Well, that was a wild week. Nothing like a US banking crisis to get the pulse racing. Financial markets hate uncertainty and they particularly hate panic around banks.

The panic caused by the collapse of Lehmann Bros back in 2008, which sparked the Global Financial Crisis (GFC), is still fresh in many people’s minds and they never want to see that ever again.

That’s why when Silicon Valley Bank (SVB) got into trouble last weekend, it had such a huge ripple effect around the world. It was pretty scary there for a while, but US regulators moved quickly to guarantee all deposits and that calmed things down quickly.

Just a couple of points from me:

- Australian banks are much better regulated than in the US so don’t think our banks are exposed to the same risks. Aussie banks have a lot more capital reserves and are more conservatively managed than their US counterparts.

- Having said that, the bond markets are indicating the uncertainty is not over, so we all need to be wary in these uncertain times.

The big difference was that the GFC was caused by banks lending to, and investing in, dodgy mortgages. The collapse of SVB was caused by investing in US Government Bonds… who would have thought you could get into trouble investing in Government bonds?

So, what happened?

You see, SVB is the bank of the world’s most important technology hub – Silicon Valley just outside San Francisco. They backed a lot of their business customers from starting up to becoming technology giants. SVB is the bank of tech.

When those tech companies were booming they deposited their surplus cash with SVB. More cash than the bank could lend out, so it invested in US Government bonds when interest rates and inflation were low.

As inflation increased and interest rates rose, the boom times finished for the tech giants and they’ve recently needed to withdraw their deposits to fund their businesses. So SVB had to sell their US Government bond investments to generate the cash needed to pay for these customer withdrawals.

But who would want to buy an old US Government Bond earning 1-2 per cent interest when you can invest in a current US Bond earning 5 per cent interest? So to sell their bonds SVB had to sweeten the deal and sell a $1 Government Bond for, say, 90 cents as an incentive to make up for the poor interest rate.

They sold those bonds for a loss, which amounted to tens of billions of dollars. And that’s why they went broke and had to be bailed out.

Then Credit Suisse hit the skids… a different case altogether

Just when global financial markets are jittery and wondering whether there will be a chain reaction of bank failures, yesterday Swiss-based Credit Suisse was in crisis. Its biggest shareholder, Saudi National Bank, said it wouldn’t be putting any more money into the troubled bank… which was never going to go down well.

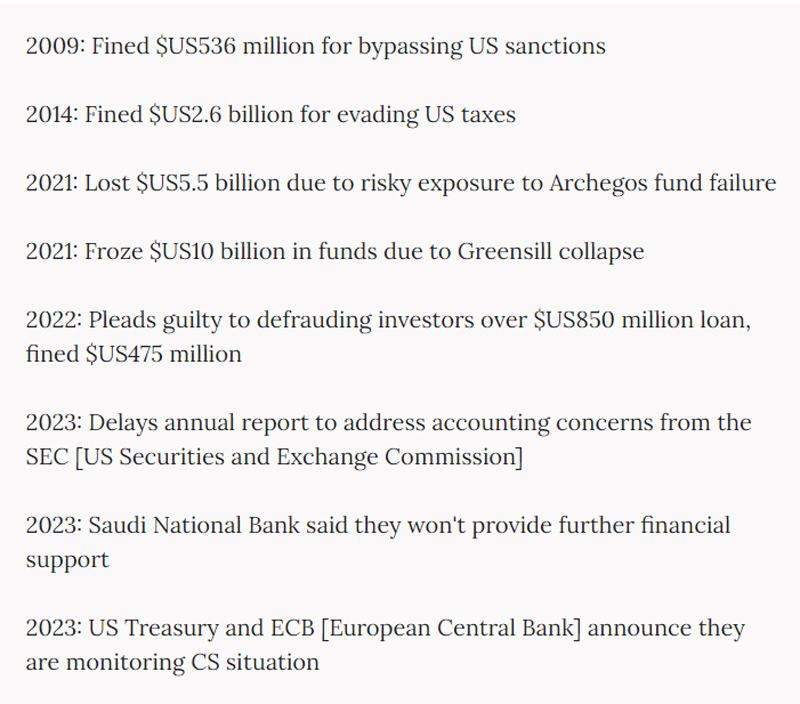

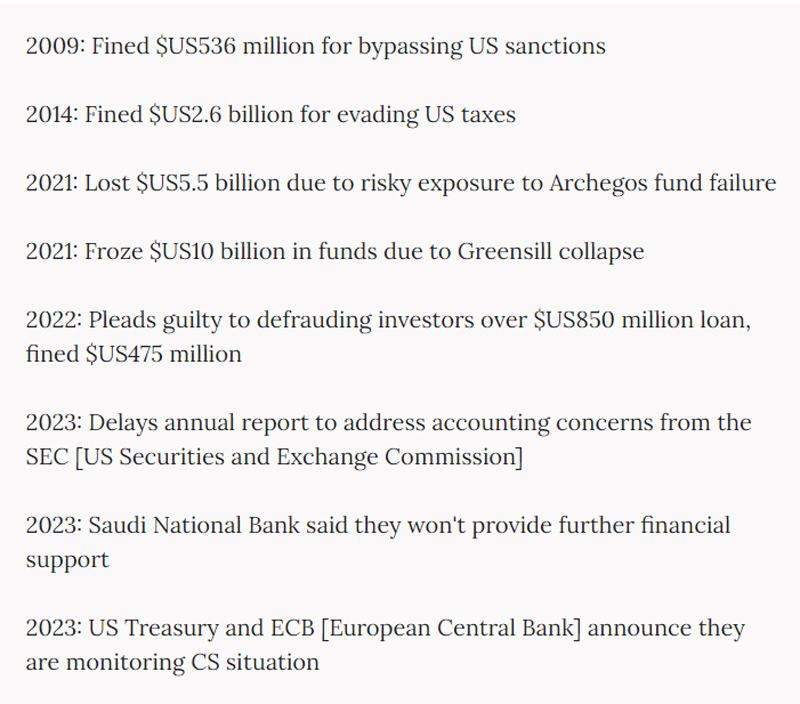

It started a whole new banking crisis. But – and this is important – Credit Suisse has been a badly run bank for a long time. The trigger for yesterday’s share price collapse was a comment from a shareholder and not the result of the US bank crisis.

This is a great timeline from the capital markets newsletter The Kobeissi Letter which outlines the strife Credit Suisse has been through.

Timeline of Credit Suisse collapse

Now, Credit Suisse is asking the Swiss Central Bank for support. Their Credit Default Swap premiums are trading above 2008 levels.

At this point, they have dug their own grave.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending

Sorry. No data so far.