Many parents are the reason first home buyers can enter the property market – but is this really the best idea?

Rising property prices are good news for existing homeowners, particularly buyers over recent years caught by rate rises increasing repayments and property values falling. At least the risk of being caught with negative equity (a loan worth more than the property) is easing for them.

For new homeowners the rising interest rates are cutting their capacity to borrow at a time when property values are surging and getting away from them. And all of us parents of adult children feel for their predicament.

Parents contributing an average $33K

So I was interested to read in Finder’s Parenting Report 2023, parents are planning to give their children $33,278 on average to put towards a first home deposit.

That’s about a third of the average first home buyer deposit ($96,274) based on the average first home buyer loan of $481,368 in March 2023.

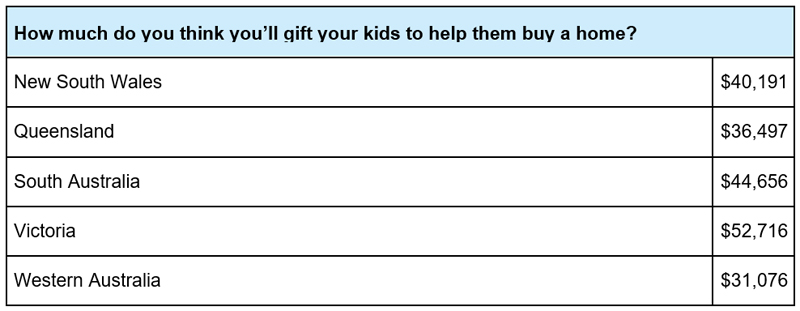

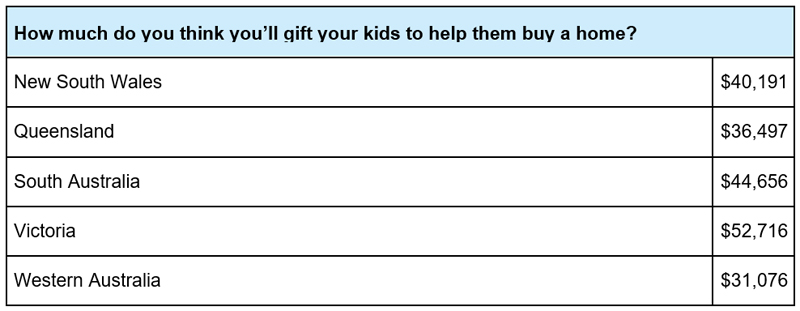

Parents in Victoria plan to extend the most financial help to their adult children to buy a home at an average of $52,716, followed closely by parents in South Australia ($44,656) and New South Wales ($40,191).

However, not everyone is ready to splash out. More than 1 in 2 (51 per cent) say they would give $1,000 or less.

Source: Finder’s Parenting Report 2023 of parents of children 0-12, November 2022.

While everyone wants to help their kids, just be careful you don’t jeopardise your own financial situation by being overly generous splashing the cash. Remember, our kids have a much longer earning capacity ahead of them to build cash reserves than we do.

Going guarantor for someone can be risky at the best of times. Basically it is making a commitment to the bank that you will pay off someone else’s debt if they can’t. This may be all right if you are certain the borrower is going to make good the loan, but if they are not, remember you could be left holding the entire debt.

Banks have a pretty strict process when it comes to lending money for property or a business. You have to ask yourself that if a bank, with all their due diligence, won’t lend your relative the money then why should you?

Other ways to help your kids buy their first home

The majority of parents contributing to their child’s first home buyer loan allow them to live at home, rent free. This helps the child increase savings towards the purchase. Bear in mind that having your child remain at (or even return) home needs careful discussion. Some questions to ask are:

- What are the expectations for family time and privacy?

- Who will be responsible for what around the home?

- Will your child pay board or contribute financially in other ways?

There are also other ways to help them purchase such as:

- Go guarantor for your child’s home loan… but make sure the guarantee is limited and not open ended and your child understands their responsibilities to make repayments on time. Get out of the guarantee as quickly as possible when sufficient equity is reached.

- Be a co-investor in the property… this has to be well-documented with clear responsibilities and a plan on how you might each buy the other one out if needed.

If you can’t get out of going guarantor

If you absolutely have to go guarantor, make sure you take steps to limit your risk. Here are my top tips:

1. Seek independent advice

Make sure as the guarantor you seek independent advice. Don’t get emotional and be liable for a debt you can’t afford.

2. Treat it as a financial transaction

If you can’t pay the debt don’t sign the paper. Remember there are no friends in business and family should also be treated with caution.

3. Be there at signing

Do not entrust the document to the borrower for signing. You should be there with the borrower to watch all is in order. As guarantor be there at the signing in case your signature miraculously appears on a document you have never seen.

4. Read everything carefully

Above all, understand what you are getting yourself into. Even when you are sitting in the lender’s office, do not sign your life away without reading the documents carefully. Don’t be afraid of taking time, even if the financier and friend is pressuring you to hurry up. A few minutes before you sign may save a few years of regret afterwards.

5. Insist on an upper limit

Don’t sign up for unlimited guarantee. Make sure there is an upper limit on the guarantee which you agree with.

6. Build in a way out

Do a deal with the borrower that when their equity grows with the increasing value of the property, then your guarantee is cancelled.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.