Yes, rising interest rates stealthily reduce your borrowing capacity. Fortunately there are a few simple things you can do to increase it.

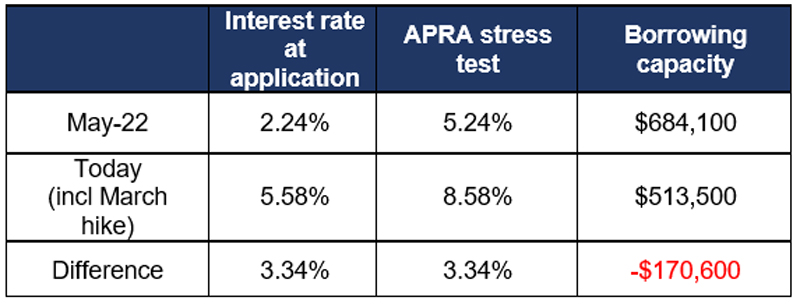

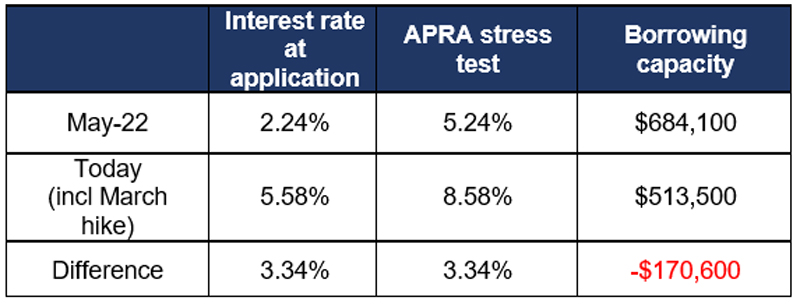

I’ve talked about this a few times over the last couple of months. Not only do rising interest rates increase loan repayments, they also reduce your borrowing capacity because the so-called “serviceability test” increases. This is where a lender must assess your ability to service a loan based on an interest rate 3 per cent above what you’re applying for.

In other words, the lender “stress tests” mortgage applications to make sure borrowers can still afford the repayments if rates rose 3 per cent above the current rate.

For example, someone earning the average wage in May 2022 has seen their maximum borrowing capacity plummet by $170,600 because of the hikes, assuming they haven’t had a pay rise in this time.

Source: RateCity.com.au

How to boost your borrowing capacity

It is becoming a real issue for borrowers. According to RateCity there are a few easy ways to boost borrowing capacity.

Increase your income

Ask your boss for a pay rise, start a part-time second job or look for a side hustle to earn extra cash.

Look for a low rate

Banks stress test your finances on the rate you are applying for, plus an additional 3 per cent. So, the lower your variable rate the more you are likely to be able to borrow. Using a mortgage broker is a good way to do a quick check on your borrowing capacity across the lenders on their panel.

Spend less and save more

The bigger your deposit is, the less you’ll need to borrow, so turbo charge your savings strategy today. A larger deposit will also help minimise or even remove the need to pay lenders mortgage insurance.

Clean up your budget

Show your bank just how frugal you can be by cutting back on your discretionary spending now. Take-away coffee, Uber Eats deliveries and multiple streaming services seem harmless but they are little luxuries that can go against you when you’re being assessed for a loan.

Close down credit card accounts

The banks have to assume you could max out your card, which can put a significant handbrake on how much you can borrow for your first home. The fewer credit cards the better.

Pay down other debts

Try to clear as much off these debts as you possibly can. Buy now, pay later spending can also raise eyebrows so it’s best to steer clear of these platforms as well.

