A big week for getting a temperature on the economy leading into Tuesday’s RBA interest rate decision… and that pesky Aussie inflation figure looks to be heading in the right direction.

Consumer prices, CPI, rose 0.2 per cent in October and 6.9 per cent over the year, which is slowing down and came in well below the 7.6 per cent forecast of most economists.

Remember, the reason the RBA is increasing interest rates is to cool the economy and bring inflation back down to an annual rate of 2-3 per cent. After peaking at nearly 8 per cent recently, a downward trend is encouraging… it means the higher interest rates are doing what they’re meant to do.

But while it’s encouraging, the monthly inflation figures could be a bit choppy in coming months depending on how energy prices move. Even so, this latest figure could see the RBA go ahead with another 0.25 per cent rate rise on Tuesday and then pause the rises for a while to get a better picture from the economic data… well, that’s what CBA economists expect.

Other economists are not so sure, depending on how pessimistic their previous forecasts have been. The doom and gloom brigade are currently sticking to their pessimism and warning this inflation result was an aberration.

This week building approvals and capital investment figures were also weak which, again, points to a slowing economy.

What everyone does agree on is that we’ll get a 0.25 per cent hike on Tuesday to 3.1 per cent – the highest rate in a decade.

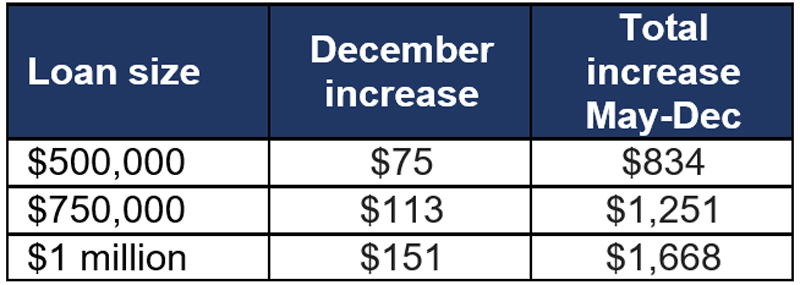

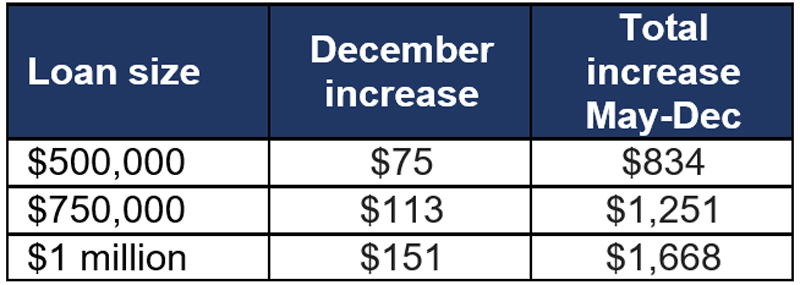

RateCity.com.au analysis shows another 0.25 per cent rise would mean the average borrower with a $500,000 loan before the hikes started in May could soon be paying a total of $834 more a month.

0.25% hike in December: Increase in monthly repayments

Source: RateCity.com.au. Based on an owner-occupier paying principal and interest with 25 years remaining. Starting rate is the RBA av. existing owner-occupier variable rate of 2.86% in April and assumes banks pass the hikes on in full.

All four big bank economic teams still have vastly different views on how many rate rises are to come and what the peak will be.

Forecast for rate rises by big four banks

Source: RateCity.com.au.

Time will tell.

Just for perspective, this is how our inflation rate compares to the rest of the world.

How Aussie inflation compares to the rest of the world

How to plan for more rising interest rates

Here are a few ways to rise along with the rates.

1. Work out what your increased repayments will be

Don’t wait for your bank – calculate how much extra you’d pay on your current home loan with future interest rates in 0.25-0.5 per cent increments. It’s an easy job when you use the Money Smart mortgage calculator. Just plug in your current loan in ‘amount borrowed’, then add all the other details as per your current mortgage, including your current interest rate.

Now, change the interest rate up by 0.25 per cent and note the repayments figure down. Then increase the interest rate by 0.25 per cent and keep noting down the increases in your repayments.

2. Take a look at your budget

Once you know what higher interest rates are likely to do to your repayments, it’s time to reassess your budget. You’ll need to find the extra money somewhere. What can you squeeze to make the higher mortgage repayments?

For some, it will mean taking money that’s allocated for regular savings or investing. For others, it may mean cutting back on things like activities or home entertainment.

3. Understand your options

If you would really feel the squeeze if your interest rate increased another 0.25 or 0.5 per cent, it’s a good idea to talk to a financial counsellor.

Even though it ‘hasn’t happened yet’, pre-empting a crisis makes sense. The National Debt Helpline is a free service and you can either call them on 1800 007 007 or click through for a live chat session.

They’ll talk you through options like:

- Extending the length of the loan so that your repayments are lower

- Converting the loan to interest only payments for a period of time

- Reducing your repayments to the minimum monthly repayment amount

- Accessing money you may have available in any redraw of your loan

- Consolidating debts for example: personal loan, credit card and home loan debts into one loan, so that your total repayments are lower.

4. Save the difference between your current repayment and the new repayment

If you’ve worked out that you’re okay to meet an increase, you should start living as if it were the case right now.

Say you’ve estimated that with a 0.5 per cent increase, you’ll pay an extra $103 per month, consider adding that amount to your mortgage repayments now.

If you can’t commit to that just yet, at least try to save the extra $110 each month so you can get used to paying it.

Get Kochie’s weekly newsletter delivered straight to your inbox! Follow Your Money & Your Life on Facebook, Twitter and Instagram.

Read this next:

Trending