their repayments drop by $235 if they refinanced to CBA’s lowest variable rate loan with a 20 per cent deposit under this new option.

However, because they would be extending out their loan term by an additional three years, they would end up paying an extra $32,117 in interest over the life of their loan, compared to if they had not refinanced at all.

If they instead took out Westpac’s lowest rate loan wit a 20 per cent deposit, which has a current introductory rate of 5.94 per cent, they would see their repayments drop by $242 ($7 a month more than the CBA offer), even if they kept their loan term the same at 27 years remaining.

Over the life of the loan, that person would pay $45,078 less in interest than the ‘do nothing’ option, and $77,195 less than the CBA option.

Impact of refinancing and extending out loan term by an additional 3 years

Source: RateCity.com.au. Notes: assumes person took out a big four bank variable loan with a 20% deposit in July 2020 and has not renegotiated since. Assumes cash rate increases in line with ANZ’s forecast. Westpac’s current lowest rate is an introductory variable loan which rises by 0.40 per cent after 2 years.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Top tips for mortgage borrowers amid tougher lending restrictions

Trending