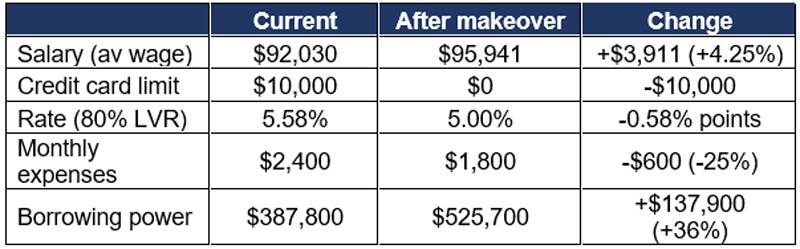

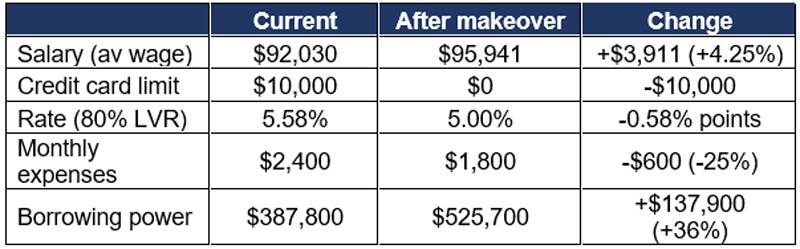

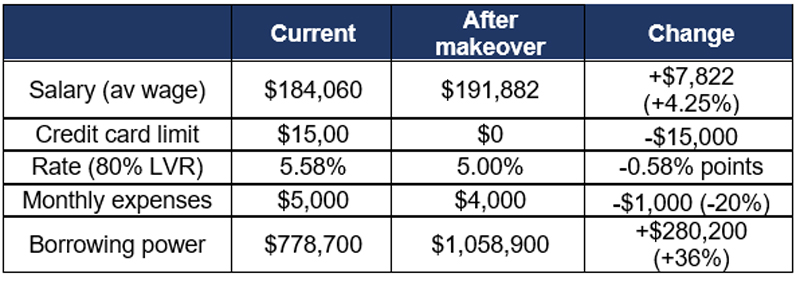

How much more could you potentially lend?

RateCity.com.au has crunched the numbers to see how far a single person earning the average wage could potentially boost their borrowing power.

The scenario is based on someone earning the average wage before the rate hikes who hasn’t had a pay rise since.

The person has a $10,000 credit card limit and is planning on applying for a big four bank basic variable loan with a 20 per cent deposit. They spend $2,400 in essentials each month (not including housing costs).

If this person could:

a. secure a 4.25 per cent pay rise

b. close their $10,000 credit card

c. switch to one of the lowest variable rates for someone with a 20 per cent deposit, and

d. cut down their expenses by 25 percent

they could potentially borrow an estimated $137,900 more from the bank.

Single person

Earning approx average wage, no dependents, $10,000 credit card, $2,400 per month expenses

Source: RateCity.com.au. Notes: Calculations are estimates based on an owner-occupier buying a property with a 20% deposit taking out a 30-year loan with no dependents. The average wage is based on the full-time adult average weekly ordinary time earnings as recorded by the ABS for May 2022. Rates are based on the average big four bank basic variable rate vs the estimated lowest 3 rates on RateCity.com.au for a 20% deposit, factoring in the March RBA rate rise. Borrowing capacity is based on CBA’s serviceability calculator. Income is before tax.

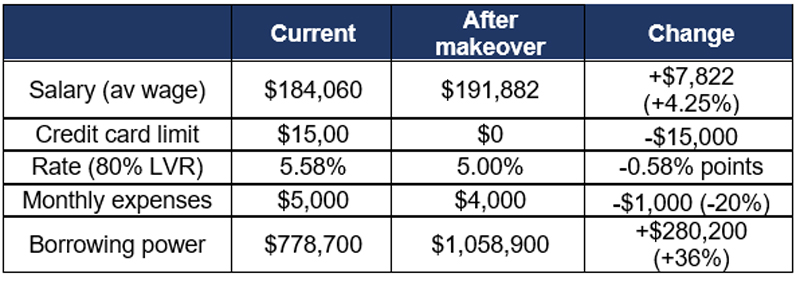

Couple

Earning approx average wage, no dependents, $15,000 credit card, $5,000 per month expenses

Source: RateCity.com.au. Notes: As above.

These are all great tips, but make sure you don’t stretch yourself so far that it is unsustainable and you don’t have a financial buffer.

It is a time for cautious borrowing.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Top tips for mortgage borrowers amid tougher lending restrictions

Trending

Sorry. No data so far.