I reckon the chances of Australia going into economic recession have increased significantly because of Tuesday’s rise in interest rates — caused by Federal Treasurer Jim Chalmers.

Why?

I remember back in 1990 when then Federal Treasurer Paul Keating said the economic crunch was “the recession we had to have”.

Current Treasurer Jim Chalmers is an economic disciple of Keating, so I’m wondering whether he is steering us into another “recession we have to have”.

Because this week’s interest rate rise from the Reserve Bank is on Jim Chalmers.

The RBA has constantly said that that any rate rises would be driven by the economic data, which has been really soft. Retail sales are flat, building approvals have collapsed, the wage price index for the March quarter was slightly less than expected, unemployment is rising and Wednesday’s economic growth was less than expected.

All the economic indicators are turning down, the economy is slowing… all good for bringing down inflation. And it should be keeping official interest rates on hold, like most economists had expected would happen this week.

But then there was last week’s decision by Fair Work Australia to lift the minimum wage 5.75 per cent – the Government recommended 5.1 per cent, the ACTU wanted 7 per cent, employers wanted 3.8 per cent.

The RBA has constantly said inflation is “stickier” than they thought, staying higher for longer than they expected. And it’s not because of the old argument about the war in Ukraine, because the prices of those affected commodities – wheat, gas, coal – have all dropped significantly.

The RBA says the services sector is behind the high inflation and that sector’s costs are driven by wages.

No more Mr Nice Guy

I’m sure the Treasurer is a good guy, but he has stopped being the economic good guy by constantly promising wage rises and leaving the RBA to play the bad guy role.

But Jim Chalmers and the Federal Budget are the big winners from rising inflation. Wage rises push taxpayers into higher tax brackets, so they pay more income tax.

In fact, average Australians are hit with a double whammy. Sure, they get a pay rise, but the amount of useable cash is reduced by higher tax and what’s left is eaten by high inflation at the shops.

Mortgage repayments as a share of household income will rise to a record high as the large number of ultra-low fixed rate loans continue to roll off over the year. There is plenty of stress to come for many home borrowers over the period ahead.

Silver lining for those with plenty of silver

The silver lining is that interest on savings should also rise for those with spare cash. But the financial institutions always seem to hold some of that back for themselves.

It’s always important to remember that a third of Aussies rent, a third own homes outright and a third are paying off a mortgage. And while those with a mortgage won’t be pleased that rates are rising, it’s a different story for depositors, even with the stingy savings interest rates. This week’s rate hike boosts interest income for households by $3.43 billion over a 12-month period.

Overall, the lift in rates will further dent prospects for retailers and other companies in the consumer discretionary sector, as well as housing-focused areas of the economy such as developers and building material providers. In short, raising interest rates is a very blunt economic instrument.

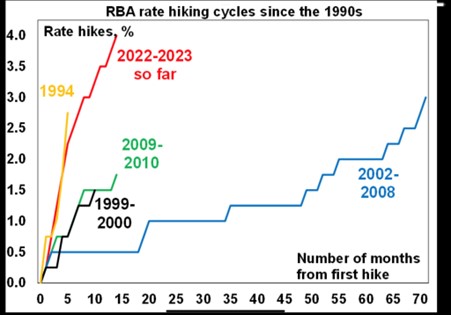

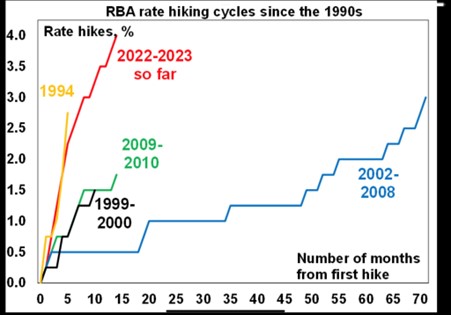

As you can see this is the fastest, most severe rate cycle in a generation.

Source: Twitter / @ShaneOliverAMP

So, what are the chances we are heading into an economic recession?

I thought Australia would avoid recession… now I’m not so sure. There is a good chance the RBA rate hikes are just too aggressive and will go overboard.

So there is a better than even chance the Australian economy will follow the rest of the world into recession, which means a lot of financial pain for a lot of people.

Germany, Europe’s largest economy, has officially entered recession due to persistent inflation resulting from Russia’s invasion of Ukraine. The International Monetary Fund data shows growth in Europe’s advanced economies slowing to 0.7 percent this year (down from 3.6 percent last year) and Europe’s emerging economies slowing to 1.1 percent this year (down from 4.4 percent last year).

Meanwhile China, the world’s second-largest economy, is experiencing its own economic turmoil after pursuing a zero-COVID strategy that has crippled growth and sparked social disruption. Zero-COVID and the lack of good-paying, post-graduate jobs have led to the highest level of youth unemployment in China’s history.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.